2 min read

Labor Shortages and Inflation Among Impacts to Intertwined Forest and Trucking Industries

Forest2Market

:

December 20, 2022

The forest products supply chain is an interlinked network comprised of timberland owners, loggers, truckers and manufacturers. Forest health and sustainability—a cyclical process that involves planting, growing, harvesting, and replanting—and the rural economies that service the forest products industry are dependent upon each participant across the wood value chain remaining viable.

Loggers and truckers are the critical links that connect forest raw materials to the mill facilities that utilize them. Even a temporary disruption in these links can cause cascading impacts that will be felt at the mill level, and longer-term disruptions can cause structural issues that erode sector health over an extended period. The interruption of this delicate relationship—in combination with labor shortages and worsening inflation—has stressed the forest products supply chain from the woods to the mill over the last year.

Logging and trucking are separate operations, but there is some crossover in costs and variables associated with each. They are both capital-intensive, low margin businesses, which typically bear the brunt of economic pain during periods of high inflation. Input costs for each sector continue to rise unimpeded, specifically insurance costs, labor, maintenance parts and costs (also impacted by scarcity), lubricants and diesel fuel costs, such that the inflationary pressures loggers and truckers are facing exceed the average rise in costs for American consumers.

Chip Capps, a professional logger with Arcola Logging Co. in NC recently noted, “… most logging operations will face annual cost inflation of 10 to 18% this calendar year 2022, with off-road fuel, labor costs, equipment costs, and parts/repairs leading the way.”

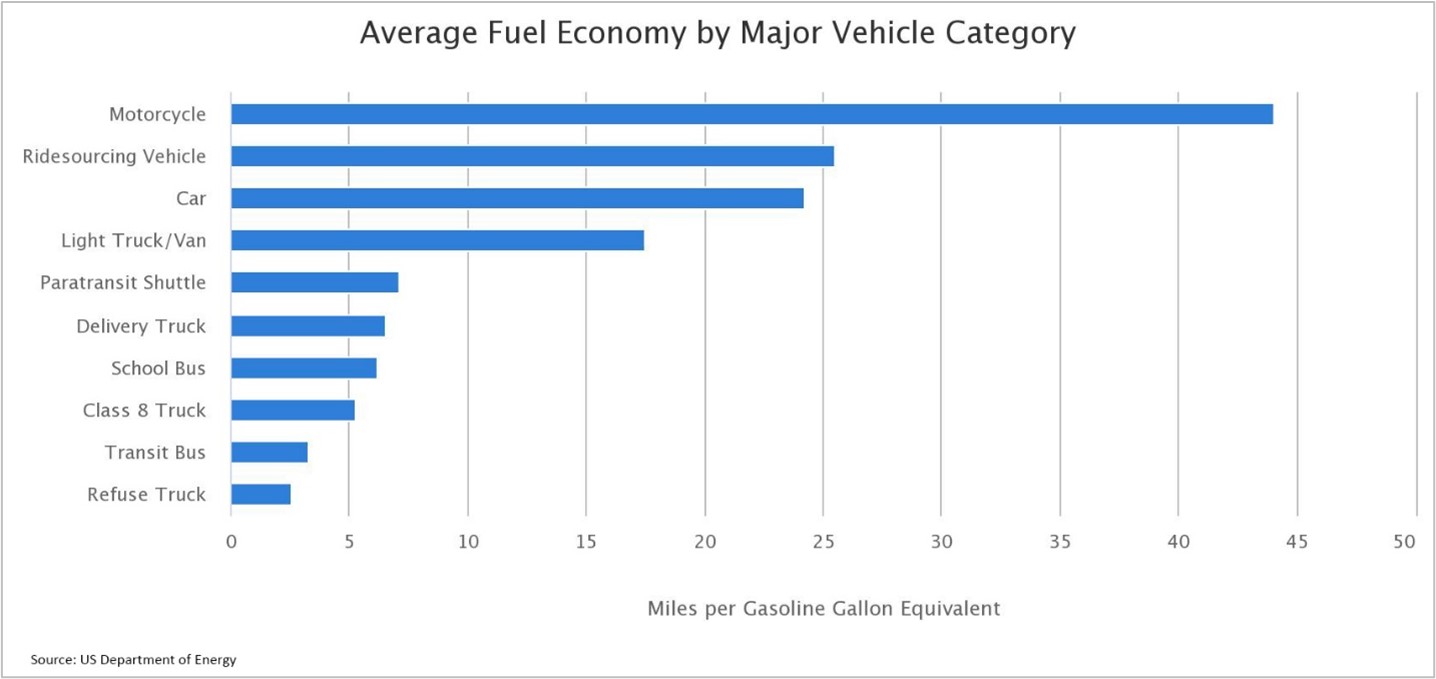

Fuel prices are now rising once again, impacting everyone’s finances via increased costs that are driving prices for everything higher. This increase is especially poignant for the trucking industry. While 2020 data from the U.S. Department of Energy shows that the average fuel economy for cars was 24.2 miles per gallon, it was 5.29 miles per gallon for heavy trucks with a gross vehicle weight rating exceeding 33,000 pounds — such as a 5-axle log truck (Class 8 Truck).

Retail prices for No. 2 “on-highway” diesel were generally rangebound between $2 - $4 per gallon between 2007-2021. But in response to rising global demand - and reduced domestic production, Russia’s invasion of Ukraine, etc. - the average price is now hovering around $5.00 per gallon, a 58% year-over-year increase. Since trucks are vital for moving forest raw materials from the woods to mill consumers, rising fuel prices have significantly impacted the cost of those deliveries.

Charlie Blinn, Professor at the University of Minnesota’s Dept. of Forest Resources, recently put together an analysis that illustrates this impact in real data—and dollars. Per the U.S. Department of Commerce Economic Census on Transportation 2017, the average roundtrip distance to transport “logs and other wood in the rough” is 138 miles. The US Forest Service estimates that the current harvested timber volume across the US is roughly 446 million green tons annually, and transporting that volume of material from the woods to the mill takes approximately 15.4 million truck deliveries (based on an average of 29 green tons per load).

Calculating an average haul distance of 138 miles at an average fuel efficiency of ~6 MPG, the change in diesel price from 2020 - 2022 has resulted in an estimated average cost increase of $2.88 per green ton of forest raw material delivered to a mill facility. The total impact to the forest supply chain is estimated at more than $1.2 billion in added fuel costs from 2020 to 2022.

As the global economy navigates the uncertainty associated with unprecedented energy concerns, the immediate challenge for a number of manufacturers – including the forest products industry - is ensuring that all stakeholders across its value chain remain viable. With rising costs and associated pressures, it’s in the best interest of the manufacturing sector to find creative ways to unify and pursue a strategy of blended outcomes that supports the entire supply chain.