1 min read

Is Investment in Western Pulp and Paper Mills an Up-and-Coming Trend?

Gordon Culbertson

:

April 30, 2014

Gordon Culbertson

:

April 30, 2014

Illinois-based Kapstone acquired Longview Fibre (Washington) in July 2013. Packaging Corporation of America, also headquartered in Illinois, followed suit a few months later when it purchased Boise (Idaho) in October.

Most recently, Rock Tenn (Georgia) announced plans to purchase the Simpson Tacoma (Washington) Kraft paper mill. Rock Tenn and Simpson have also entered into a seven-year wood chip supply contract.

Once viewed with a "Will the last pulp mill out please turn off the lights?" mentality, why is investment in western mills now desirable?

Historically, southern mills have enjoyed a distinct advantage over western mills. The majority of the southern chip supply comes from easily accessible plantation pine forests. Tree-length pulpwood is delivered to efficient wood yards, giving mills in the US South a more predictable and lower cost alternative for wood chip procurement.

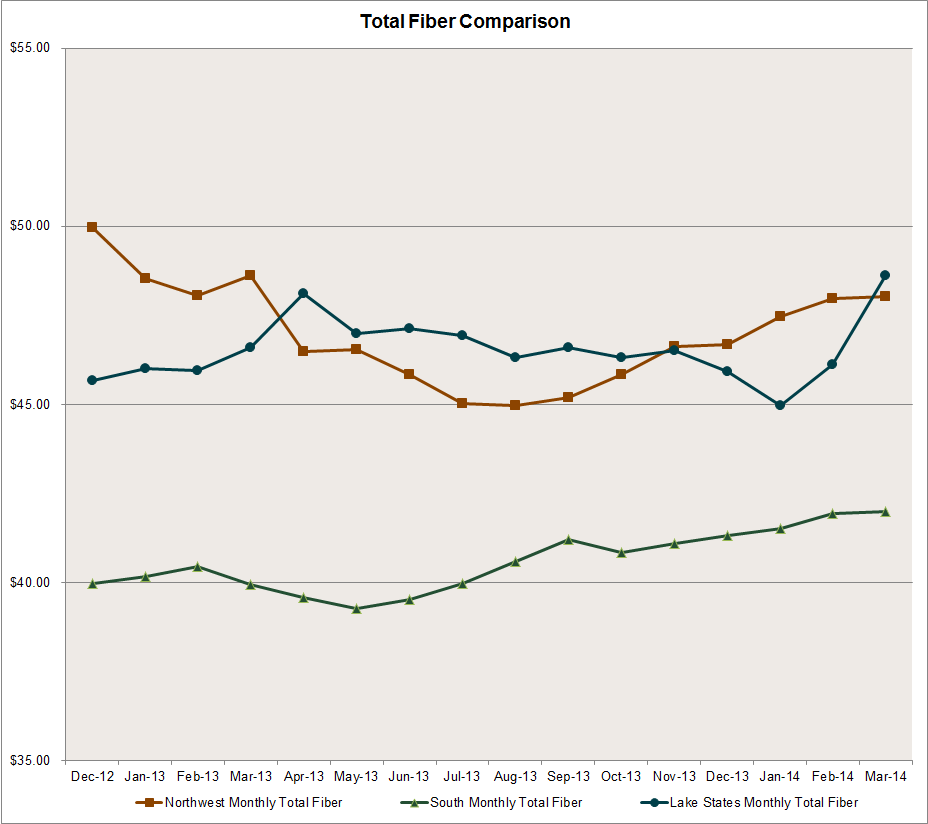

Price is compared on a green ton basis.

Today, prices in the South are increasing and supply is tightening as competition for pulpwood from wood fuels has become the trend. For northern operators, fiber supply remains tight and costly. Even with vigorous finished product markets, data shows western wood chip costs have not returned to previous high levels as supply remains relatively abundant out west.

These changes in ownership represent a larger pattern of operations consolidation. Increased lumber production and improved timber harvests will support stable wood chip availability and pricing in the near-term, making Northwest pulp and paper operations an attractive venture.

Comments

05-05-2014

Gordon,

Nicely stated. Should it happen, it will be a wonderful change.

Rick Breuner