The overall pace of growth in manufacturing slowed in August, though just slightly. The Purchasing Managers Index (PMI) fell from 50.9 in July to 50.6 in August, the weakest reading since July 2009. Bradley Holcomb, chair of the Institute of Supply Management's (ISM) Manufacturing Business Survey Committee, observed that the "overall sentiment is one of concern and caution over the domest and international economic environment, which is affecting customers' confidence and willingness to place orders, at least in the short term."

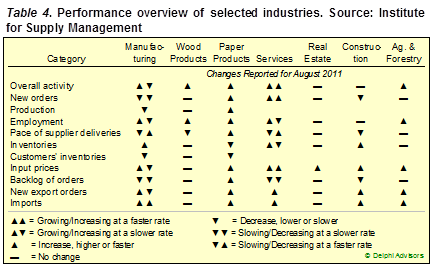

The following table summarizes industry performance over the course of August.

Wood and Paper Products both reported growth in August, although Wood Products saw upticks in employment and overall activity only. Paper Products, on the other hand, continued to show strength, with 9 out of 11 categories improving, including new export and domestic orders, the need to replenish customers' inventories and increases in both production and employment. One Paper Products respondent to the survey indicated that "demand remains constant and strong."

The non-manufacturing or service sector grew at a faster pace in August, as evidenced by a 0.6 percent rise in the non-manufacturing index (NMI) to 52.7. Despite overall growth, however, the service sector did show some signs of weakening, including slower employment growth and imports that are roughly equal to exports.

Of the three related service industries--Real Estate, Rental and Leasing; Construction; and Agriculture, Forestry, Fishing and Hunting--two expanded: Real Estate and Ag & Forestry. "We had a good first half," one Ag & Forestry respondent said. Reflecting poor conditions in construction, one respondent said, "this month we have seen a downward trend in sales activities due to weather and economic conditions."

Suz-Anne Kinney

Suz-Anne Kinney