We recently discussed the direct and indirect impacts the COVID-19 pandemic has had on e-commerce and the corrugated segment over the last 18 months. To recap, since the onset of the lockdowns, there has been a significant increase in demand for corrugated products as a result of the shift in consumer habits driven by the pandemic.

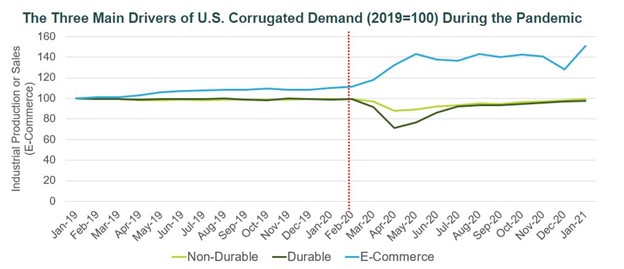

The three main drivers behind the growing demand for corrugated boxes in the US are the manufacture of non-durable goods, durable goods and e-commerce deliveries. As we can see in the image below, of these three main drivers, e-commerce was the primary channel that drove most of the gains in corrugated packaging since 1Q2020, when the economy experienced a huge transition toward e-commerce as consumers were forced to turn to online shopping. Nearly two years later, shoppers have acclimated to shopping online and the trend seems permanent.

Source: FRED, Fisher-STE Systems Dynamic

Source: FRED, Fisher-STE Systems Dynamic

There are a number of questions to consider when evaluating this shift: How long will strong demand last? How much more market share can e-commerce take from traditional retail? Will the intensity of packaging use change?

The intensity of packaging comes into question because of both circular economic trends and the pressures created by the increase in prices with the rise in demand, which is ultimately passed along to companies such as Amazon. However, Amazon actually has the resources to address the issue and make an impact, given its huge customer base. In fact, the over 200 million subscribers to its Prime service would make up the 8th largest country in the world.

Global Populations (2020)

Source: FisherSolve™ Next

Since Amazon is such a large company, it is constantly working on innovations and “how to do things better,” and this objective also applies to packaging. This provides Amazon with significant competitive advantages and the ability to drive continuous improvement in what they do best: delivering goods. Some examples include:

- Adopting drones for packaging delivery: Amazon introduced its plan for its newest service Prime Air back in 2013, and while it’s been a few years since that announcement, the company is still working on developing the project. Prime Air is a future delivery system designed to safely get packages to customers in 30 minutes or less using drones. The goal of this new service is to provide rapid parcel delivery that will increase the overall safety and efficiency of the transportation system. But will the program eventually ‘take off?’ Time will tell, though it’s tough to bet against Amazon.

- Use of lockers: Amazon Lockers are a delivery option that allows customers to retrieve their Amazon packages from a secure locker. This option allows customers security without the risk of it being stolen from their apartment or home.

- Use of different technologies: Box On Demand is an example of a type of packaging and shipping method Amazon uses, which is a concept that is ideal for highly variable shipping environments. Instead of ordering premade boxes, Box on Demand equipment is installed that allows a company to make the right-sized boxes for every order.

With these different innovations in progress, what does this mean for the future of US containerboard demand? Fisher modeled US containerboard cut-up by e-commerce box optimization assumption, which is illustrated in the image below.

US Containerboard Cut-Up by E-Commerce Box Optimization Assumption Model

Source: FisherSolve™ Next

This illustrates that the resulting total demand in the market is very sensitive to what ‘we’ believe happens to those main drivers (e-commerce’s share of retail, packaging intensity, etc.). Fisher believes that is important for those within the industry to consider and understand this, as it could lead to companies making changes in terms of substrates or packages. We’re already beginning to see this with the shift in products previously being ‘retail ready’ to now ‘e-commerce ready.’

Coated Recycled Board CUK Linerboard

Amazon is rapidly refining its business operations and further defining the future of e-commerce. What might the future look like should the company become the third or fourth largest ‘economy’ on earth?

In order to stay on top of these trends, talk with an expert at Fisher International who can help your business formulate an actionable plan with a high degree of accuracy. Fisher customers also have access to Fisher International’s business intelligence system, FisherSolve Next, which provides detailed information on every paper and pulp mill in the world. Because this is the only database with integration and true data transparency for every mill, line and machine, subscribers can drill down to the details that differentiate each mill and roll the details up for strategic analysis and improved decision making.

Matt Elhardt

Matt Elhardt