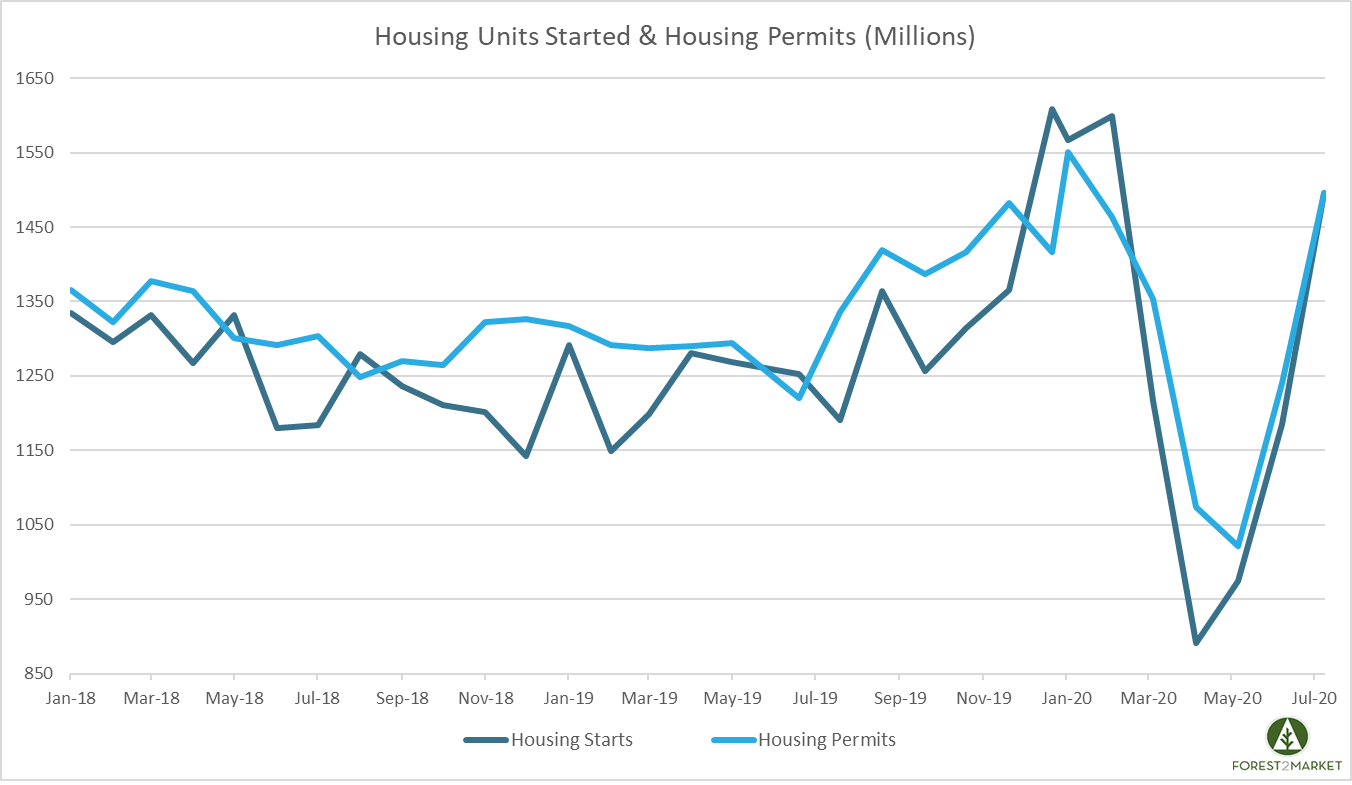

It may be a tad lopsided but housing starts are nevertheless charting a pretty convincing “V”-shaped recovery as they bounce back from the COVID-19 induced lows that began in March.

The Dow Jones Industrial Average (DJIA) has also demonstrated some resilience after bottoming in late-March, but it has not been as decisive as the recovery seen in the homebuilding sector. For manufacturers of lumber and other construction products, the strong demand has resulted in record high prices.

Read our analysis of the current lumber market: Why Are lumber Prices at Record Highs?

Housing Starts, Permits & Completions

Privately-owned housing starts were up 22.6 percent in July to a seasonally adjusted annual rate (SAAR) of 1.496 million units. Single-family starts increased 8.2 percent to a rate of 831,000 units; starts for the volatile multi-family housing segment jumped 58.4 percent to a rate of 556,000 units.

Privately-owned housing authorizations jumped 18.8 percent to a rate of 1.495 million units in July. Single-family authorizations were up 11.8 percent to a pace of 834,000 units. Privately-owned housing completions were up 3.6 percent to a SAAR of 1.280 million units. Per the US Census Bureau Report, seasonally-adjusted total housing stats by region included:

- Northeast: +35.3 percent (+114.3 percent last month)

- South: +33.2 percent (+20.2 percent last month)

- Midwest: +5.8 percent (+29.3 percent last month)

- West: +5.8 percent (-7.5 percent last month)

Seasonally-adjusted single-family housing starts by region included:

- Northeast: -2.6 percent (+111.8 percent last month)

- South: +13.3 percent (+12.1 percent last month)

- Midwest: -0.8 percent (+28.4 percent last month)

- West: +6.2 percent (+4.9 percent last month)

The 30-year fixed mortgage rate dipped in July from 3.16 to 3.02, the lowest level on record. The NAHB/Wells Fargo Housing Market Index (HMI) jumped from 72 to 78 in July, which matches its highest level in the history of the indicator achieved in December 1998.

Why Has the Housing Sector Bounced Back?

As we noted in the most recent issue of the Economic Outlook, the rebound in housing starts has been swift and largely inspiring despite the slight shortfall (-4,000 units) in July. New home sales, on the other hand, massively outperformed with a 76,000-unit beat over expectations. Resales also roared back with a record 20.7 percent jump, but undershot expectations by 75,000 units.

Interestingly, despite the rally in starts, residential construction spending retreated by 1.5 percent in June, including a 0.4 percent decline in home-improvement spending. However, the insatiable demand for lumber remains so strong that this slight downtick is unlikely to impact finished lumber prices anytime soon.

How has the housing market been able to rally in the face of an historic shock that has left tens of millions unemployed? Bank of America analysts offer a practical subset of explanations:

- An uneven recession. The shock disproportionally impacted the lower-income population, who are less likely to be homeowners. Roughly 55 percent of households earning less than $35,000 per year lost employment income versus only 40 percent of those earning at least $75,000. The median household income of homebuyers was $93,000 in July.

- Record low interest rates. Mortgage rates reached a new record low in mid-July. Average monthly mortgage payments have declined by $80/month relative to this time last year due to those lower rates.

- Lean pre-crisis inventory. Inventory was low, home equity was high and debt levels manageable. In combination with the low mortgage rates mentioned above, demand from young buyers has driven the homeowner vacancy rate to lows reached in the mid-1990s.

- Pandemic-related relocations. Moving to the suburbs appears to be a real phenomenon. The number of mail forwarding requests from New York City spiked to 81,000 in April, roughly three times the pre-Covid-19 monthly average; 60 percent of those requests were for destinations outside the city.

Despite all of this positive news, there is a concerning dynamic unfolding in the background: Rising delinquency rates among homeowners represent a major headwind for the residential sector. The road ahead could prove challenging for the multi-family segment as well. Freddie Mac expects loan-origination volume for multi-family projects to fall between 20 and 40 percent in 2020 relative to 2019. Declining loan originations are the product of tenants failing to make monthly rent payments (perhaps more than $22 billion over the next four months), which causes apartment building operators to also skip out on mortgage payments. This situation can ultimately ripple into a surge of multi-family property delinquencies among specific series of collateralized mortgage-backed securities.

The housing market has demonstrated considerable momentum since May, and the “V”-shaped rebound is evident in the data. But it remains to be seen whether the sector can continue to make up all the ground lost due to the pandemic—and exactly how long the rally will last.