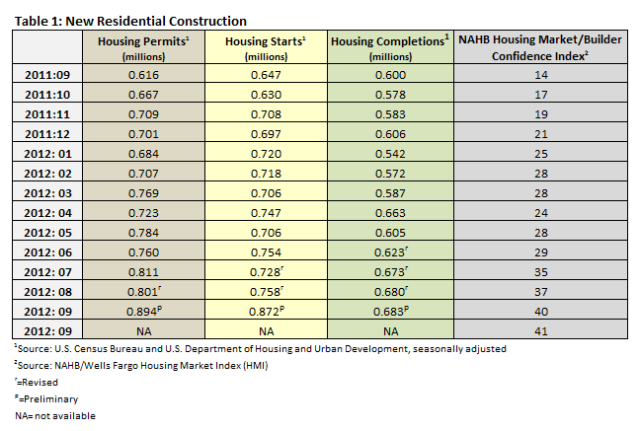

The good news for the housing sector in September was headlined by the new residential construction numbers. Housing starts increased by 15 percent, from an annualized rate of 758,0000 in August to 872,000. This is 34.8 percent above September 2011's annualized rate of 647,000. Building permits were 11.6 percent higher than in August, increasing from an annualized rate of 801,000 to 894,000. This is 45.1 percent higher than September 2011's rate of 616,000 (see Table 1).

Builders expressed some confidence that this trajectory will continue, as the National Association of Home Builders/Wells Fargo Housing Market Index (HMI, also known as the Builders' Confidence Index) increased by 1 point from 40 to 41. According to the NAHB, the HMI "gauges builder perceptions of currently single-family home sales and sales expectations for the next six months." October's 41 is the highest the index has been since June 2006 (Table 1).

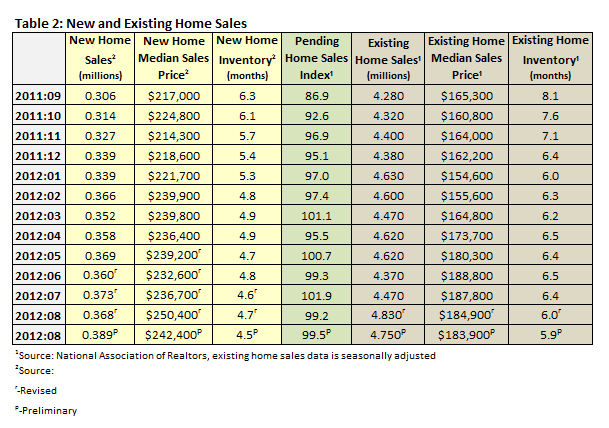

New residential sales improved in September as well, up 5.7 percent from August's annualized rate of 368,000 to 389,000. This is 27.1 percent above September 2011's 306,000. At the end of September, inventory of new homes fell to 145,000 units, a 4.5 month supply at current sales levels. In September 2011, inventory stood at 6.3 months (Table 2).

These numbers are supported by a variety of other market trends.

- The Case-Shiller Home Price 20-City Composite Index for August post an annual rate of +2 percent (after a +1.2 percent increase in July). David Blitzer, chair of the Index committee at S&P Dow Jones, remarked that increases in "home prices over the past five months makes us optimistic for continued recovery in the housing market."

- Inventory of existing homes continues to drop; currently, inventory stands at 5.9 months. While existing home sales fell by 1.7 percent in September, they are still 11 percent above the annualized pace set in September 2011. The median number of days on the market has fallen from 101 days to 70 days over the course of the last 12 months (Table 2). Pending home sales held steady, increasing 0.3 percent to 99.5. This is 14.5 percent higher than September 2011 when it was 86.9.

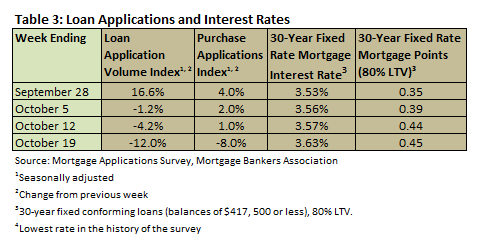

- Mortgage interested rates remain low as well, with Freddie Mac reporting the 30-year conventional rate fell from 3.60 percent in August to 3.47 percent in September (down from 4.11 percent in September 2011). The Mortgage Bankers Association reported slightly lower rates, marginally below 3.60 percent (Table 3).

The following tables show the details of the housing statistics in the September/October timeframe.

Comments

10-30-2012

Well done. Thanks,

Lon Sibert

Comments

10-30-2012

Reblogged this on Martin Arnold Associates LLP.

Suz-Anne Kinney

Suz-Anne Kinney