Mortgage rates remained at all-time record lows in September. At the same time, home sales, permits, starts and completions all increased, but this apparently did little to boost builder confidence as it remained at the lowest level in a year for the second month in a row according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) monthly builder confidence index.

“Builders report that the two leading obstacles to new-home sales right now are consumer reluctance in the face of the poor job market and the large number of foreclosed properties for sale,” said David Crowe, NAHB chief economist. “However, we do expect that moderate improvement in the job market will help boost consumer confidence and improve conditions for new-home sales in this year’s final quarter.”

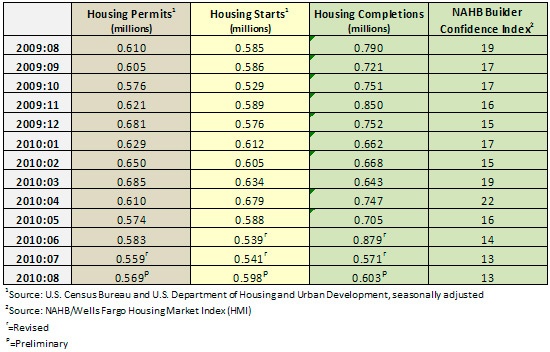

New residential construction statistics showed promise. Housing permits increased 1.7 percent in August to 569,000 (Table 1). Starts increased 9.5 percent to 598,000 units, and completions experienced a 5.3 percent increase to 603,000.

Table 1: New Residential Construction, August 2009 through August 2010

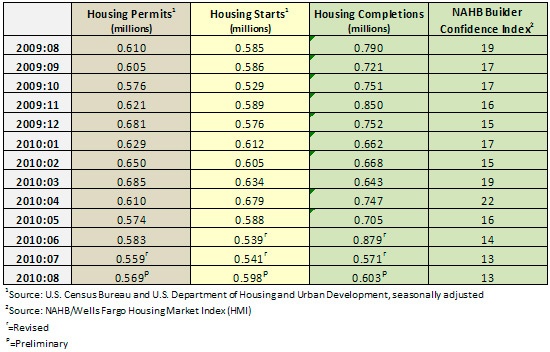

In August, existing home sales increased 7 percent, a modest indicator of a market recovering in a post-government intervention environment (Table 2). New home sales remained the same as July, virtually stuck at 1960's lows. Sales prices for existing and new homes declined at 2 percent and .6 percent respectively. Months of inventory for both also decreased.

Table 2: Housing Statistics at a Glance, August 2009 through August 2010

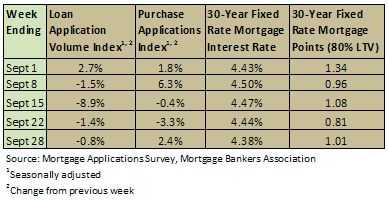

Loan applications saw a sharp decline throughout the month of September, despite 30-year fixed rate mortgage interest rates continued record lows, which finished the last full week of the month at 4.38 percent (Table 3).

Table 3: Loan Applications and Interest Rates

Suz-Anne Kinney

Suz-Anne Kinney