2010 left its mark on wood and building products markets, with the worst home sales in more than a decade, high unemployment, record foreclosure levels, and tightened credit requirements. Confidence among consumers, producers and lenders remained low.

In 2011, concerns about market conditions will continue. One of the concerns will be a double-dip in home sales prices. The most recent numbers from the S&P/Case-Shiller Home Price Index, which tracks real estate value changes both nationally and in the 20 largest U.S. metropolitan areas with a two-month lag time, were the lowest in over a year. Economists and industry experts are predicting another 7-8 percent decline in home sales prices in the first half of 2011 before prices stabilize in the second half of the year.

The glut of foreclosures that lenders have not yet placed on the market, referred to as the shadow inventory, will continue to place downward pressure on home sales prices. The shadow inventory is now thought to be around 8 million homes. At the current annual rate of 4.5 million home sales per year, it will take two years to work through the back log.

With housing prices low and only expected to get lower in the next six months, the percent of homeowners considered underwater—those who owe more on their homes than they are worth—can only be expected to increase. Currently, 23 percent of homeowners are carrying a difference in mortgage debt to home equity of $75,000. These circumstances force many homeowners to stay where they are until prices turn around, seek permission for a short sale, or allow the house to enter foreclosure. Even those who have used the government loan modification programs have not fared well, with half re-defaulting within a year.

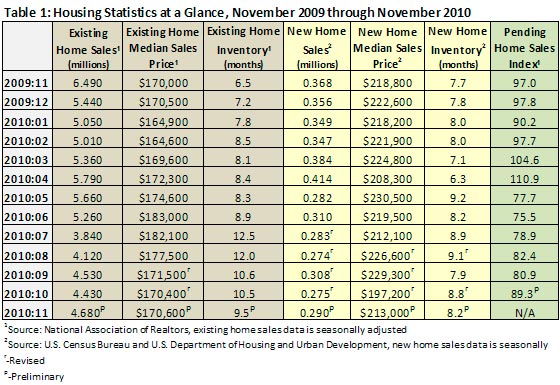

The housing numbers overall for November showed a slight increase in activity. Months of inventory for both new and existing homes decreased. Existing home inventory dropped from 10.5 to 9.5 months, and the inventory of new homes dropped from 8.8 to 8.2 months. New home sales rose by 5.5 percent to 290,000 and the median new home sales price increased by 7.5 percent to $213,000. Existing home sales saw a similar increase, up 5.6 percent to 4.68 million; median sales price remained essentially unchanged with only a 0.1 percent increase to $170,600.

Lawrence Yun, chief economist for the National Association of Realtors, believes this trend will continue: "The relationship recently between mortgage interest rates, home prices and family income has been the most favorable on record for buying a home since we started measuring in 1970. Therefore, the market is recovering and we should trend up to a healthy, sustainable level in 2011."

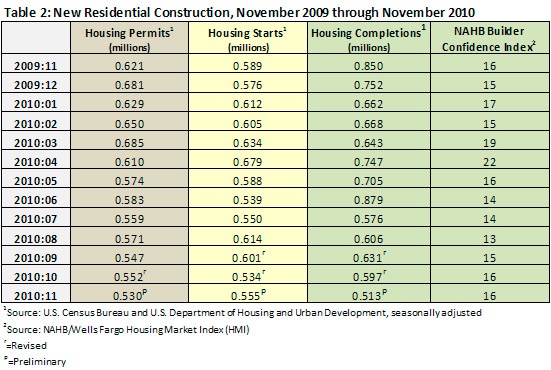

On the construction front, housing starts was the only positive news. Starts increased 3.9 percent over October, and down 5.8 percent over the same month last year. The NAHB/Wells Fargo Housing Market Index (HMI) showed November home builder confidence has remained unchanged at 16 since October, the same level as November 2009. From October to November, housing permits dropped 4 percent to 530,000, and completions fell 14.1 percent to 513,000.

“The steady but low level of the HMI reflects the fact that builders and consumers have yet to see consistent signs of the economy is improving,” said David Crowe, chief economist for the National Association of Home Builders.

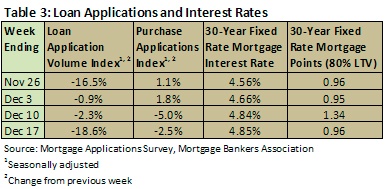

Due to the holidays, the Mortgage Bankers Association will not release the December 29 results of their weekly mortgage application survey until January; however, the numbers that were released show the steady rise of mortgage interest rates and the consistently dropping volume of loan applications.

Suz-Anne Kinney

Suz-Anne Kinney