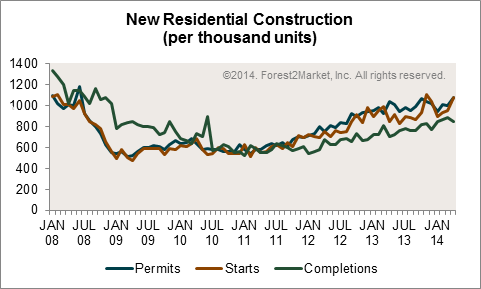

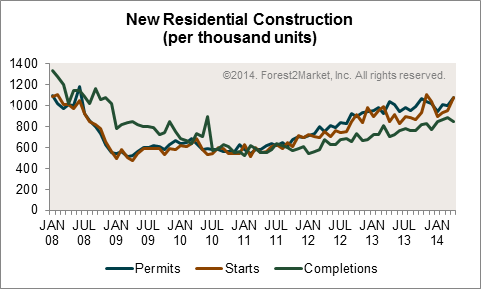

After plummeting between the second half of 2008 and the start of 2009, permits and starts have gradually returned to 2008 levels. Housing starts peaked at 1.105 million units in November 2013 but have only hovered near the one million mark since. Analysts point to a volatile multifamily sector as the cause of the recent discrepancy in permits and starts.

Six months to a year must past before the numbers show if new supply (measured by completions) met the expectations for future supply (measured by starts). Completions and starts usually approach the same levels when the market hits a low point, which is evidenced throughout 2010 and 2011.

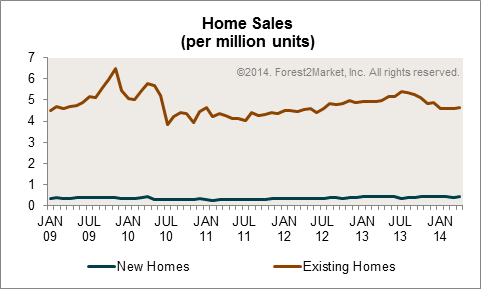

Healthy sales numbers for existing homes range between 5 and 5.5 million units. Three years after July 2010 marked the low point for sales of existing homes, sales neared healthy numbers last summer, peaking at 5.38 million in July before tapering off to 5.33 in August and 5.26 in September. Sales continued to decline for the remainder of 2013 and have ranged between 4.59 and 4.65 million sales for the first four months of 2014.

New home sales have not fared nearly as well. February 2011 marked a low point with 270,000 sales, and sales failed to climb out of the 300,000 range before the first half of 2013. Even then sales reached a high of only 459,000 units, in sharp contrast to the 700,000 mark indicative of healthy markets. The bottom line is it is difficult to sell new houses when new houses are not being built.

Home inventories have remained hard pressed to reach the six months mark indicative of a healthy market. Multiple sources put builders operating at about half of historical volumes. For the most part, new home inventory stayed in the four months range throughout 2012 and the first half of 2013. In July 2013, new home inventory improved to 5.6 months and, with the exception of October 2013 (4.9 months, has stayed within the five month range.

Existing home inventory has fared slightly better. The 5.9 months inventory noted in April was the highest since August 2012, the last time the market was at six months of inventory. The spike in existing home inventories is in line with a record number of foreclosures in 2009 and 2010 that brought homes to the market.

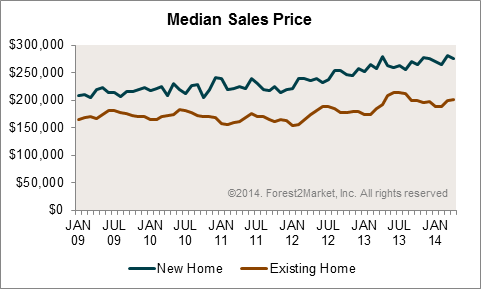

Despite an upward trend, home prices nationally have not yet made it back to 2005 levels. And rising prices might actually be a good thing for the housing market. Price decreases can, somewhat counterintuitively, discourage home sales. When prices fall, so does equity, and current homeowners who would like to make a move are unable to do so. In turn, consumer confidence diminishes and new construction activity stalls.

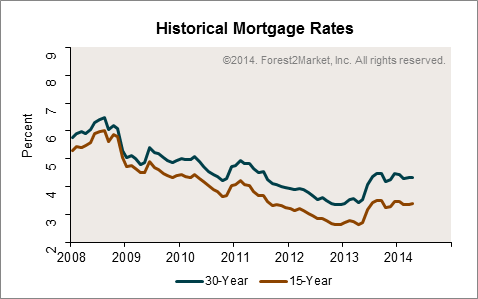

Mortgage interest rates spiked in May 2013 and have remained steady since, a trend some analysts have attributed to the weakness seen in the housing market. Others cite concerns about consumer confidence, the difficulties would-be homeowners (especially first time buyers) face qualifying for loans, and an all-around lack of jobs that pay well.

What can we expect in the months ahead? If GDP growth continues to slump as we move through the year, the housing market recovery could be further delayed. Chairman of the S&P Dow Jones Index Committee David M. Blitzer noted not all woes should be blamed on the housing market, with his recent statement “the economy will need to look to gains in consumer spending and business investment more than housing.” We will have to wait and see if the housing market gains strength throughout the second half of the year.