Every month, Forest2Market publishes updated forecasting products designed specifically for participants in the forest value chain. The Economic Outlook is a macroeconomic indicator forecast that supplies critical information, context and insight about general economic trends and direction, and the 4Cast supports regional operational decision making for those who buy and sell timber. With an understanding of economic indicators, future stumpage prices and insight into buying and selling windows (periods in which buyers or sellers hold relative market advantage), subscribers are better able to time sales or purchases, negotiate prices, manage workloads and control inventory levels. The following commentary is just a sampling from the most recent Economic Outlook for September, 2019.

Residential construction metrics remained on shaky footing in July, with only new home sales higher YTD compared to the same months in 2018. Private residential construction spending was also down 8.5 percent YTD.

July’s 12.8 percent plunge in new home sales is a function of the ridiculously large revision to June’s sales (from a preliminary SAAR of 646,000 units to a 12-year high of 728,000); had June’s estimate not been revised, July’s retreat would have been a relatively mundane -1.7 percent. The Census Bureau made sweeping revisions to construction spending (spanning back to January 2013 in the not-seasonally adjusted series), in the process adding $72.5 billion to total spending but subtracting $1.5 billion from the private residential component.

Opinions vary regarding a turnaround in housing and depend somewhat upon whether the new- or existing-home market is the subject of discussion.

- Existing Homes: Although Fannie Mae claims home-buying sentiment and pent-up demand are at record levels, its analysts now expect existing home sales will decrease this year compared with 2018 because “strong housing sentiment does little in the face of limited supply,” they wrote. “The likely cause of this decline is the persistent issue of limited housing supply, which restricts the potential for sustained growth in home sales.” Indeed, the inventory of existing homes for sale fell to a series-low (since 1999) 1.89 million units in July, corresponding to 4.2 months of supply at the present sales rate.

- New Homes: Ordinarily, contractors could be expected to respond to a shortfall in resales by building more units, but demand for available new homes can hardly be described as “white hot.” Yes, sales have crept higher so far this year, as mentioned above, and are on pace to give the best annual performance since 2007; but, months-of-inventory has also climbed (averaging 6.2 months YTD2019 versus 5.7 months during the same period in 2018) despite the median new-home price falling by 4.2 percent (trend basis) since July 2018—coupled with super-low mortgage rates thanks to the Fed’s “dovish pivot” earlier this year.

While recognizing current conditions are far from stellar, there are reasons to expect housing will muddle through. “A significant disappointment in July housing starts should be at least somewhat offset by a nicer reading on building permits, suggesting that there’s better news coming for U.S. housing,” said CIBC Capital Markets’ Avery Shenfeld.

“As builders continue to adjust to a less favorable market, along with rising tariffs for building materials and a labor shortage, I expect to see new-home inventory stay low overall,” Redfin’s Daryl Fairweather said. “But low mortgage rates and more affordable prices for new homes mean sales could strengthen a bit in the coming months.”

Lastly, the Millennial generation is trickling into the housing market. Despite approaching the age at which past generations typically purchased homes, as we have noted in the past Millennials’ impact thus far has been comparatively modest because of challenges involving interactions among location preferences, inventory availability and affordability, and other debt levels. However, this may be starting to change. In the aftermath of the Great Recession, some had speculated that Millennial attitudes regarding home ownership may be different from prior generations; yet, a 2019 study found “84 percent of Millennials believe that buying a home remains a core component of the American Dream.”

Recently, Forbes’ Caroline Feeney wrote, “As huge waves of Millennials continue to reach peak home-buying age, that will put pressure on demand not only this year but in the years to come.” That pressure may initially be concentrated in the existing-home segment owing to Millennials’ preference for living in urban environments compared to past generations. Feeney also expects housing will not be “devastated” if a recession hits due to that demographic cohort’s sheer size.

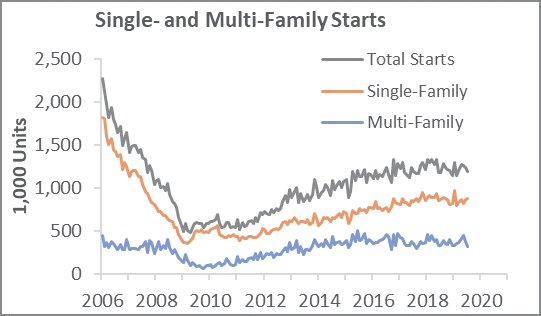

We think total starts will fluctuate between SAARs of 1.014 and 1.245 million units (MU), with 2019 averaging 1.218 MU (-2.5 percent compared to 2018).