The merger of MeadWestvaco and RockTenn caught many by surprise when it was announced earlier this year. According to the press release, the combination will create a global packaging company with $15.7 billion in sales and a projected cost savings of $300 million in three years. More than likely, after the merger is complete in June, a significant top-down analysis will occur (if it is not already underway) to consolidate sales, realign mill production with demand and reduce costs throughout the newly formed company. One of the costs under the microscope during the due diligence process will be wood fiber costs. Because they represent a significant portion of mill operating expense, a thorough examination of wood fiber costs across the new company’s system of mills will take place.

This type of systematic review of wood fiber costs is beneficial for a company even when it is not going through a merger. Many of Forest2Market’s customers conduct regular review of their system’s wood fiber costs, a practice that helps them identify the issues that drive their costs higher than the market average.

The Problem: High(er) Wood Costs

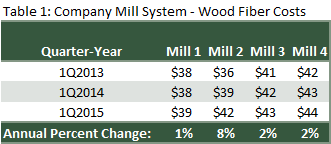

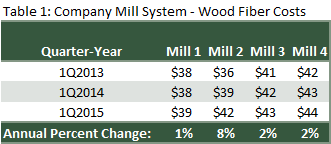

Generally, unless a merger and acquisition event has occurred, a company’s mill system will be static. During these times, company executives tend to know which mills in their system are higher cost mills. Let’s look at a real situation, one we hear from clients operating two or more mills. Generally, we receive a call from a procurement manager or VP that starts with: “Hey, I’ve got a problem that I need to explain to management. Can you guys take a deeper dive into the data and help me explain what is going on?” The data in question appears in Table 1.

According to this snapshot of wood fiber cost, Mill 2 is a mid-tier mill within the company’s overall mill system. Executives know that Mill 4 is a problem due to its high fiber cost. Its annual rate of increase, however, is close to Mills 1 and 3. Mill 2, on the other hand, has something going on; its annual rate of increase is way outside the system norm. What explains this outlier? Theories may include:

- Perhaps demand in the market has changed and the mill is now operating in a higher cost stumpage (or wood chip) environment.

- Perhaps the mill’s supply chain is structured differently because of geography, competition or any number of other factors.

- Perhaps it is an inventory issue where a decision has been made to reduce cash tied-up in inventory.

The Application of Comparative Data

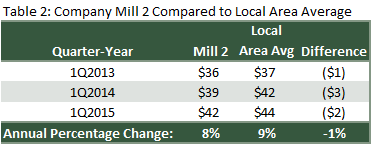

When compared only to other mills in the same system (Table 1), any attempt to rationalize this anomaly is just that--theory. If the caller had a benchmark, however, one that compares Mill 2 to its local market (Table 2) or to its peer group, he can demonstrate that the problems are systemic in the wood basin and are not isolated to the mill alone. Table 2 provides that data:

Even though costs for Mill 2 are on the rise, it is still performing ahead of the market average. With this knowledge, the caller can switch from problem to solution and begin looking for ways to reduce or mitigate these higher costs.

Use Data to Develop Solutions

At Forest2Market, we have a saying: “Going to your boss with a problem is a career-limiting move. Go with a solution instead.” This is why it is essential for our caller (and other procurement managers and VPs) to make the transition from problem to solution before meeting with management. Now that he has data explaining the issue, he can ask the questions that will help him formulate strategies for dealing with the higher costs.

- If there are structural issues causing higher costs at this mill, are there other areas in which I can lower costs? A comparison of each component of delivered cost (stumpage, freight, cut-skid-load, etc.) to those of other mills will point out areas for improvement.

- Have other mills with similar structural issues found a way to manage their costs more effectively? A peer group comparison will suggest strategies for overcoming these structural issues.

- How can I make sure I’ve tried everything to make this mill profitable before executives decide to shut it down? A capital improvement might be justified.

The list of strategies developed in this fashion turns the table and changes the nature of the meeting. Instead of being on the defensive, our caller will be able to play offense, not only explaining why the problem exists, but laying out a series of tactics that can be implemented to solve the problem or at least mitigate its effects. With this proactive approach—identifying the problem mills in the system, uncovering the causes of the problems and applying data to develop solutions—procurement managers and VPs can make their managers look good. And there is nothing career-limiting about that.

Daniel Stuber

Daniel Stuber