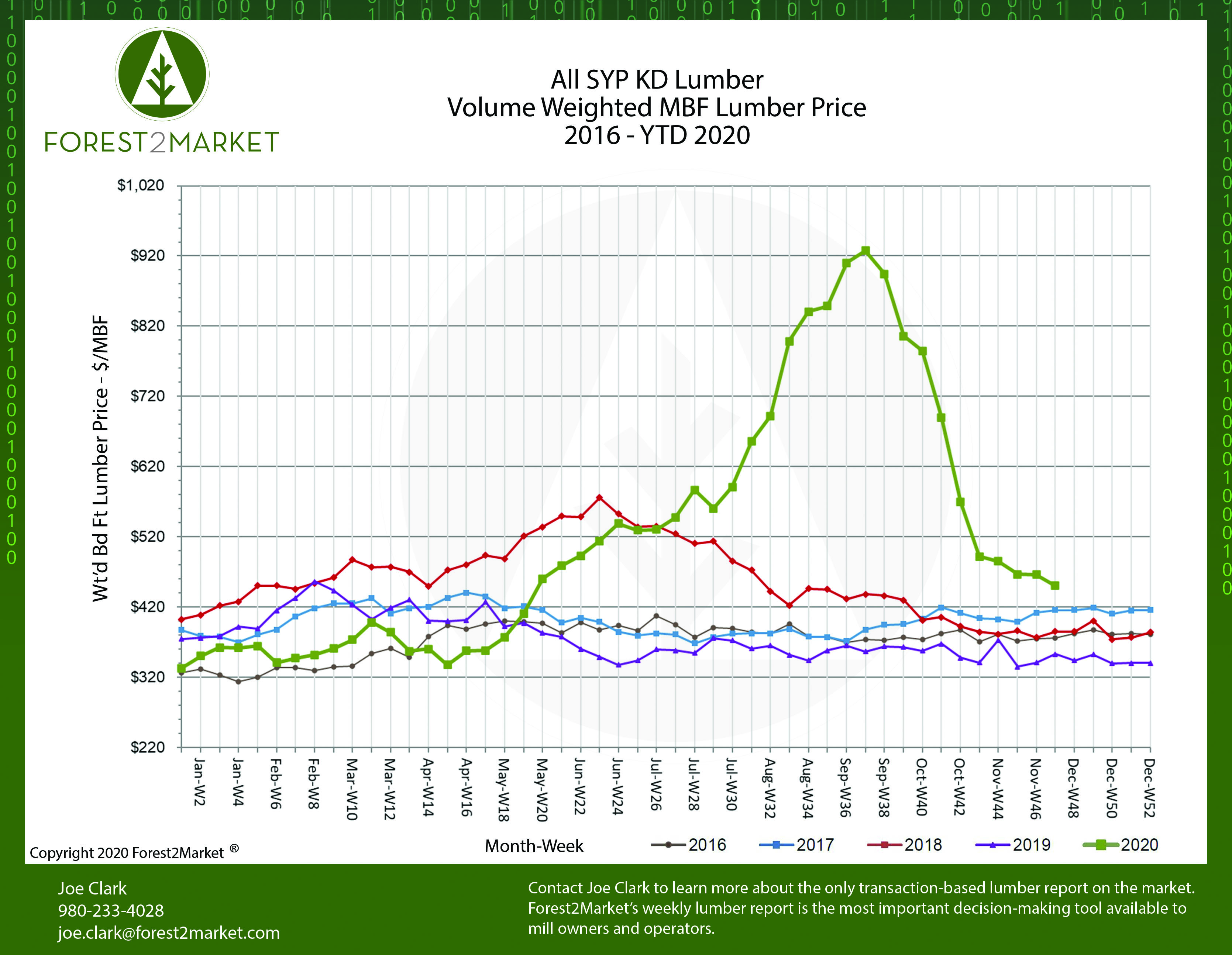

In late October, southern yellow pine (SYP) lumber prices plunged in the wake of an historic runup that culminated in record high prices of $926/MBBF just a month earlier. While the trend represented a quick reversal and prices retreated even faster than they rose, SYP prices seem to have found a floor… for now.

Forest2Market’s composite SYP lumber price for the week ending November 20 (week 47) was $450/MBF, a 3.4% decrease from the previous week’s price of $466/MBF, but a 27.5% increase from the same week in 2019. Since peaking at $928/MBF in September, SYP prices have now dropped 52%.

Other price trends include:

- 1Q2020 Average Price: $360/MBF

- 2Q2020 Average Price: $456/MBF

- 3Q2020 Average Price: $761/MBF

- YTD Average Price: $521/MBF

Market View

The Wall Street Journal recently noted that “Lumber prices are making an unusual late-season climb, thanks to builder-friendly autumn weather and suppliers stocking up for what they expect to be another big year for home construction.”

Indeed, demand for single-family housing has increased so rapidly in recent months—fueled by low interest rates and a desire for more space—that there is now a gap between sales and home construction not seen since the housing bust. Census Bureau estimates and NAHB surveys indicate builders are selling a greater number of homes that have not begun construction. September sales of such homes were up 49 percent YoY.

As Walt Breitinger of Paragon Investments wrote, “The pandemic has exacerbated the problems with city living accompanied by crime, high taxes, pollution, and congestion. Strong housing starts were announced Wednesday while single family home sales, announced Thursday, exploded to a 14-year high. Much of the housing demand was attributed to the rise in electronic learning, remote meetings, and home offices in suburbs while the 40-year low in mortgage rates continues to help affordability.”

Available home inventory remains tight on a months-of-sales basis: New-home inventory (3.6 months in September) has been lower only four times (the first time was in November 1998), whereas resales (2.7 months) were at a record low going back to January 1999.

Despite the pervasive sense of global uncertainty surrounding the COVID-19 pandemic, any upcoming vaccine distribution, US election outcomes, etc., the strong demand signals and market underpinnings suggest that the housing sector is on solid footing. If that is indeed the case, softwood lumber prices should reflect that relative strength for the foreseeable future.