3 min read

Harvests Approach Maximum Sustainable Levels as Roundwood Prices Surge in Sweden

Jarno Seppälä

:

February 27, 2019

Jarno Seppälä

:

February 27, 2019

Swedish forest industry performance was largely positive in 2018 due to strong export opportunities. Roughly 70% of the forest industry’s production is export driven, which means that successfully penetrating foreign markets is crucial for the competitiveness of the entire Swedish industry.

Production volumes of wood products and the pulp and paper segment were largely unchanged in comparison to 2017, but export values rose sharply—particularly in the pulp segment, which experienced an almost 30 percent increase in export values. The increased values are driven by increased demand in many key export markets; the average prices for pulp were at record levels during 3Q2018, but they have since decreased slightly. The improved performance is linked to the strengthening of the international economy that has driven an increase in housing starts and lumber/panels, and the increased consumption of pulp, tissue and packaging products.

Swedish monetary policy has also contributed to improved forest industry performance, which has allowed the use of Crown currency in export trade that has resulted in improved profits compared to Euro-based competitor countries. Additionally, Sweden has existing logistics and supply chain solutions to penetrate larger markets throughout Europe, and the country is advantaged when compared to Finland—a competitor country—which lacks land access to the Central Europe.

Sweden’s upbeat financial performance in its forest industry has encouraged companies to make recent investments in both traditional forest products sectors and new industries exploring innovative wood-based bioproducts and composites that are competing with fossil-based plastics in the market. The use of wood biomass for energy has also increased.

Increasing Demand & Price Trends

Sweden’s forest industries have the capability to produce high-quality, high-margin wood products in large part due to access to quality wood raw materials. Like all forest economies, the raw material supply plays a crucial role in the forest industry's long-term success and ability to manage sustainable growth. Recent developments in the domestic raw material base show that supply risks are always present.

According to the Swedish Forest Agency, the total harvest level increased by almost 20 million cubic meters (m³) from 1999-2018; from 72 million m³ to 92 million m³. The growing harvest level reflects the increasing raw material demand from wood-consuming industries over a nearly 20-year period. Current harvest data suggests Sweden is close to its peak sustainable harvesting level, which the Swedish Forest Agency estimates is in the range of 95-100 million m³.

This very tight supply/demand situation can also be found in neighboring Finland, although its gap between current harvests and sustainable maximum levels is slightly larger. However, it must be noted that the supply/demand balance in Finland varies regionally and between wood assortments and types. Finnish demand is expected to increase in the near term as there are several greenfield pulp mill plans on the horizon.

To further stress Sweden’s supply/demand dynamic, the supply of wood raw material has recently experienced unforeseen damage due to major forest fires, which broke out throughout the country in the summer of 2018. These fires had a significant impact on the forest supply chain and production capabilities, as large volumes of salvage harvests were necessary. As a result, the total harvest area in 2018 was its largest since 1995, and manufacturers are still working through inventories of roundwood salvaged from the fires, which impacts final-product quality. Prolonged storage times also increase the risk of exposing the wood to various fungi and insect damage. As a result of this situation, the Swedish Forest Agency reported a steep increase in roundwood prices from roadside sales, which is likely the result of increased demand of fresh wood.

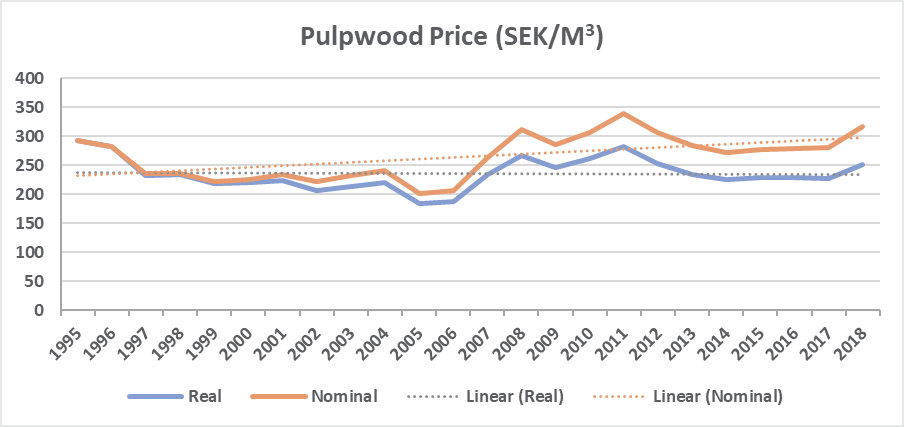

- Pulpwood prices rose 13 percent compared to 2017, which is the largest increase since 2008. Every quarter of the year showed prices increase in comparison to the corresponding quarter in 2017.

- Sawlog prices increased 7 percent during 2018 in comparison to 2017, which is the largest increase since 2010.

Swedish forests are producing enough annual volume to meet current capacity, but there is very little room for growth in the domestic raw material supply, and any growth alternative must come from raw material imports. Currently, less than 10 percent of wood raw materials are imported; however, there are signs that the Swedish pulp and bioenergy sectors are increasing import volumes, especially from the Baltic countries.

Next door, Finnish manufacturers have also increased their share of imports from many of the same countries, which has caused sharp price increases. These developments are representative of the intensifying competition for wood raw materials throughout the Baltic Rim, which also impacts Swedish wood-consuming industries. Furthermore, Swedish producers will also be impacted by activities overseas; low-cost sawmill capacity is increasing significantly in the US South and these manufacturers will compete with Swedish sawnwood exporters in the US as well as in the Middle East and North Africa (MENA) region.

Strategies for the Future

How will Swedish wood-consuming industries maintain sustainable growth in the future? These producers will need detailed supply chain data detailing raw material costs that can account for as much as 75% of the cost of their finished products. Industry leaders must learn how to:

- Access sufficient and secure supplies of wood raw materials

- Assess actual market prices and supply chain cost components, compare these prices to competitors and understand how to lower these costs

- Mitigate price volatility and risk

- Improve supply chain productivity, efficiency and stability

- Establish mutually beneficial partnerships with members throughout the entire forest value chain

Forest2Market produces Europe’s only transaction-based log, pulpwood, chip and biomass pricing index and supply chain optimization structure that offers companies the ability to measure and improve their performance in the raw material supply chain. Forest2Market benchmarks wood raw materials around the world so customers can access the necessary data to analyze their performance globally as the forest products industry becomes more international in nature. Forest2Market and Indufor provide the necessary tools and supply chain expertise to help Swedish wood-consuming industries assess and manage these keys to maximizing performance.