4 min read

Global Wood Fiber Prices: 2Q2017 Insights from Forest2Market’s Western Hemisphere Benchmark

Daniel Stuber

:

September 18, 2017

Daniel Stuber

:

September 18, 2017

Forest2Market’s Western Hemisphere Benchmark allows producers to compare their own raw material costs to the market average in one of many ways:

- By end-product segment. If you produce boxboard, you can compare your costs to the market average for all boxboard producers.

- By species. If you consume conifer (softwood), you can compare your costs to those of all other softwood consumers (the same is true for hardwood).

- By region. If you are in the US South, for instance, you can compare your costs to average costs in the US South.

- By global competition. Because markets for pulp and paper are global, you can understand your relative cost position compared with other producers in the Western Hemisphere.

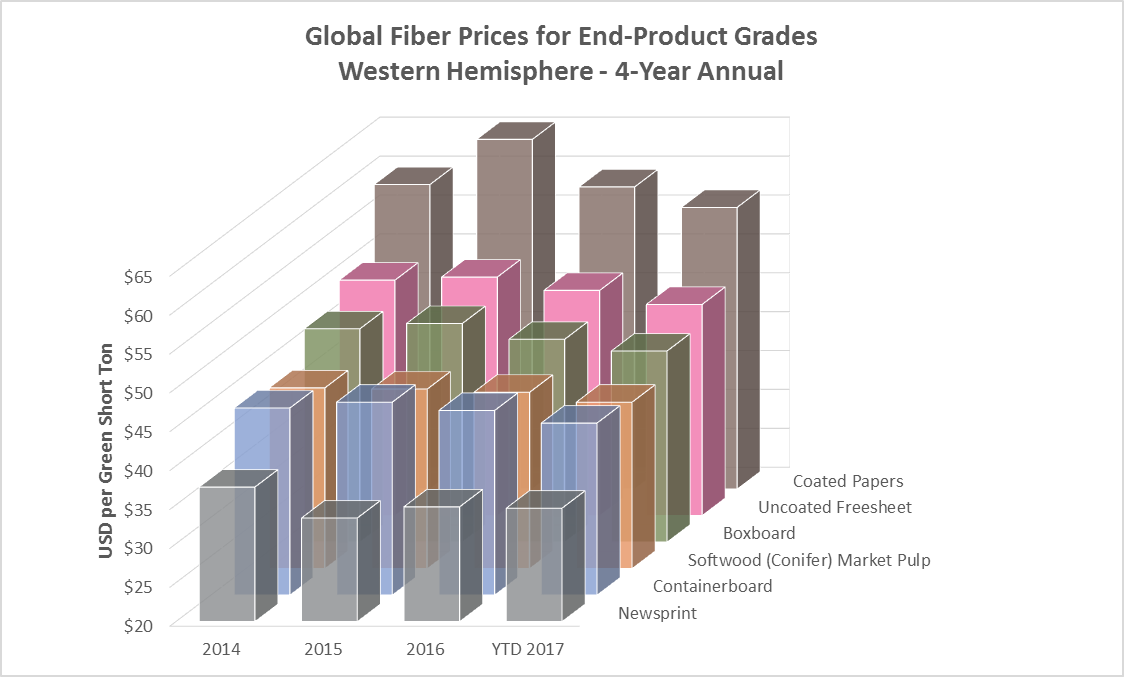

Delivered Wood Fiber Prices for End-Product Grades

Wood fiber prices decreased for all of the pulp and paper producers in 2Q2017 with the exception of newsprint, which was up 1.8 percent on a quarter-over-quarter basis. Year-over-year, all segments saw decreases in their pricing, with the hardwood pulps seeing the largest drop of more than 5.8 percent, coated papers falling 5.5 percent and boxboard, uncoated freesheet and containerboard all falling between 4-5 percent.

Below are 2Q2017 results (average price change) compared to 1Q2017 and to 2Q2016 for various end-product segments:

The following chart shows the trendlines for various end-product segments from 1Q2014 through 2Q2017. Prices were highest for coated paper and hardwood pulp producers, lowest for newsprint and softwood pulp manufacturers.

Delivered Conifer and Hardwood/Eucalyptus Wood Fiber Prices

Lowest Cost Regions: Brazil and the US South

As odd as it may sound, recent quarters in Brazil can be described in one word: stable. With the distractions of the Dilma Rousseff impeachment and Olympics over, the Brazilian economy expanded in 1Q2017. Even though the political environment still has its challenges and corruption accusations continue, GDP grew 1 percent in the first quarter, ending the country’s two-year recession and economic contraction of almost 8 percent.

Wood fiber prices are representative of this stability. Fixed exchange rate prices for conifer fiber have declined $3.00/gst since 1Q2016 with the majority of the decrease occurring in 1Q2017 ($1.59/gst) and a further decrease in 2Q2017 of $0.86/gst. Eucalyptus fiber has experienced even stronger declines with fixed exchange rate prices falling $9.13/gst since 1Q2016. Like conifer fiber, the majority of the decrease occurred in 1Q2017 ($2.94/gst) and a further decrease in 2Q2017 of $4.05/gst.

Accounting for the exchange rate, Brazil continues to maintain a significant dollar denominated cost advantage over the other Western Hemisphere markets including the US South. Year-to-date 2017 conifer prices are $8.56/gst lower than the US South. However, this is a reduction when compared to the same period in 2016 which had Brazil observing a $12.35/gst advantage. For Eucalyptus fiber versus US South hardwood fiber, the trend is the same. Year-to-date 2017 prices have a $12.94/gst advantage whereas for the same period in 2016, the advantage was greater at $15.60/gst.

While the majority of Brazil’s reduced advantage is due to a strengthening of the Brazilian Real against the dollar, a portion of the reduction is also due to declining prices in the US South.

The US South typically experiences seasonal highs in the winter as mills build inventories and ground conditions deteriorate due to heavier precipitation. However, the latter trend did not materialize last winter as precipitation in 4Q2016 and 1Q2017 was 14 percent below average. As mill inventories were strong, demand softened and wood fiber prices decreased as a result; 2Q2017 conifer prices were $1.68/gst lower than 2Q2016, and hardwood prices were $2.90/gst lower.

Highest Cost Regions: North America – West, North America – East

Seasonality in British Columbia and the Pacific Northwest usually occurs in the second quarter and 2Q2017 was no exception. However, this year’s conifer cost increase of $4.15/gst was much higher than the $2.05/gst average over the last 5 years. Since the beginning of the year, sawmill production has been coming up in the region, driving residual chip prices to a 5-year low in 1Q2017. This continued into 2Q2017 where heightened sawmill production allowed pulp/paper mills to continue to shift their purchases from higher cost whole-log chips to the heightened supply of lower cost residual sawmill chips. So why the strong $4.15/gst cost increase? The answer is demand. Demand in 1Q2017 was up 10.4 percent compared to 1Q2016 and 2Q2017 was up 3.3 percent from 1Q2017 and 11.8 percent from 2Q2016.

In North America – East, with continued reductions in production of coated papers and newsprint, prices are on a steep declining trend. Seasonality in 1Q2017 for conifer caused a slight spike in prices, but subsequently declined again in 2Q2017; for first half 2017, prices in the region were $1.91/gst lower than first half 2016.

For hardwood, seasonality in 2Q’s spring break-up drove prices slightly higher. But like conifer prices are on a steep declining trend. 1H2017 prices were $4.28/gst lower than 1H2016.

2H2017 Outlook

In-country wood fiber prices in Brazil are predicted to flatten and as economic conditions are likely to continue to improve, this will cause the Real to strengthen against the dollar. As a result, dollar denominated prices will rise in the second half of the year. The recent start-up of the second machine at the Fibria pulp mill in Mato Grosso do Sul is an indication of strengthening global demand not being filled by Asian mills. As a direct result of current economic conditions, the fiber demand in some sectors that are directly influenced by GDP—particularly containerboard—will increase. However, the gap between Brazil and the US South is predicted to widen as US South prices are likely to climb.

Demand in containerboard and OSB shows continued strengthening and the effect of Hurricanes Harvey and Irma will likely disrupt the market. Additionally, strong precipitation over the summer season and into the winter is predicted to have an upward effect on prices. Current price increases appear to confirm this.

In British Columbia, wildfires, reductions in Annual Allowable Cuts and the US’s (potential) duties on lumber will dampen sawmill production and reduce residual chips in the market. This will push prices higher for pulp/paper mills in the region as they move to higher cost whole-log chips. In the Pacific Northwest, prices are also likely to be higher as demand and production increases outweigh any increase in residual chip supply.

In eastern North America, prices are likely to continue their slide as the market continues to seek a price floor for vacated demand.

Methodology

For the Western Hemisphere Benchmark, we report stemwood (i.e. tree-length pulpwood or bolts) and wood fiber chips (wood fiber chips only, not energy chips) delivered through the supply chain to the end producer’s mill gate. We then convert the price and unit of measurement to US dollars/short ton. For stemwood, we also convert the product to a wood fiber chip equivalent and add a cost of five US dollars/green ton for debarking and chipping to the chip pile. We then compute a weighted average price for all combined wood fiber.