Mill inventory levels are a perennial challenge in the US Northeast/Eastern Canada subregions. In fact, the seasonality of wood supply is the most significant factor mills must take into consideration when planning for a consistent supply. While the specific inventory plan at each mill depends on a variety of other factors as well, the wood production system must generate a sufficient volume of supply while considering the timing of the volume coming to market.

With the exception of a dramatic spike that developed in April 2018, wood fiber prices remained pretty flat in Eastern North America over the last several years, which is somewhat surprising given the convergence of events that have developed in response to the pandemic that began two years ago. While the economy demonstrated steady growth in 2021 — and it really had nowhere to go but up — delivered wood fiber prices in the region skyrocketed to their highest level since 2015.

This is a strange development based on regional forest industry activity over the last decade, a period in which the Northeast experienced a widespread loss of demand for pulpwood. For example, the Great Northern Paper mill in East Millinocket, Maine shuttered in 2013 and a year later, Verso’s mill in Bucksport, Maine followed suit. The closing of these two mills alone resulted in a permanent loss of over a million tons of annual pulpwood demand.

The area has seen a bit of a resurgence recently: Nine Dragons restarted operations at two previously-closed mills in Old Town and Rumford, ME, and Standard Biocarbon plans to produce innovative biochar via source-verified biomass in part of the East Millinocket mill. But these projects couldn’t — or shouldn’t —apply the kind of demand pressure to drive prices to current levels.

What’s driving this dramatic price change in the region?

Basic economics and the law of supply and demand dictates that — all other things being constant — the loss of demand should result in a price decrease. However, if we have learned one important lesson from the cascading impacts of the pandemic, it is this: all other things are simply not constant.

Based on price reactions and current market dynamics in the Northeast, it’s clear that there isn’t a single reason that delivered pulpwood prices have increased while demand has largely been flat. Rather, the compounded effects related to the pandemic response have exacerbated interactions across the forest supply chain. While the region has lost pulp mills, remaining mill operations have gained new demand through capacity creep. Many mills are working hard to make their machines run above nameplate capacity and the result has been increased wood demand at a number of existing mills.

However, I believe a majority of the price impacts are related to logging capacity and the structural changes that have affected the region’s logging and transportation segments over the last several years.

It’s no secret that the Northeast has lost significant logging capacity and will lose more in the future. While large, integrated loggers usually survive a single mill closure and diversify their sales through a number of markets, smaller loggers often disappear when a mill does. Some of these loggers are only capable of turning out a handful of loads per week. Their impact on the larger industry might appear to be minimal, but when enough of these small loggers disappear, it can have a huge impact.

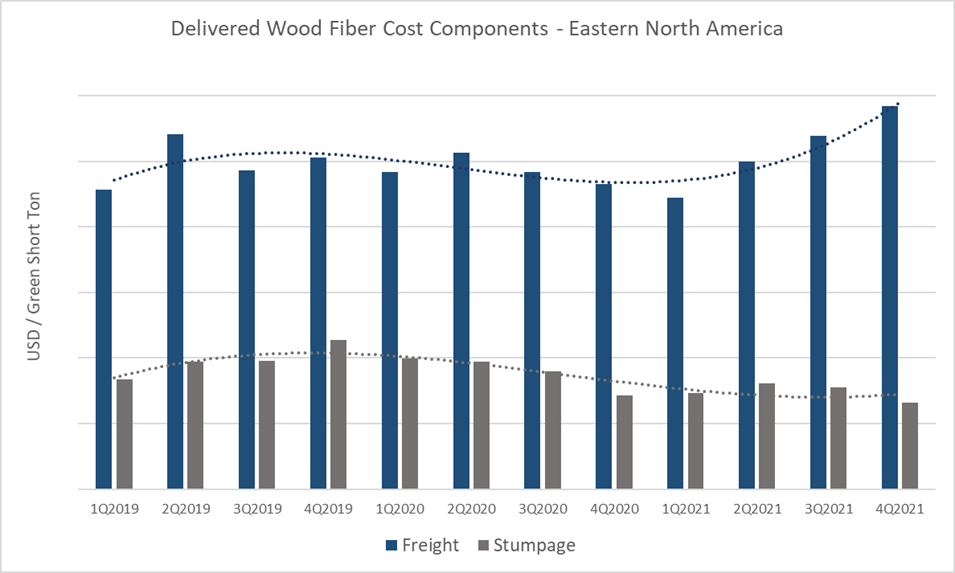

Likewise, the trucking sector is experiencing the same challenges, and events related to the pandemic have further squeezed availability of an already strained and irreplaceable segment of the supply chain. In fact, when digging into the individual cost components over the last three years, we see a clear pattern of decreasing stumpage prices and increasing freight prices in the region – particularly in 2021.

What can this data tell us about how freight prices impact the wood fiber supply chain? While it might seem intuitive to blame a price increase on escalating oil and/or fuel prices, supply and demand of forest products is ultimately what drives the price of logs on the market. However, fuel price does impact the cost of producing logs and wood fiber. In fact, the prices of other important factors that go into generating these products – specialized machines, maintenance parts, steel, labor, tires, etc. – all affect the cost of producing logs and fiber as well. If the cost of freight shifts dramatically, it will drive supply out of the market, which is what eventually impacts the market price of wood.

As our friends at Forest Resources Association noted last month, these types of pandemic-fueled stressors related to logging and trucking capacity are having a real impact on delivered wood prices. The challenges outlined in these instances are compounding, and an increase in freight costs is therefore not surprising:

- A trucking company that hauls raw forest products domestically as well as to and from Canada has experienced significant increases in costs over the past year. Labor has increased 25% and diesel fuel 50%. Trailers and tractors are taking more than six months to receive. This company will additionally be impacted by the vaccine requirement for drivers hauling forest products to and from Canada to the US. The company anticipates losing more than 50 percent of its drivers that haul products to Canada due to the vaccine requirement which were implemented in early 2022.

- A logging and trucking company located in Minnesota has been waiting for parts to fix road building equipment for more than two months. Trailers to haul logs were ordered more than six months ago and still have not been received. New trucks ordered today are more than one year out. Maintenance items subject to wear, such as saw blades and saw bits, are more than three months out.

- A logging business in the Northeast US has been waiting for parts to fix in-woods equipment (skidder) for two weeks. The business owner has been told that the part, normally available locally, is on a shipping container off the Port of Los Angeles. This delay will result in a significant loss of timber production during the busy winter harvest season.

Suppliers in Eastern North America are facing a number of challenges right now, and there doesn’t seem to be a “silver bullet” solution on the horizon. Further supply constraints are likely, at least through 2Q2022 or possibly longer.

The reality is that the Northeast has some of the highest wood fiber prices in North America, and it’s only a matter of time before more demand exits the market. It is more critical than ever for both suppliers and consuming mills in the region to optimize the wood fiber supply chain. While consumers can’t materially impact the logging and trucking capacity squeeze right now, a focus on overall supply chain value going forward will help the entire industry remain competitive.

Joe Clark

Joe Clark