From Forest2Market's Economic Outlook:

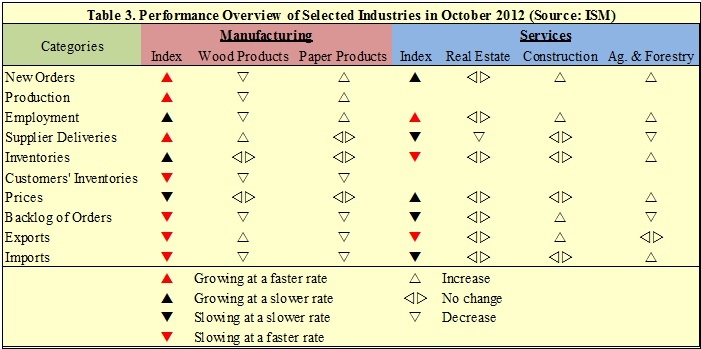

Manufacturing continued to expand in October, with the PMI up 0.2 percentage points to 51.7 percent; this is the second straight increase after three months of minor contraction. Overall, Paper Products reported growth while Wood Products contracted. One respondent to the survey from the Paper Products industry remarked that the “market is still very soft.” A Wood Products industry respondent added, “[Our] 4th quarters usually begin to show a slowdown in demand, and this year is not different; prices are also dropping.”

The sub-indices indicate that Paper Products saw an increase in new orders and Wood Products saw a decrease. Paper Products reported growth in production during the month, and Wood Products reported contraction. Paper Products had higher employment and Wood Products lower. Some good news for both industries can be found in Customer Inventory levels—both were reported as too low during October.

The import/export news is mostly good as well: both Wood Products and Paper Products saw a decrease in imports during the month, and Wood Products also saw an increase in export orders. (Paper Products saw a decrease in export orders.)

The service sector grew at a slower pace in October, reflected by a 0.9 percentage point drop in ISM’s non-manufacturing index (NMI), from 55.1 to 54.2. (Any reading over 50 signifies growth.) Overall, the sub-indices were mixed, with business activity and new orders falling and employment improving. Anthony Nieves, the chair of the ISM’s Non-Manufacturing Business Survey Committee, remarked that “The majority of the respondents’ comments reflect a positive but guarded outlook on business conditions and the economy.”

Of all service industries, Agriculture & Forestry and Construction reported the best performance, ranking #1 and #2 of all industries surveyed. Real Estate also expanded, after contracting in September. Agriculture & Forestry and Construction also led the pack in growth of business activity, new orders and employment.

To get Forest2Market's forecast of industrial production, subscribe to our Economic Outlook.

We included this bit of analysis about manufacturing employment from the Boston Consulting Group (BCG) in last month’s post. For those of you who did not see it, we repeat it now:

The short-term outlook for American manufacturing jobs may be rather bleak, but the Boston Consulting Group (BCG) is very upbeat about longer-term prospects*. BCG recently predicted that manufacturing could repatriate between 2.5 and 5 million jobs by 2020. By as early as 2015, BCG predicts “the United States will have an export cost advantage of 5 to 25 percent over Germany, Italy, France, the U.K., and Japan in a range of industries [including machinery, chemicals, transportation equipment along with electrical and appliance equipment]. Among the biggest drivers of this advantage will be the costs of labor, natural gas, and electricity. As a result, the United States could capture 2 to 4 percent of exports from the four European countries and 3 to 7 percent from Japan by the end of the current decade. This would translate into as much as $90 billion in additional U.S. exports per year.” In addition:

- “America’s natural gas boom from shale (commonly referred to as ‘fracking’) has provided this country with some of the cheapest natural gas prices around the world. For the foreseeable future, natural gas prices will remain 50 to 70 percent cheaper in the United States versus Europe and Japan

- “Labor costs in other developed economies will be 20 to 45 percent more expensive compared with the costs of hiring U.S. workers

- “The United States could grab additional exports from the aforementioned nations to the tune of $130 billion annually

- “Average manufacturing costs in China will only be 7 percent lower compared to in the United States in 2015.”

*http://www.bcg.com/media/PressReleaseDetails.aspx?id=tcm:12-116389

Suz-Anne Kinney

Suz-Anne Kinney