According to ISM, the pace of growth in manufacturing slowed slightly in February; its PMI fell to 52.4 percent, from 54.1 in January (50 percent is the breakpoint between contraction and expansion). Nonetheless, Bradley Holcomb, chair of ISM’s Manufacturing Business Survey Committee, related that “comments from the [respondent] panel continue to reflect a generally positive outlook for the next few months.” Paul Dales, senior U.S. economist at Capital Economics, had a less upbeat take, saying the PMI decline “is hardly a disaster but it does support our view that the economy is not quite as strong as recent data have led others to believe.”

The non-manufacturing sector extended gains in February, reflected by a 0.5 percentage point rise (to 56.8 percent) in the non-manufacturing index (now known simply as the “NMI”). “The majority of comments from the respondents reflect a growing level of optimism about business conditions and the overall economy,” concluded Anthony Nieves, chair of ISM’s Non-Manufacturing Business Survey Committee. However, “there is a concern about inflation, rising fuel prices and petroleum-based product costs.” The diffusion indices for input prices jumped noticeably in both the manufacturing and service sectors. Caustic soda, lumber, diesel fuel and gasoline were up in price. Paper and paper tissues were the only relevant commodities down in price.

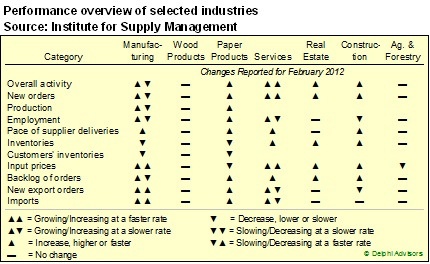

As the following table shows, Wood Products was unchanged in February, while Paper Products expanded once again; Paper Products and Agriculture & Forestry bucked the trend of higher input prices. Real Estate and Construction both reported expansion in overall activity, while Agriculture & Forestry was unchanged overall.

From: Forest2Market's Economic Outlook. For more information. Order now.

Suz-Anne Kinney

Suz-Anne Kinney