Forest industry performance in September and October was reported by both the US government and the Institute for Supply Management.

Total industrial production (IP) decreased 0.2% in September (+0.4% YoY) after edging down 0.1% in August (originally -0.4%). Manufacturing output retreated 0.1% (but +1.6% YoY) for a second consecutive monthly decrease. Mining fell 2.0% (with oil and gas drilling down 4%, to its lowest level this century), while utilities rose 1.3%. Wood Products output fell 2.0% (-2.0% YoY) while Paper decreased 0.5% (-2.5% YoY). For 3Q as a whole, total IP rose at an annual rate of 1.8%, and manufacturing increased 2.5% on gains from motor vehicles and parts.

Capacity utilization (CU) for the industrial sector fell 0.3% in September to 77.5%, or 2.6 percentage points below its 1972-2014 average.

-

Wood Products CU tumbled 2.1% (-4.3% YoY) to 68.2%

-

Paper retreated by 0.5% (-1.9% YoY) to 81.5%.

Capacity at the all-industries and manufacturing levels moved higher.

-

All-industries: +0.1% (+1.6% YoY) to 138.1% of 2012 output

-

Manufacturing: +0.1% (+1.3% YoY) to 138.7%

-

Wood Products: +0.2% (+2.5% YoY) to 159.8%

-

Paper: unchanged (-0.6% YoY) at 116.9%

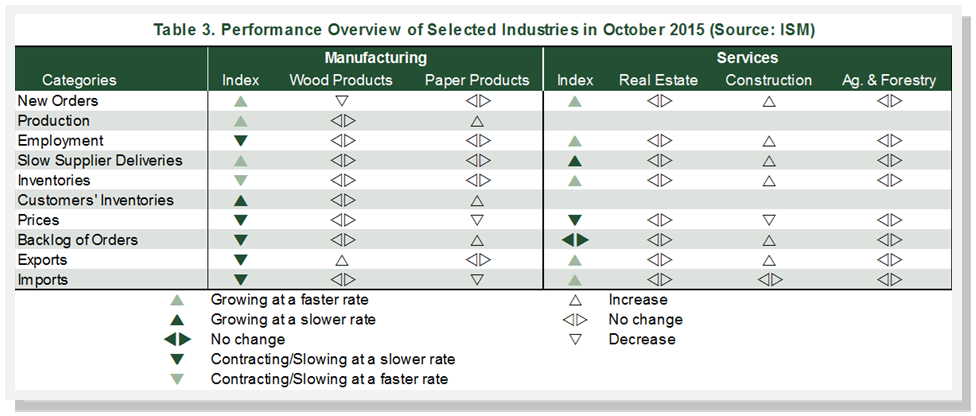

The Institute for Supply Management’s (ISM) survey showed that U.S. manufacturing "remained stuck in neutral" in October. The PMI edged down 0.1 percentage point, to 50.1% (Figure 2)—the lowest reading since May 2013. (50% is the breakpoint between contraction and expansion.) The key internal new-orders sub-index improved, however, and remained in expansion; also, the contraction in backlogged orders improved relative to September (Table 3). Wood Products contracted in October, as a drop in new domestic orders more than offset a rise in export orders. Paper Products expanded as usual, with only imports declining.

Whereas manufacturing nearly stalled in October, the pace of growth in the non-manufacturing sector quickened. The NMI picked up 2.2 percentage points, to 59.1%. Important internals improved and remain in expansion. Only Construction reported an increase in activity among the service industries we track; Real Estate and Ag & Forestry were completely absent from the October report.

Joe Clark

Joe Clark