Forest industry performance in February and March was reported by both the US government and the Institute for Supply Management.

Total industrial production dropped by 0.5% in February; a Federal Reserve annual revision published April 1 also showed that total IP contracted on a YoY basis during the six months through February. On a more positive note, however, manufacturing showed consecutive YoY increases in February, perhaps “a signal that the drag from the strong U.S. dollar is diminishing,” said Millan Mulraine, US macro strategist at TD Securities.

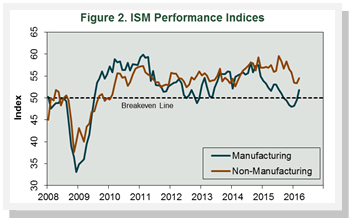

The Institute for Supply Management’s (ISM) monthly opinion survey showed that US manufacturing gained ground during March (Figure 2). The PMI increased by 2.3 percentage points, to 51.8%. (50% is the breakpoint between contraction and expansion.) Changes to key internal sub-indexes included a pick-up in new orders and production, and a return to increasing input prices (Table 4).

The pace of growth in the non-manufacturing sector picked up slightly; the NMI rose by 1.1 percentage points, to 54.5%. Except for backlogged orders and imports, all sub-index values were higher in March than February. Wood Products was unchanged, and Paper Products expanded as more new orders and production apparently outweighed decreases in employment, backlogged and new export orders, and imports.

The consumer price index (CPI) declined 0.2% in February (but +1.0% YoY), as a 13.0% drop in the gasoline index more than offset increases in the indexes for food (+0.2%) and all items less food and energy (+0.3%).

The producer price index (PPI) fell 0.2%, thanks primarily to energy (-3.4%) and food (-0.3%). For the 12 months ended in February, however, prices for final demand less food, energy, and trade services rose 0.9%, the largest 12-month advance since a 0.9% increase in July 2015.

- Pulp, Paper & Allied Products: -0.5% (-1.4% YoY)

- Lumber & Wood Products: +0.1% (-2.1% YoY)

- Softwood Lumber: -0.4% (-6.4% YoY)

- Wood Fiber: +0.3% (-3.2% YoY).

Joe Clark

Joe Clark