3 min read

Fisher International’s Top 10 Blog Posts of 2021

Fisher International

:

December 21, 2021

.png)

The global pulp & paper industry has undergone some significant changes in 2021 – some expected, some unexpected – but the industry as a whole has emerged from another tumultuous year in a relatively strong position. In light of these changes, we wanted to take an opportunity to look back and see which topics resonated the most with visitors to Fisher International’s Paper Industry Commentary blog in 2021.

It’s also a great opportunity to offer our sincere gratitude to the contributors and regular readers of our blog and newsletters. We are delighted that you find continued value in our content. We wish you a safe, warm, and joyous holiday season and we look forward to providing you with fresh industry insights and meaningful content in 2022.

The Top 10 Most Popular Blog Posts of 2021

1. Market Pulp Price Surge: What’s Driving Prices Higher?

Market pulp is a critical global commodity within the pulp and paper industry. As such, market pulp is a constant fixture in global trade flows because of its primary role in manufacturing numerous paper grades. Market pulp prices have always been volatile and kraft market pulp, in particular, saw some of its lowest prices in the last 10 years in 2020. However, 2021 has brought price increases with skyrocketing spot prices in February and early March. Between December 1, 2020 and late February 2021, bleached softwood kraft futures were up 48% on the Shanghai Futures Exchange (SHFI), and additional price increases have been announced, leaving buyers wondering what has happened and when it will end.

2. North American Tissue Demand Trajectory Through the Rest of the Pandemic

North America represents the world's most mature tissue market and maximum tissue consumption rate per capita. China and the Asian region have supplanted North America as the center of global tissue growth. However, North America's product and consumer trends are still predictive of potential trends in the developing regions.

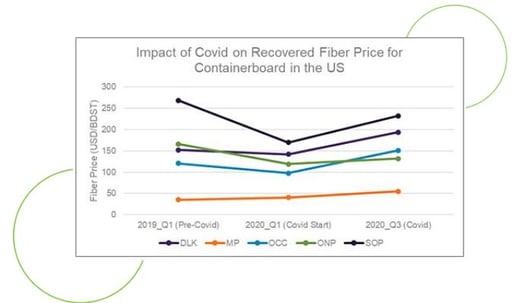

3. Why Haven’t OCC Prices Come Down?

This year, we have seen a number of price increases occur within the pulp and paper industry. Most recently, the price for old corrugated cardboard (OCC) and mixed papers (MP) has increased sharply as the national average price for OCC has gone up about $20 since last month to $183/ton, a $90 difference from last year’s average — leaving many left to wonder how much longer this will last.

4. Is Printing and Writing Making a Comeback?

Earlier this year, we speculated where the printing and writing segment was headed post-COVID and discussed the anticipated “short-term bump” in demand as we’ve been experiencing economic recovery and relaxation of COVID restrictions. Recently, Domtar announced plans to restart its Ashdown mill in response to increasing customer demand, signaling the beginning of this short-term bump. The mill is expected to resume full operation in January 2022, at which time it will add approximately 185,000 tons of uncoated freesheet to the market.

5. How Will China’s Energy Crisis Impact Its P&P Industry?

China was recently hit by one of the worst power shortages in a decade. So far, around 20 provinces/municipalities are undergoing local power restrictions of varying degrees. Currently, the temporary power shutdowns that have been occurring in most provinces since September are only targeting industrial users. For example, Guangdong (one of the biggest papermaking provinces) implemented a reduced supply schedule on September 16 to its industrial users, according to Guangdong Power Grid.

6. Do You Know How to Fix What’s Slowly Killing Your Company?

Robust, competitive markets force participants in those markets to learn how to serve their customers in more efficient, cost-effective ways, or else they risk going extinct. In our own experience, however, Fisher has found that companies can sometimes fall victim to “inertia” – a tendency to do things over and over in the same way, which is often driven by biases that we all have as humans.

7. Could New Carbon Regulations Impact the Tissue Industry?

On January 20, 2021 Joe Biden was sworn in as the 46th President of the United States, which capped off an especially contentious election season. The Biden administration has widely publicized that a key component of its vision for the country is pursuing clean energy to help mitigate the impacts of climate change; he even wrote one of the first climate bills in the US Senate. How could this new administration and its push for clean energy affect the tissue industry?

8. How the Rise in E-Commerce Has Facilitated the Value of Mixed Paper

The rise in e-commerce amid the pandemic has been one of the most significant changes to have occurred. This change in shopping habits has been beneficial for the pulp and paper industry as demand for paper and packaging materials used to ship goods to consumers has substantially increased. However, we are now seeing that this rise in e-commerce has also allowed US paperboard producers to turn recycled catalogs, boxes, and newspapers into new paper products.

9. Brazil Moves from Tissue Importer to Tissue Exporter

Those within the tissue industry know Brazil for its robust eucalyptus pulp production, which is generally used within the tissue segment due to its positive impacts on tissue properties. As a result, Brazil has started to invest in its domestic tissue business, affecting both tissue imports and exports.

10. With Domtar Acquisition, Paper Excellence Expands Presence in NA Market

The post-COVID global landscape continues to shift in a number of new directions within the pulp and paper industry – some expected, some unexpected. The accelerated decline of the printing and writing (P&W) segment, for instance, is no surprise. However, while M&A and consolidation activity can largely be expected during transitional periods, new opportunities are prompting some ambitious moves. Most recently, British Columbia-based Paper Excellence (PE) announced that it is in the process of acquiring South Carolina-based Domtar.