3 min read

Export Wood Pellet Facilities’ Raw Material Delivered Cost Trends

Javon Carter : July 16, 2013

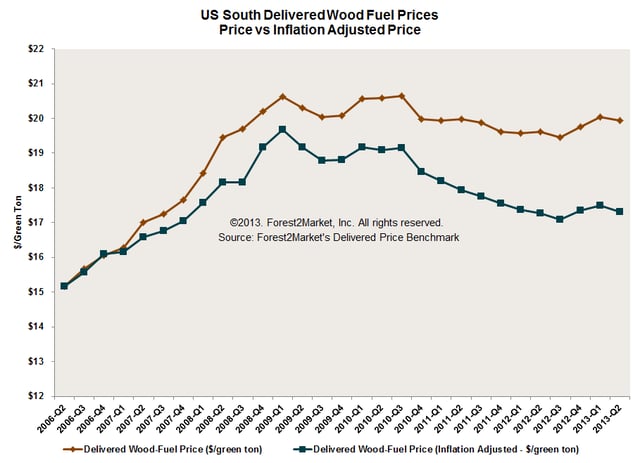

The majority of export wood pellet facilities use three feedstocks: pine pulpwood (roundwood or chip) and/or hardwood pulpwood (roundwood or chip) for pellet production and wood fuel for operation of the dryer. Delivered prices for pine pulpwood, hardwood pulpwood and wood fuel all increased over the past year (2Q2012-2Q2013). Conversely, from the first quarter to the second quarter of 2013, delivered prices decreased for each product.

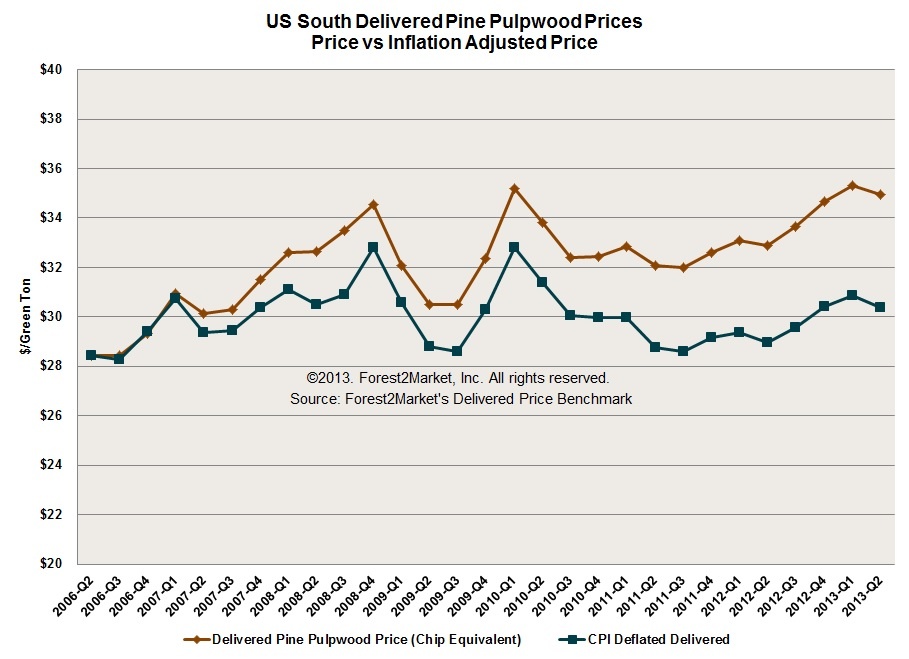

Pine Pulpwood*

Year-over-Year

Though they fell in 2Q2013, pine pulpwood prices are up $2.06 per ton or 6.3 percent from a 2Q2012 average price of $32.90/ton to $34.96/ton. Between 2Q2012 and 2Q2013, demand for pine pulpwood increased by 3.7 percent, due to increases in OSB and wood pellet production. Stumpage prices have risen in response to the demand increase, gaining $1.00/ton or 10 percent. Freight costs rose 12.2 percent or $1.01/ton. Handling costs (cost of harvesting the timber) remained steady, gaining just $0.06/ton.

Quarter-over-Quarter

In 2Q2013, pine pulpwood prices decreased $0.37/ton or 1.0 percent from the 1Q2013 average price of $35.33 per ton. Demand for pine pulpwood declined as total purchase by volume was down 0.9 percent in 2Q2013. Freight costs increased an average $0.07/ton. Stumpage and handling costs, on the other hand, were lower, down $0.39/ton and $0.05/ton, respectively.

3Q and 4Q 2013 Expectations

We expect pine pulpwood to increase in the near term mostly due to seasonality. This trend will be driven by the lumber industry tapering off production and emptying inventories. This will lead to a lower supply of residual chips available to the market and cause pine pulpwood demand to increase.

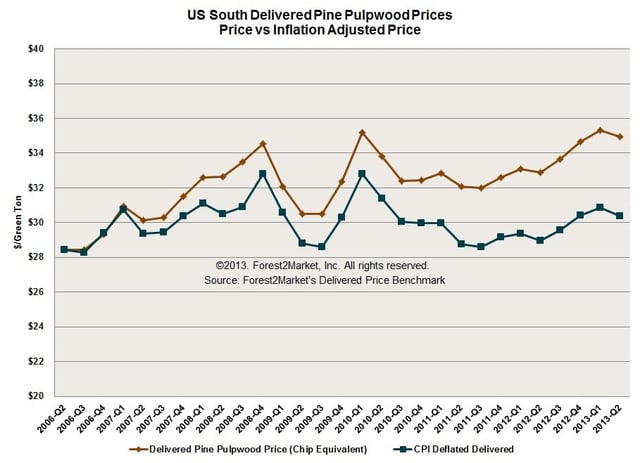

Hardwood Pulpwood*

Year-over-Year

The current US South hardwood pulpwood average delivered price is $39.36 per ton. Year over year, they have increased $1.70/ton or 4.5 percent from a 2Q2012 average price of $37.66/ton. Despite the fact that hardwood pulpwood demand decreased 2.0 percent during this period, stumpage prices have gained ground; they are $1.03/ton or 10.4 percent higher than they were last year. Freight costs also increased an average $1.00/ton or 9.6 percent, while handling fell an average $0.34 per ton or 1.9 percent.

Quarter-over-Quarter

During 2Q2013, hardwood pulpwood prices declined $0.24 per ton or 0.6 percent from the 1Q2013 average price of $39.60/ton. Stumpage costs fell $0.16/ton, handling cost fell $0.05 per ton, and freight fell $0.03 per ton.

3Q and 4Q 2013 Expectation

In 2H2013, we expect hardwood pulpwood delivered prices to trend higher. The gains will be driven by the relationship between pine sawtimber and hardwood pulpwood harvest activity. Hardwood pulpwood supply is largely a byproduct of pine sawtimber harvest activity; as pine sawtimber supply decreases in response to deteriorating construction demand (a function of seasonality), so too will hardwood pulpwood supply. As hardwood supply decreases, delivered prices are expected to rise.

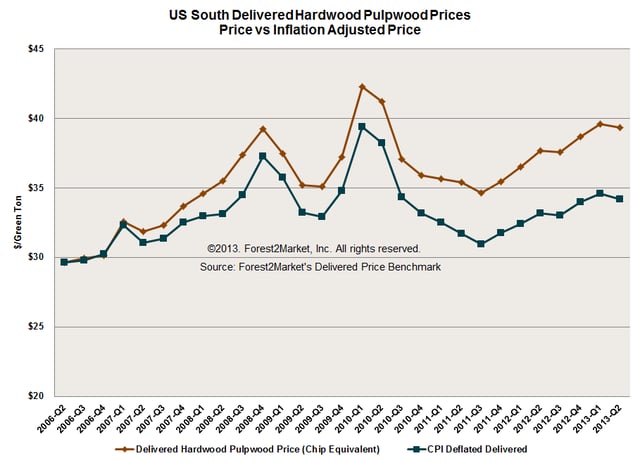

Wood Fuel

Year-over-Year

Wood fuel delivered price gained $0.32/ton or 1.7 percent from the 2Q2012 average price of $19.62/ton to $19.94/ton in 2Q2013. Improvements in housing construction over the past year resulted in a 4.8 percent increase in demand for pine secondary chips (sawmill residues). This increase in demand helped exert downward price pressure on wood raw material costs which fell $0.43/ton or 3.6 percent. The real driver of wood fuel prices can be attributed to freight costs which escalated an average $0.75/ton or 9.7 percent.

Quarter-over-Quarter

Quarter over quarter, wood fuel delivered prices decreased by $0.11/ton to an average of $19.94/ton. Demand for wood fuel declined, as total purchases by volume were 4.5 percent lower in 2Q2013. Freight costs increased an average $0.22/ton. Wood raw materials costs fell an average $0.33/ton, causing wood fuel delivered prices to decrease overall.

3Q and 4Q 2013 Expectation

Despite an increase in price due to freight for 4Q2012 and 1Q2013, wood fuel prices are likely to continue a downward trend in the second half of the year. Although sawmills are curbing lumber production in response to vascillating housing start numbers, pulpwood demand continues to increase creating steady in-woods supply.

*As pine pulpwood and hardwood pulpwood are often delivered in roundwood or chips, delivered costs are expressed in chip equivalent $/ton to maintain cost consistency despite the form.