Every month, Forest2Market publishes updated forecasting products designed specifically for participants in the forest value chain. The Economic Outlook is a macroeconomic indicator forecast that supplies critical information, context and insight about general economic trends and direction, and the 4Cast supports regional operational decision making for those who buy and sell timber. With an understanding of economic indicators, future stumpage prices and insight into buying and selling windows (periods in which buyers or sellers hold relative market advantage), subscribers are better able to time sales or purchases, negotiate prices, manage workloads and control inventory levels. The following commentary is just a sampling from the most recent Economic Outlook for July, 2019.

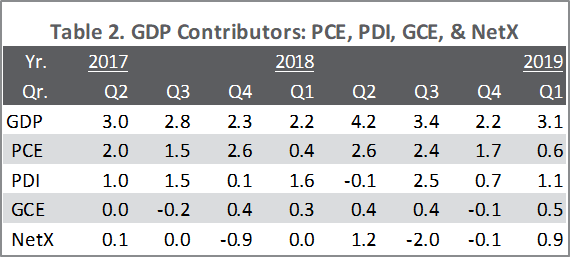

In its third estimate of 1Q2019 gross domestic product (GDP), the Bureau of Economic Analysis (BEA) nudged the growth rate of the US economy to a seasonally adjusted and annualized rate (SAAR) of +3.12% (+3.1% expected), up 0.06 percentage point (PP) from the second estimate (“1Qv2”) and +0.95PP from 4Q2018.

As in 1Qv1&2, all four groupings of GDP components—personal consumption expenditures (PCE), private domestic investment (PDI), net exports (NetX) and government consumption expenditures (GCE)—contributed to 1Q growth. Although the headline number was essentially unchanged in 1Qv3, material shifts occurred in:

- Consumer spending on goods, which were revised from contraction to expansion

- Consumer spending on services, in which growth was cut by nearly half

- Fixed investment (especially in the non-residential and intellectual property products line items) which was increased by more than one-third above the 1Qv2 rate

After a strong 1Q, signs of slowing momentum have proliferated during 2Q. Reuters provided a dashboard of indicators that may be warning of a global recession. Closer to home, many analysts point to the Federal Reserve’s apparent willingness to loosen monetary policy—via rate cuts and/or an early end to its balance-sheet reduction process—as an admission the US economy is decelerating.

Two-thirds of chief financial officers (CFO) responding to the most recent Duke University/CFO Global Business Outlook survey see a recession hitting the United States by the end of 2020, and 48.1% expect negative growth by 2Q2020. “This is the third consecutive quarter that U.S. CFOs have predicted a 2020 recession,” said survey director John Graham. Also, “it’s notable this quarter how strongly recession is being predicted in other parts of the world.”

The more bearish among analysts argue a recession is either imminent or already ongoing in the United States. Citing a steepening of the US yield curve after an inversion (discussed in a subsequent section of this report), and other factors, Société Générale’s Albert Edwards thinks recession warnings are being “shouted” from the “rooftops.” Economist Gary Shilling believes a recession is already ongoing, but that “it will probably be a run-of-the-mill affair, which means real GDP would decline 1.5% to 2%, not the 3.5% to 4% you had in the very serious recessions.” Note that Shilling’s comments were sandwiched between May’s abysmal and June’s blowout employment numbers; such labor market gyrations are themselves entirely consistent with late-business-cycle indicators.

Regulatory reform in the United States will support ongoing growth but, by itself, not stimulate additional growth. Political wrangling is hindering progress on trade negotiations (e.g., the agreement among the US, Canada and Mexico is bottled up in the House of Representatives) along with meaningful health care cost relief. Also, further tax changes are unlikely (with the possible exception of a Presidential executive order indexing capital gains to inflation) thanks to intensifying inter-party rancor as the 2020 election cycle unfolds.

Because the National Bureau of Economic Research (the body that determines when recessions begin and end) typically does not make such a call until a downturn is well underway, an official call is unlikely anytime soon. Regardless, “1Q GDP paints a misleading picture of the U.S. economy’s vigor,” said Oxford Economics’ Lydia Boussour, “and 2Q GDP will come as a timely reminder that the economy is now well past its inflection point.”