1 min read

China’s Importation of Logs & Lumber Plunged by Over 50% from 4Q2021 to 1Q2022

Håkan Ekström

:

August 10, 2022

Håkan Ekström

:

August 10, 2022

China's economy weakened in the 1Q/22 as the COVID epidemic took its toll in cities such as Shanghai. US financial institutions forecast the GDP growth to range between 3-4% in 2022, less than the Chinese government’s target of 5.5% for the year. The GDP outlook is on pace to be the second-lowest, after 2020, in 45 years.

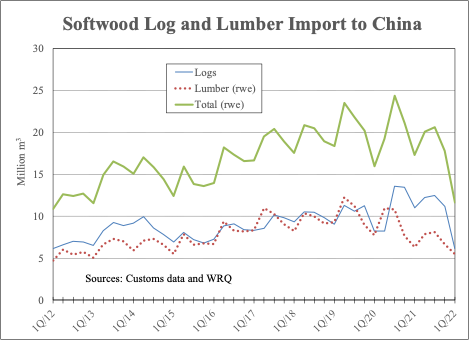

The weak economy, widespread Covid-related shutdowns of the manufacturing industry, logistical bottlenecks with supply chain interruption, and less demand for housing and apartments have reduced consumption of wood products in the past years. The decline in wood demand has resulted in a sharp drop in the importation of logs and lumber. From the all-time high in the 3Q/20 to the 1Q/22, China’s import volume of softwood forest products fell over 50% (see chart).

In the 1Q/22, softwood log imports declined sharply to 6.1 million m3, 45% lower than the previous quarter and the lowest quarterly volume over the past ten years. With Russia implementing a log export ban beginning in January 2022, import volumes to China fell substantially, from 800,000 m3 in the 4Q/21 to only 80,000 m3 in the 1Q/22 (customs data show no imports at all for March and April, 2022). Other supplying countries also have reduced shipments from the last quarter of 2021 to the first quarter of 2022, including Uruguay (-93%), the US (-58%), Germany (-43%), and New Zealand (-35).

With the reduced demand for imported logs, average import prices have fallen for two consecutive quarters from their all-time high of $190/m3 in the 3Q/21 to $170/m3 in the 1Q/22. However, despite the decline, prices in early 2022 were still among the highest they have ever been.

Are you interested in worldwide wood products market information? The Wood Resource Quarterly (WRQ) is a 70-page report established in 1988 with subscribers in over 30 countries. The publication tracks prices for sawlog, pulpwood, lumber & pellets and reports on trade and wood market developments in most key regions worldwide. For more insights on the latest international forest product market trends, please go to www.WoodPrices.com