2 min read

At Issue: The Renewable Fuel Standard and Small Refinery Waivers

Suz-Anne Kinney

:

January 11, 2019

Suz-Anne Kinney

:

January 11, 2019

In 2007, when Congress passed and President Bush signed the Energy Independence and Security Act (EISA), the renewable biofuels industry was in its infancy. Outside of corn ethanol, most pathways for the production of renewable fuels were still in development, and producers were operating in pre-commercial demonstration facilities. In order to account for this uncertainty in the timeline for moving from developing to proven technologies and processes, EISA provided EPA with the legislative authority to waive Renewable Fuel Standard (RFS) requirements under certain circumstances.

If the EPA Administrator determines that implementation of the requirements would severely harm the economy or the environment of a State, region or the country, for instance, it can make exceptions. In addition, small refineries can request temporary exemptions if they can demonstrate that compliance would cause the refinery disproportionate economic hardship.

The latter is developing into one of the most controversial of the growing pains that the RFS is undergoing. Small refineries (those producing 75,000 barrels per day or less) can request temporary exemptions if they can demonstrate that compliance would cause the refinery disproportionate economic hardship. These refineries—who would otherwise satisfy their obligations by purchasing RINs—can apply for waivers, and EPA can grant them on a case-by-case basis.

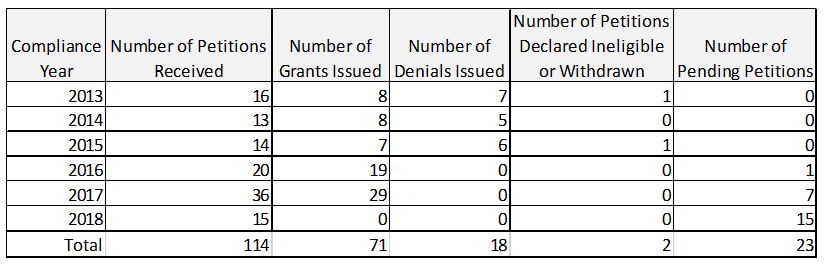

To date, EPA has considered 114 petitions for waiver; 71 have been granted, 18 have been denied (all in the first three years of the waiver program) and 23 are still pending (see table below).

Small Refinery RFS Waivers

The impact of these waivers on the market has been considerable. The table below shows that a total of more than 28 billion gallons of demand and more 2.9 billion RINs have been removed from the market.

Impact of Waivers on Volumes and RINs

These numbers show that 2017 was a record setting year for RVO waivers; a record 36 petitions were received, the EPA granted 29 of these petitions, and 7 are still awaiting decisions. 2017 also set a record for fuel volumes and RINs removed from the market—more than 13 billion gallons and 1.4 billion RINs, almost double the previous year.

It should be noted that starting in February of 2017, the EPA Administrator was Scott Pruitt, who sued the EPA 14 times when he was Attorney General of Oklahoma. He resigned in mid-2018 as the result of multiple scandals; he is the subject of at least 14 federal investigations by multiple government accountability entities. Before he resigned, however, EPA granted small refinery waivers to refineries in the portfolios of companies as large and as profitable as billionaire Carl Icahn and Chevron, which reported a net income of $9.2 billion in 2017.

Pruitt's replacement is acting administrator Andrew Wheeler, a former coal lobbyist and a climate change denier. It remains to be seen whether he will grant waivers for the remaining 2016 and 2017 petitions, as well as the 15 that are currently pending for 2018.

Waivers are problematic for the industry because they remove demand from the system, undermining the purpose of the program, which is to drive growth in production and use of advanced biofuels. This decrease in demand takes a toll on the market for Renewable Identification Numbers (RIN) market as well; the removal of demand from small refinery waivers was a major contributing factor in the drop in RIN prices in 2018.