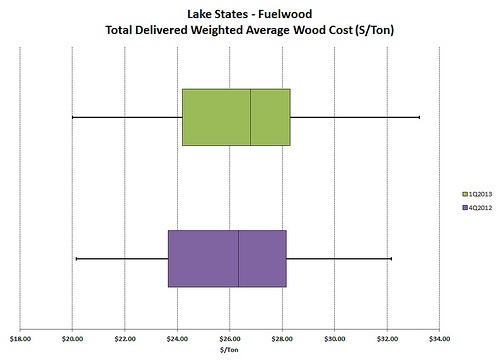

Biomass prices in the Lake States remained relatively constant from Q4 2012 to Q1 2013, increasing only $0.44/green ton. The average delivered price per green ton reported during the fourth quarter of last year was $26.34. The first quarter of this year saw average prices move 1.7 percent higher to $26.78 per green ton. The increase in price can be attributed to seasonal factors including winter inventory building, road postings and uneven mill delivery schedules.

For the Midwest Delivered Price Benchmark, Forest2Market collects not only the total delivered cost of wood raw materials, but all of the individual cost components that make up total delivered cost. As a result, we isolate the components that caused prices to increase. Two components put upward pressure on biomass prices in 1Q2013: fiber costs and freight. Fiber costs jumped $0.42/green ton quarter over quarter and freight costs increased by an average of $0.27/green ton. These component price increases were somewhat offset by decreased procurement overhead.

The graph below shows price variability increased in the marketplace by 14.75 percent.

In Q1 2013, consumption volume increased by 18.55 percent, indicative of stronger demand. As we move into the second half of 2013, the new 50 megawatt WE Energies facility at the Domtar paper mill site in Rothschild, Wisconsin is expected to come online. Increased competition for raw material is likely; the plant is expected to use 300,000 to 500,000 tons on wood biomass annually with supply sourced from forests within a 75-mile radius of the plan.

Pete Coutu

Pete Coutu