2 min read

10 Interesting Facts about the Current State of the Pulp and Paper Industry

Marko Summanen

:

October 12, 2022

Marko Summanen

:

October 12, 2022

A heightened sense of uncertainty continues to plague various aspects of our lives as global geopolitical trade flows and economic structures remain stressed. As we continue to wonder what the market will look like in 2023, it’s first important to have a solid understanding of where the current global Pulp and Paper industry is now before aiming to predict where it will be in 6 months, a year, or longer.

Below are 10 interesting facts about the current state of the global pulp and paper industry.

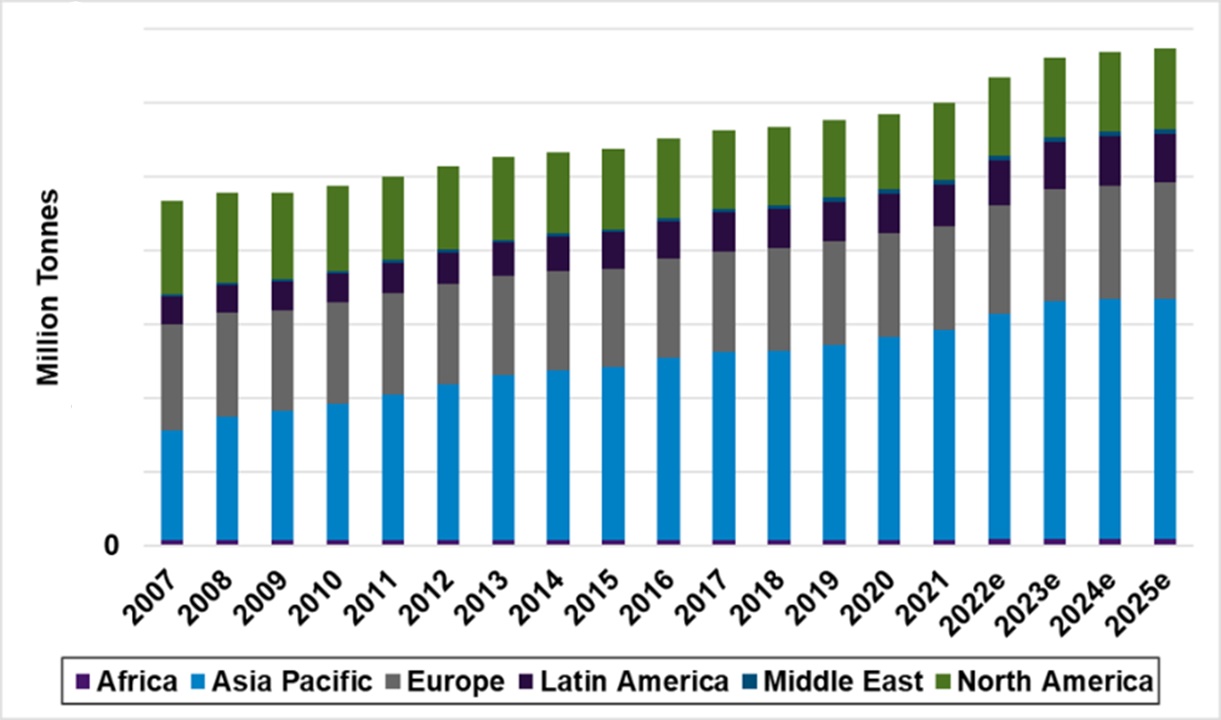

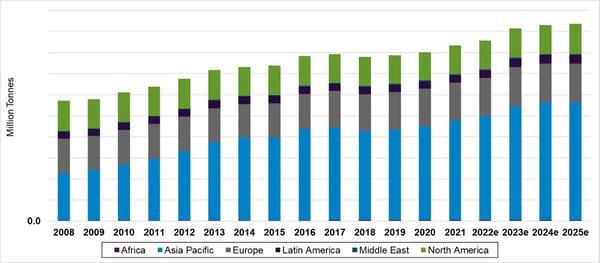

- The Pulp and Paper industry is growing 2.0% annually. Despite being deemed a ‘dying industry’ by so many who are uninvolved or lack knowledge about the industry, we can see in the image below that since 2007, the P&P industry has been on a steady incline and is expected to keep pace through 2025.

Global Market Pulp, Paper and Tissue Capacity (Actual and Announced)

Source: FisherSolve

Source: FisherSolve

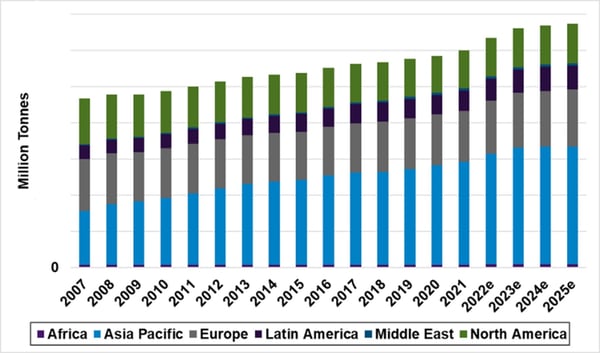

- The packaging sector will continue to lead the industry in demand and growth. As we can see in the image below, the packaging sector is heads and tails above all the other grades with roughly 155 million tons more capacity compared to market pulp in 2023 – the grade with the second largest amount of capacity.

Global Market Pulp, Paper and Tissue Capacity (Actual and Announced)

Source: FisherSolve

Source: FisherSolve

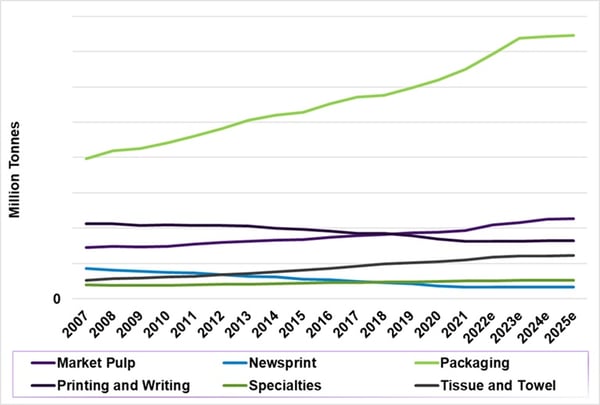

- 25 MM tons of new containerboard capacity in Asia is to be produced. However, something to consider when looking towards the future is whether or not this will be hampered by recycled fiber availability and a near-term economic slowdown.

Global Containerboard Capacity

Source: FisherSolve

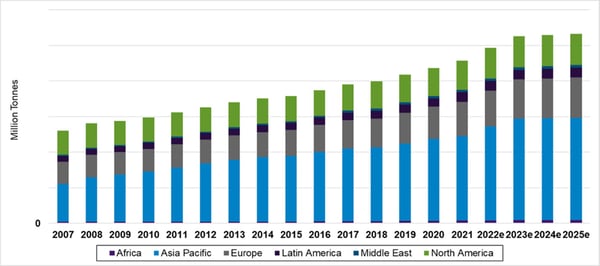

- Additionally, Asia’s cartonboard capacity boom is expected to continue as well, as 8 MM tones of new capacity has been announced through 2025.

Global Cartonboard Capacity

Source: FisherSolve

Source: FisherSolve

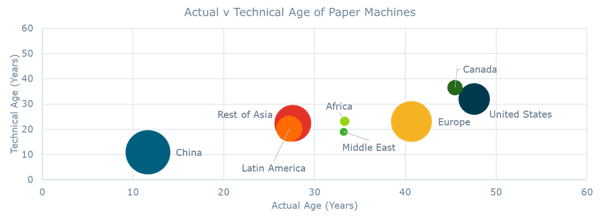

- Compared to Europe and North America, Asian and Latin American companies have invested more in new paper machines and in keeping their existing fleets modernized.

Source: FisherSolve

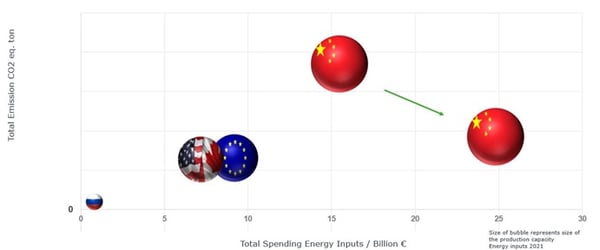

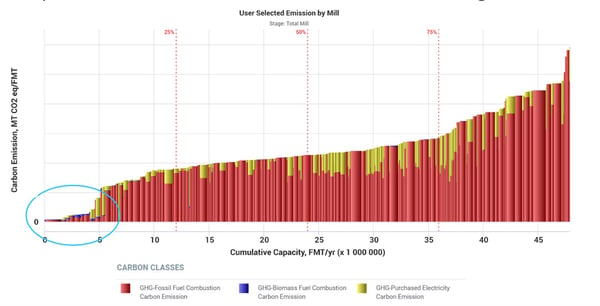

- However, despite having the newest fleet of machines, China remains the largest CO2 emitter in the paper industry. China’s emissions could be reduced by roughly 50% by simply replacing coal with natural gas. This would add €10+ billion to annual energy spending (2021 price level) and a €10+ billion one-time asset rebuild cost for mills would be required.

Source: FisherSolve

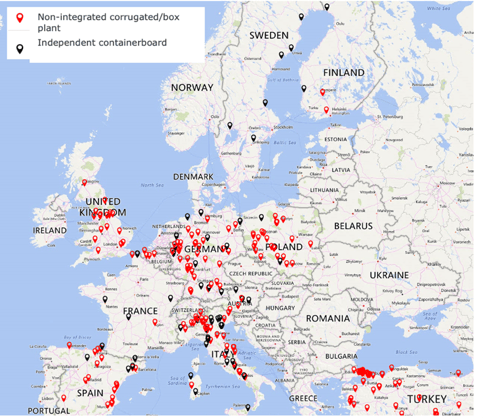

- There are over 7.8 million tons of announced net capacity changes in CTB, but no single EU-based listed company has integrated to box/corrugated – why is that? It’s important to note that if future containerboard capacity is not integrated to corrugated, it could become an issue.

- Some European containerboard mills are benefitting from on-site kraft pulp production in regard to decreasing energy and carbon usage.

European Containerboard Mills Carbon Emissions According to EU ETS

Source: FisherSolve

Source: FisherSolve

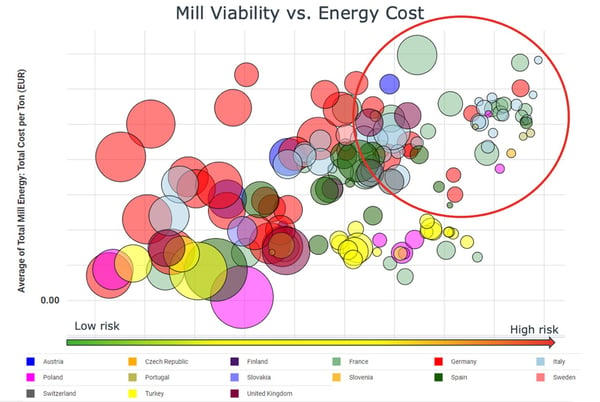

- We will likely see industry consolidation speed up. This means that some smaller producers could find themselves disadvantaged against larger competitors.

Source: FisherSolve

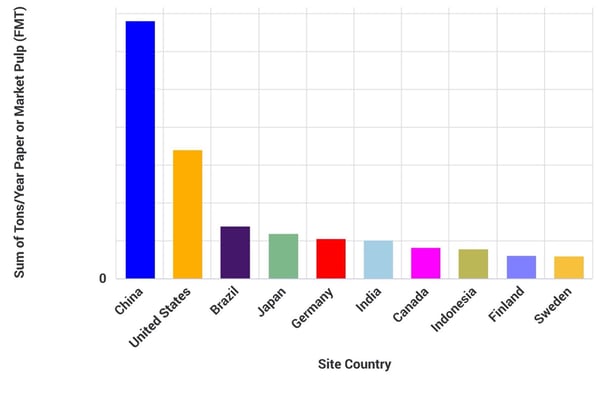

- Population and urbanization drive production. The graph below illustrates the top producing countries. China’s capacity is much larger than many of the top 10 countries combined; the United States is also a very important producer, with about half of China’s capacity.

Top 10 Producing Countries

Source: FisherSolve

For further insight into these various trends, talk with an expert at Fisher International who can help your business formulate an actionable plan with a high degree of accuracy to ensure you’re prepared to handle the volatile market that is to come in the near future.

About the Author

Marko Summanen is a career paper industry professional with over 20 years of experience across strategic, tactical, engineering, and sales functions as well as a worldwide scope that includes China, Southeast Asia, the U.S., Canada, and several European countries. Throughout his career, Marko has championed the transformative power of data-driven management. At Fisher, he uses his deep solutions-focused understanding of paper making operations to help clients improve performance and address the particular challenges faced by European players.