2 min read

Why Is Kraft Paper Demand Rising and Where Is it Heading?

Marko Summanen

:

Aug 31, 2022 12:00:00 AM

Marko Summanen

:

Aug 31, 2022 12:00:00 AM

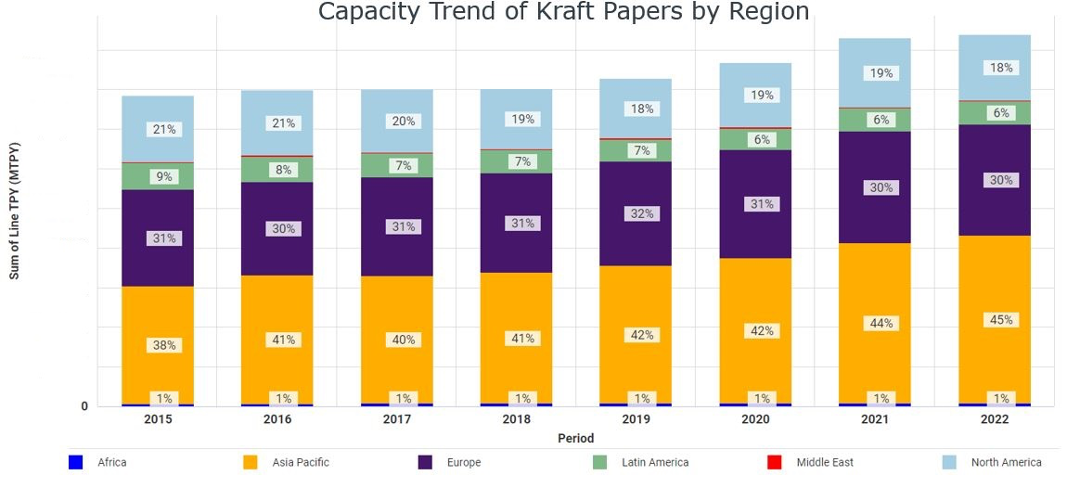

Kraft packaging paper has maintained a roughly 4% share of all fiber-based packaging capacity since 2015, however, as of late, the relative share of Asia-Pacific (APAC) capacity in kraft papers is beginning to grow, as seen in the image below. Let’s take a closer look and discuss the factors behind this growth, the viability of it, along with what sort of opportunities this could present for major players in the P&P industry.

Source: FisherSolve

Source: FisherSolve

As illustrated in the image below, Europe has remained the main supplier of kraft papers globally over the last couple of years. In 2021 alone, Europe exported 610,000 MT to Asia; 430,000 MT to Africa/Middle East; 200,000 MT to Latin America; and 114,000 MT to North America. And as demand for kraft papers continues to rise, Europe is hoping to add more kraft paper capacity.

Source: FisherSolve

Source: FisherSolve

Some mills in the US have ‘swing machines,’ meaning these lines can easily switch between certain grades depending on demand. In the past, some American swing machines have often switched between kraftliner sack and sack kraft when the domestic kraftliner market became soft, or alternatively, exported kraftliner volumes to Europe at a low cost. Many are now wondering if this could be a viable source for Europe to obtain its desired additional capacity. However, with the market being so tight, it is likely that we will not see a swing in capacity and/or import increase.

Before diving deeper, let’s look at some of the current factors that affect kraft paper demand:

- End-use development (such as industrial vs. consumer, retail, changing consumer habits, packaging sizes, hygienic requirements, etc.)

- New substitution demands

- Performance vs. cost

- Continued e-commerce growth

However, mega trends (such as the economy, population, urbanization, sustainability, and government policies/regulations) have arguably played the largest role in increased kraft paper demand. For example, many countries have recently announced paper sack size regulations and are in the process of limiting the cement bag size to 25kg – half of the current standard bag size. This is to go into effect in Mexico in 2022, Argentina by 2025, and Brazil by 2028 or 2029.

Additionally, the surge in e-commerce has also fueled kraft paper growth as costs for corrugated material remains high and demand for lighter weight packaging creates an opportunity for kraft paper in the e-commerce sector. Kraft paper bags laminated with bubble wrap are replacing corrugated boxes in the US, and we’re seeing more companies invest in this area. For example, Georgia-Pacific recently built two new converting sites to produce recyclable paper padded mailers which combine a unique expansive material between layers of kraft paper.

Another factor at play in the growth of kraft paper is the numerous and extensive sustainability-related initiatives that have been announced. To address the environmental crisis, government regulations have increased and as of mid-2021, 77 countries passed some sort of full or partial ban on plastic bags to help drive change and reduce the impact of plastics.

In order to meet this growing demand, an important question to consider is if there is an opportunity to convert graphic paper machines to produce kraft papers in Europe. Graphic paper machines are often too wide for single kraft paper production, however, with healthy demand in different kraft paper segments, larger machines could be repurposed for multi-kraft grades.

Some other valuable questions to consider going forward also include:

- What other European sites have suitable machines to convert for kraft paper production?

- Could Eucalyptus fiber-based kraftliner become a global disrupter?

- How will volatile energy prices impact the kraft paper segment?

- Will this increased demand mainly benefit the EU market?

For more insight on how Fisher International can predict kraft paper and sack market behavior using our business intelligence system FisherSolve, contact us today. In combination with our consulting services, we can help provide answers to these and other important questions by explaining market movements in verifiable, fact-based terms that industry professionals find valuable.