1 min read

Toward Top Quartile: Southern Pine Productivity Insights

Bryan Beck

:

Nov 18, 2024 12:00:00 AM

The world of sawmilling has seen major changes throughout the last forty-plus years, and the past decade has reflected several such changes. Overall manufacturing costs—and labor costs in particular—have risen faster than the overall inflation rate over the past decade.

Specific to the Southern pine industry, capital investment has poured into the South’s mills. Part of this capital influx has gone to expand existing mills’ capacities; the rest has been deployed to build new large-scale greenfield operations. This has made the region a bigger player in the North American industry, increasing average annual capacity at SYP mills from 150 million board feet to nearly 200 million board feet.

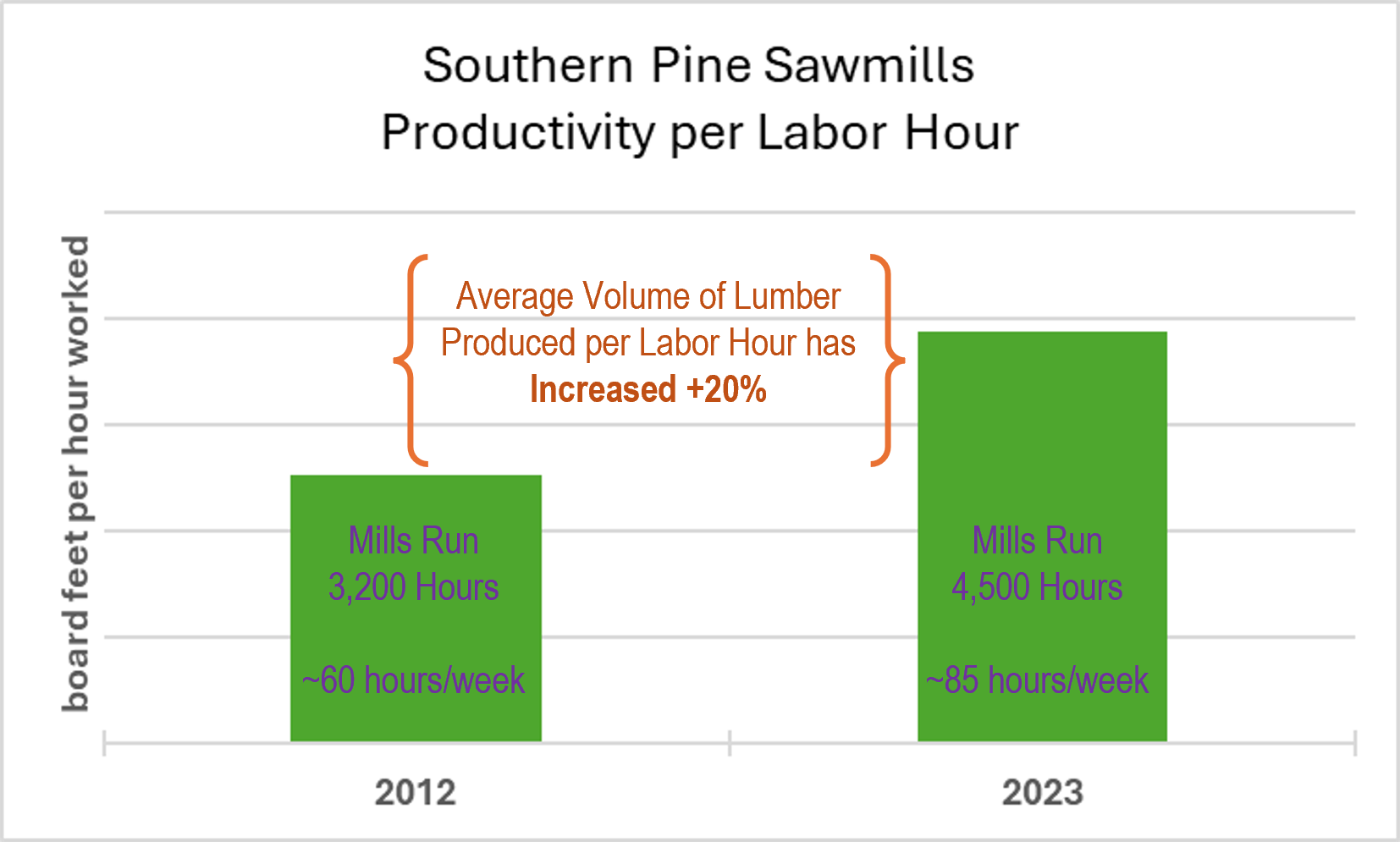

Meanwhile, sawmills increasingly require less staff even as they grow larger. Since 2012, the average volume of lumber produced per labor hour has increased more than 20%, as illustrated in the chart below:

What’s driving this improvement? Largely, advancements in automation. But that’s not the only factor in play. The average production rate per operating hour (at sawmills and planer operations) did not skyrocket during that period. Average production volume per hour (in thousands of board feet) still hovers in the low 40s.

To achieve higher annual production levels, mills are running more hours. In 2012, the average SYP sawmill ran approximately 3,200 hours (about 60 hours per week). In 2023, that number rose to more than 4,500 hours (more than 85 hours per week) even as lumber markets weakened, and supply began to outstrip demand.

So, what does the future hold? As new large-scale mills continue to come online, and ongoing capital investments continue to bear fruit, we expect SYP mills to continue to increase in scale, and continued advancements in automation should continue to provide productivity gains for the foreseeable future. Investments in automation (reducing labor requirements) become more attractive as the cost of labor rises.

Read More: Toward Top Quartile: Southern Pine Labor Data Insights

Beck Group Consulting continually works to improve its benchmarking services to offer the most complete, accurate, and timely information available to sawmillers. Sawmill TQ is offered in partnership with ResourceWise, a leader in industry analytics.

For more information, the Beck Group conducts regular timber industry workshops, including its upcoming Keys to Successful Sawmill Management (December 3-4, 2024), Business of Forest Products (January 23, 2025), Sawmilling 101, Human Resources for the timber world, and more.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)