3 min read

Lumber and Wood Price Index Dives with 26% Fall in Softwood

ResourceWise

:

Feb 21, 2023 12:00:00 AM

Continued economic downturn ripples across manufacturing. Sentiment is down somewhat, but the services sector is showing promise after an unexpectedly high number of new jobs added to the economy.

However, the wood products market continues its dip with a significant year-over-year (YoY) change in softwood lumber price indices.

ISM Shows Continued Manufacturing Contraction

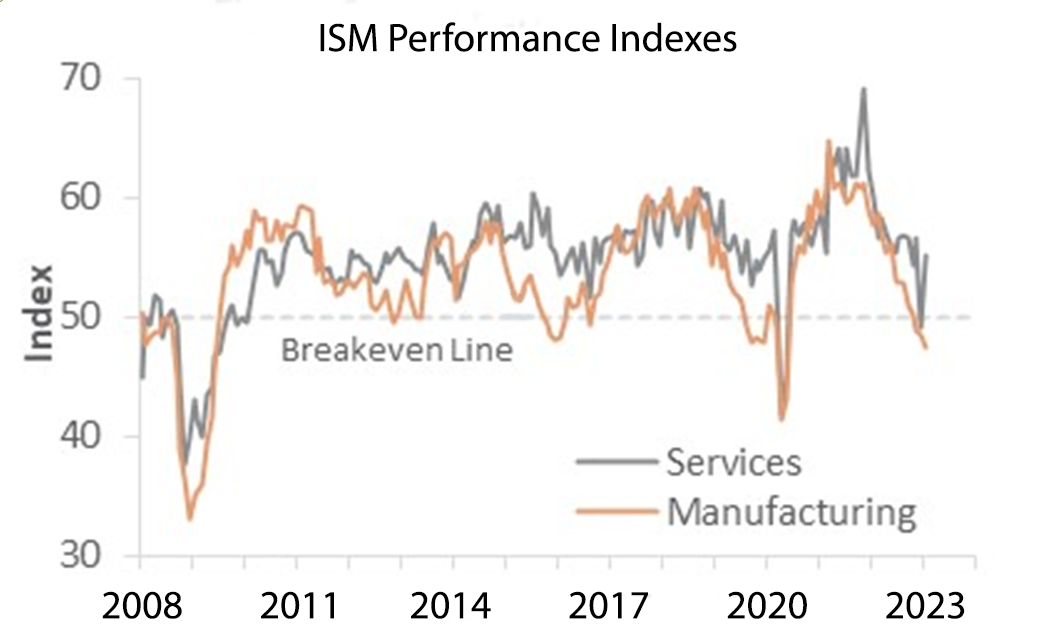

The Institute for Supply Management’s (ISM) monthly sentiment survey of U.S. manufacturers for January 2023 contracted further.

The PMI registered 47.4%, down 1.0PP from December’s reading. To clarify, 50% is the breakpoint between contraction and expansion.

The largest changes included prices paid (+5.1PP), exports (+3.2PP), imports (+2.7PP), and new orders (-2.6PP).

Concurrent activity in the services sector jumped back into expansion, however (+6.0PP, to 55.2%). New orders (+15.2PP) and exports (+11.3PP) drove the rebound. These numbers exceeded all positive month-over-month (MoM) moves prior to the pandemic.

Of the industries we track, only Real Estate and Ag & Forestry expanded.

S&P Global Survey Marks Less Expansion than ISM

Changes in S&P Global’s survey headline results were mixed relative to ISM’s. Both manufacturing surveys showed contraction. But the retrenchment in S&P’s services survey was at odds with ISM’s expansion.

According to S&P Global’s Chris Williamson, “A sharp fall in output…is now becoming increasingly evident in the official statistics and suggesting that the manufacturing sector has become a major drag on GDP.”

The drag will continue to cause market hesitation with added risk. As Williamson also noted, this probably means further contraction this quarter: “[The service] sector’s downturn at the start of the year adds to the risk the U.S. economy could contract in 1Q.”

S&P Global expects U.S. GDP to contract at a SAAR of 1.6% in 1Q2023 with a more modest pullback in 2Q. This contributes to hopes for a “soft landing,” Williamson furthered, while forecasting that “growth for the whole of 2023 is only expected to reach 0.5%, reflecting the soggy start to the year and prospect of further interest rate hikes.”

Declines in Both Consumer and Producer Price Indices

The consumer price index (CPI) declined 0.1% in December (+6.5% YoY) after increasing 0.1% in November. Meanwhile, the producer price index (PPI) retreated 0.5% (+6.2% YoY), reversing MoM advances of 0.2% in November and 0.4% in October.

December’s decrease in the final-demand index can be attributed to a 1.6% decline in prices for goods, led by a 13.4% drop in wholesale prices for gasoline. In contrast, the index for final demand services rose 0.1%, driven by a 17.6% jump in margins for fuels and lubricants retailing.

Forest Products Sector Insights

Some good news is present in the forest products sector – at least in pulp & paper. The price index for pulp, paper & allied products rose 0.4% (+9.2% YoY). Wood fiber also saw a modest increase of +0.4%, reflecting a +4.6% YoY rise.

Conversely, lumber & wood products dipped -1.5% for a -3.8% YoY decrease. Softwood lumber also fell 5.1%, a stark YoY difference of -26.1% from the same time in 2022.

Drops in these numbers highlight continued manufacturing hesitancy in new home starts as interest rates continue rising to combat inflation.

The Federal Reserve Open Market Committee (FOMC) wrapped up its most-recent meeting on February 1 with a 0.25PP rate hike. While lower than some analysts predicted, continued hikes are probably on the horizon.

“It is our judgment that we’re not yet at a sufficiently restrictive policy stance, which is why we say that we expect ongoing hikes will be appropriate,” Fed Chair Jerome Powell stated during a recent press conference. “We are seeing the effects of our policy actions on demand in the most interest-sensitive sectors of the economy, particularly housing. It will take time, however, for the full effects of monetary restraint to be realized, especially on inflation.”

Key Market Insights with Forest2Market’s Economic Outlook

Forest2Market, a ResourceWise company, provides subscribers with an expansive range of forecasting, pricing, and economic data. This post is an excerpt from F2M’s most recent Economic Outlook.

Whether you need investment insight or strategies across the forestry industry, the EO provides critical data customized for forestry.

Our market data can help you recognize market performance indicators, changes, trends, and other relevant economic factors. This data will help you improve decisions with benchmarks and data to give your business a competitive edge.

Learn more about the Economic Outlook and see just how much it can help your business.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)