3 min read

Global Softwood Lumber Prices Down About 10% in First Half of 2022

Håkan Ekström

:

Sep 1, 2022 12:00:00 AM

Håkan Ekström

:

Sep 1, 2022 12:00:00 AM

Global trade of softwood lumber fell about 10% in the first half of 2022 compared to the same period in 2021. Most of the decline was driven by lower lumber demand in China, the US, and Germany.

The slowdown in lumber consumption worldwide came at an opportune time since European countries, North America, and Asia boycotted Russian forest products after the country invaded Ukraine. As a result, Russia's lumber exports fell by over 30% year-over-year during the first six months of 2022 and are expected to fall further in the year's second half.

Lumber Markets – North America

A weakening in wood demand and sharply falling lumber prices reduced operating rates throughout North America during the spring and summer months. The most significant declines in production were seen in British Columbia and the Western US.

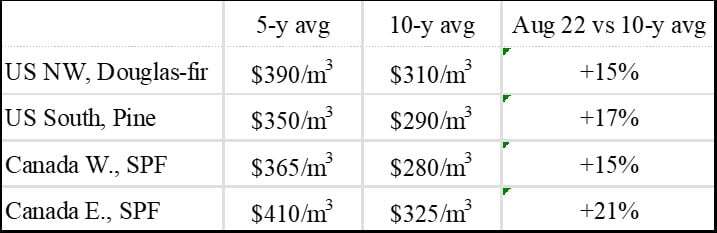

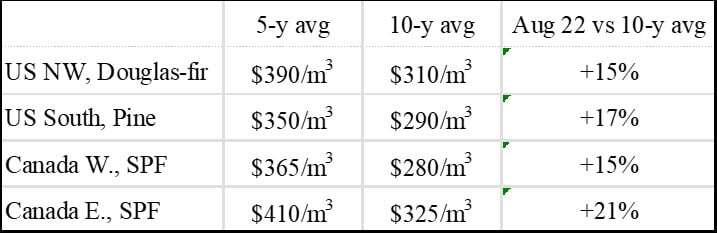

Average prices for southern yellow pine and spruce/pine/fir in western and eastern Canada fell by about 50% from March to July 2022. Despite the recent price plunge, it is essential to note that the current price levels are close to their five-year averages and 15-30% higher than the average prices over the past ten years.

North American Softwood Lumber Prices: August 2022 vs. 5-year avg., 10-year avg.

Lumber Markets – Europe

Russia's invasion of Ukraine and the boycott of Russian forest products created much uncertainty in the European lumber market. Many expected that lumber flows from the east into Europe would halt reasonably quickly.

As a response, buyers started to build inventories with the expectation that supply would get tighter in the year's second half, according to Wood Resource Quarterly. However, this short-term demand upswing promptly faded, and lumber prices softened in early summer.

Lumber exports from the Nordic countries fell about five percent year-over-year during the first five months. In addition, shipments to China took a big hit, with about 30% less imported in 2Q/22 than in 1Q/22. As a result, volumes in the 2Q/22 were close to being the lowest in seven years.

Lumber Markets – China

In 2019, China was the world's largest importer of softwood lumber, importing just over 27 million m3. However, in the following two years, import volumes fell 44%. Imports in 2022 are on pace to reach their lowest levels in ten years as demand has fallen in the construction sector.

The lumber volume from Russia declined the most from 2021 to 2022. However, Ukraine, Canada, and Chile are the countries that lost the most significant amounts in market shares.

Average import values have remained relatively stable in 2022, with 2Q/22 lumber prices averaging $260/m3. This figure is up from $255/m3 in the previous quarter.

It is important to note that in the past, Russian lumber prices in China were typically lower than those of Canada and the Nordic Countries. In 2022, however, they have been practically the same.

Lumber Markets – Japan

Japan decreased the importation of lumber from 6.1 million m3 in 2017 to an estimated 4.7 million m3 in 2021. The importation of sawlogs for domestic sawmills has also declined over the same period, with local logs being used increasingly instead.

The Japan Lumber Journal reports that the domestic share of total log consumption is now almost 80%. However, during the first half of 2022, the declining lumber import trend turned around, with volumes increasing 18% year-over-year.

Most of the increase was in shipments from Finland, Sweden, Chile, and Russia. Furthermore, Canada reduced supply the most because of solid demand and higher prices for lumber in the US.

Sawmill Gross Margins

Sawmills worldwide can look back on a few years with historically high profits due to record high lumber prices and limited increases in wood raw-material costs. Gross margins, revenues from lumber sales, and byproducts-minus-sawlog costs have been higher for continental sawmills over the past two years than during most of the period since 1995 when WRQ started tracking this indicator of profit levels.

The US lumber market saw the most dramatic fluctuations in gross margins in 2021 and 2022, when lumber prices saw unprecedented volatility. The Nordic countries' lumber prices stayed elevated in the first two quarters of 2022, resulting in high profits into the 2Q/22. After that, however, wood markets started to weaken domestically and internationally, and sawmills announced downtime during the fall.

This is a preview post of our Market Insights report from Wood Resources International (WRI). For the past 13 years, Wood Resources International has distributed Market Insights on a regular basis to over 8,000 forest industry executives, analysts, investors, consultants and journalists worldwide. These Market Insights have covered the most recent developments in regard to global wood supply, forest industry production, forest products trade, and pricing of sawlogs, pulpwood, wood chips, lumber and biomass.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)