Recent earnings reports from major forestry companies paint a concerning picture for the lumber industry, with a noticeable decline in 2Q lumber earnings. Understanding these shifts and their implications is crucial for industry professionals looking to stay competitive.

This blog post explores the recent trends, underlying factors, and how ResourceWise can provide the tools and expertise to help you navigate this challenging market.

Insights from Key Players in the Lumber Industry

Current earnings data reveals a challenging landscape for the lumber market, characterized by fluctuating sales volumes and pricing pressures. Several trends emerged across the industry. For example:

- While some companies experienced a slight recovery in sales volumes, largely due to recovery from seasonal disruptions, overall financial figures remained troubling. Weyerhaeuser, for example, managed a modest uptick in sales volumes, yet saw a 2% decrease in lumber realizations.

- 2Q continued to experience a decline in benchmark pricing, especially for Southern Yellow Pine, which placed significant downward pressure on market performance. Canfor experienced a $115 million loss in the lumber segment, exacerbated by the decline in benchmark prices.

- Factors such as reduced sales volumes for specific products like plywood and LVL further underscore the ongoing volatility and uncertainty in the lumber market. For instance, Boise Cascade reported an 8% decrease in wood products sales in 2Q.

- Overall sales figures are dropping. Interfor saw an 11.5% decline in total sales, alongside a 7.2% fall in the average selling price per thousand board feet of lumber.

These indicators show persistent downward pressure on the lumber market, affecting both sales volumes and pricing across the board.

Factors Behind the Decline

Two main factors contributed to the drop in 2Q lumber earnings:

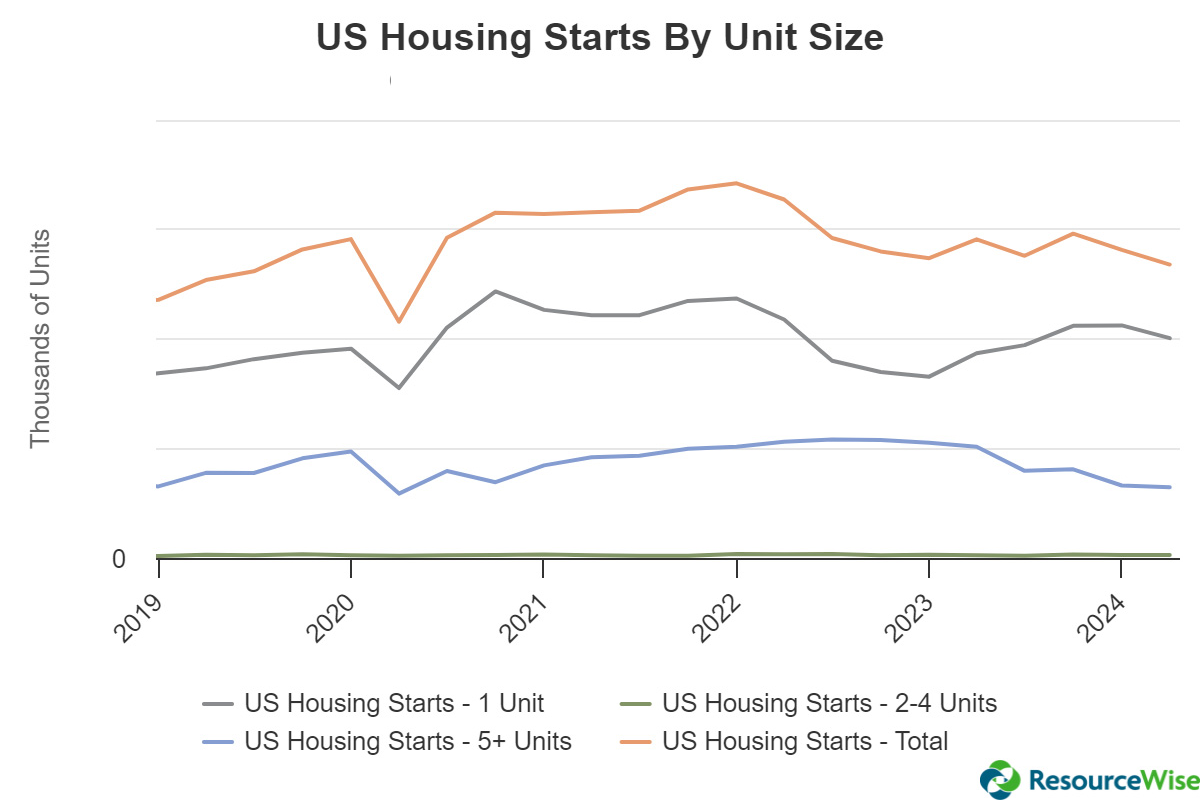

- Market Demand: The drop in lumber earnings during the second quarter was largely due to market demand. Many had hoped for a recovery in the housing market, but it didn't happen as expected. High interest rates stuck around longer than anticipated because policy decisions were delayed, slowing down housing starts and construction activity. This directly hit lumber demand and pushed earnings down across the industry. Additionally, benchmark pricing for key lumber types like Southern Yellow Pine and Eastern SPF Composite faced downward pressure, affecting overall revenue potential for producers.

Source: SilvaStat360

- Closures and Curtailments: The decline in 2Q lumber earnings was further compounded by closures and curtailments across the industry. An oversupply in the market due to excess capacity led many mills to temporarily or permanently close operations to realign supply and demand. These strategic decisions were necessary for companies aiming to stabilize pricing and mitigate financial losses, but they also resulted in decreased production capabilities and added a layer of uncertainty within the sector.

Some of these closures and curtailments included Hampton Lumber’s Banks sawmill in January, West Fraser Timber Co.’s Fraser Lake sawmill in January, Interfor’s Philomath sawmill in February, and C&D Lumber Co.’s Riddle mill in May.

Analyzing US Softwood Lumber Prices

The historical volatility of US South pine lumber prices serves as a critical indicator of broader market health. From their peak in January 2022 to a 68% decline by January 2024, these price swings underscore the industry's susceptibility to market fluctuations.

US South Pine Softwood Lumber Prices

Source: WoodMarket Prices

When we examine the cost curve of manufacturing cost trends, we can see differences between the general market and top-quartile companies. If top-quartile companies are underperforming compared to the general market, how are those outside this group assessing their operations?

While market price movements may be beyond your control, addressing how you manage your wood and manufacturing costs is within reach. But to do so, you need to accurately understand your position.

Enhancing Your Market Position

The decline in 2Q earnings highlights the urgent need for lumber producers to adapt to shifting market conditions. To navigate these challenges, developing strategies that focus on managing costs, optimizing production efficiency, and exploring new revenue streams is essential.

ResourceWise provides a comprehensive suite of tools and expertise specifically designed to assist professionals in the forest products industry in tackling these issuesFor example, our WoodMarket Prices platform offers real-time data on lumber prices, enabling businesses to monitor fluctuations and benchmark their performance against industry standards. This empowers companies to develop informed pricing and sales strategies.

Meanwhile, SilvaStat360 delivers comprehensive analytics on forest resource management, facilitating better decision-making regarding inventory and operations. Together, these tools provide a holistic view of market dynamics and operational efficiency, helping companies identify opportunities for improvement and maintain competitiveness in a challenging landscape.

Learn more about how ResourceWise's forest products market intelligence platforms can benefit your business with actionable insights and strategic advantages.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)