2 min read

Europe's Sawlog Prices Nearly Doubled in Past 2 Years

Håkan Ekström

:

Nov 7, 2022 12:00:00 AM

Håkan Ekström

:

Nov 7, 2022 12:00:00 AM

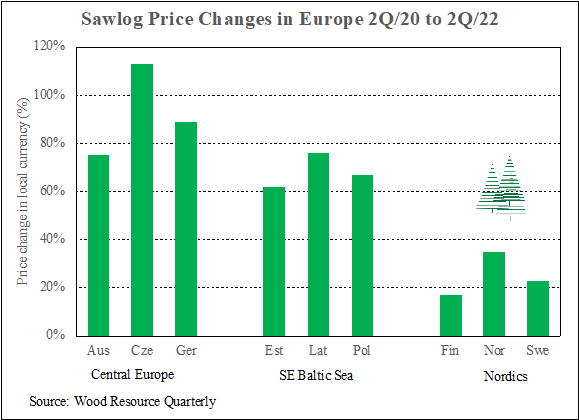

Sawlog prices in Central Europe have almost doubled in the past two years — the highest increases on the continent.

Over the past two years, sawlog prices have gone up throughout Europe. However, the increases have not been uniform because of different price drivers in each subregion.

In Central Europe, there has been an oversupply of insect-damaged timber since 2019, which resulted in declining sawlog prices. Degraded log quality and a shortage of fresh sawlogs contributed to a surge in the costs for sawtimber, which doubled in the Czech Republic and Germany from 2020 to 2022.

Domestic Sawmills Aid in Industry Expansion

The recently released Focus Report "Central Europe Softwood Supply - Constrained Industry Growth Post-Bark Beetle," published by Wood Resources International and O'Kelly Acumen, reports that the surge in wood supply has been absorbed by domestic sawmills (~60%) and an increased export of sawlogs and pulplogs (~40%).

Additional wood supply at competitive prices has helped the Central European sawmill industry expand, taking advantage of solid lumber markets in Europe and globally in 2020-21. Furthermore, increased sawdust and woodchip supplies from sawmills have enabled growth within the wood pellets and panels manufacturing sectors.

With the timber harvests having peaked, exporters and consumers of logs will need to adjust to a reduced supply of softwood logs in the coming years. Central European lumber production will decline from current record levels, and the region may shift from being a net log exporter to becoming a net importer again.

Furthermore, Russia's invasion of Ukraine has resulted in sanctions on the importation of practically all forest products from Russia and Belarus to Europe. This trade totaled almost six million m3 of logs and nine million m3 of softwood lumber in 2021.

Log Demand in Baltic States and Nordics Also Up

Log prices in the Baltic States have been significantly impacted by log demand around the Baltic Sea, particularly in Sweden. In strong lumber markets and when log supply in Sweden is tight, log buyers typically reach out to the Baltic States to for marginal volumes. Consequently, log prices tend to fluctuate more in the Baltics than in the Nordic countries (see chart).

Of all the timber markets in Europe, Finland and Sweden have experienced the smallest price increases in the local currencies the past two years, according to Wood Resource Quarterly. The two countries saw increases of about 20%, unlike the Baltic States at about 70% and Central Europe at roughly 90%.

This is a preview post of our Market Insights report from Wood Resources International (WRI). For the past 13 years, Wood Resources International has distributed Market Insights on a regular basis to over 8,000 forest industry executives, analysts, investors, consultants and journalists worldwide. These Market Insights have covered the most recent developments in regard to global wood supply, forest industry production, forest products trade, and pricing of sawlogs, pulpwood, wood chips, lumber and biomass.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)