5 min read

Wood Market Dynamics and the Impact on Pulp and Paper: Current Trends

Marko Summanen

:

Sep 28, 2023 12:00:00 AM

Marko Summanen

:

Sep 28, 2023 12:00:00 AM

The decrease in pulp prices we’ve recently seen may not be a temporary occurrence. We anticipate an excess of market pulp capacity in the near future. This could lead to a global shakeout of high-cost capacity and the consolidation of pulp players.

An example of this is Metsä Group’s new bioproduct mill in Kemi. This new mill was intended to replace its current Metsä Group pulp production in Kemi. It will be the largest forest-sector production facility in the northern hemisphere. This project will likely impact the future of some smaller softwood pulp mills in this region.

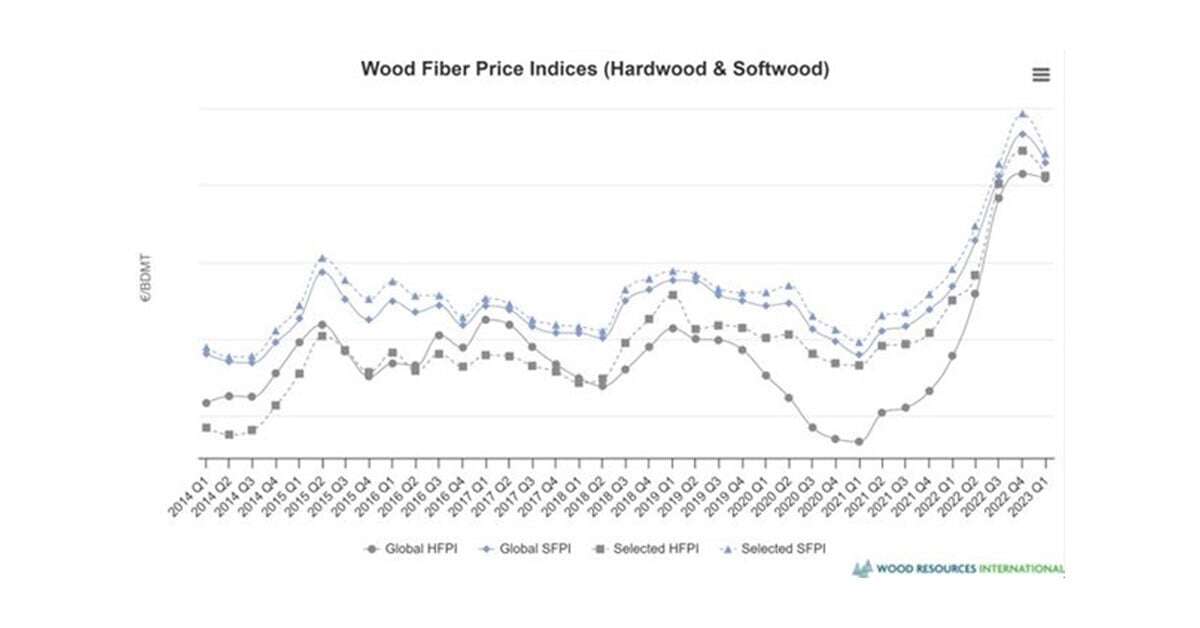

However, wood prices have simultaneously surged despite the low demand. For instance, the cost of Brazilian pulpwood has doubled within the span of two years. This unexpected behavior in the market has raised an important question:

How will the volatility of wood prices impact the pulp and paper industry?

Wood Trends in Pulp and Paper

Wood plays a vital role in the pulp and paper industry. It serves as the primary source of cellulose fibers for paper production. Various types of wood are used in this process, highlighting its significance to the industry.

Taking a closer look at the European pulp and paper sector, we can observe the distribution of diverse wood species across countries. Among them, pine and spruce emerge as the top two most extensively consumed types of wood in the industry.

Given that wood is an essential raw material for pulp and paper producers, the impact of rising wood costs has reverberated throughout the entire industry. However, the question arises: Who has been most affected by the burden of high wood prices?

When looking at data on pulp and paper mills’ wood consumption, we can see that Sweden and Finland are two major countries consuming wood in Europe. Finland, however, is in a unique situation because of the Ukraine war.

Wood Consumption in Pulp and Paper Mills in the EU

Wood imports from Russia have ceased, significantly impacting the supply of wood in Finland and other European countries. The demand for energy wood is increasing, intensifying the competition for this valuable resource.

To make matters more challenging, Finland's forestland carbon sinks have reached an all-time low. This will have long-term implications for the number of trees that can be harvested in the future. In the meantime, mills have started to accept smaller-diameter wood to meet the demand, adapting to the changing dynamics of the industry.

Virgin fiber mills with high operational costs and smaller machines are also particularly vulnerable to the negative impact of soaring wood prices. Their assets may become nonviable, leaving them ill-equipped to handle the financial strain.

Additionally, mills that produce declining grades, such as printing, writing, and newsprint, are also likely to experience significant pressure. Some of these mills process wood mechanically, demanding a lot of energy, and potentially worsening their competitive position.

While it is reasonable to question the necessity of numerous mills and advocate for improved recycling, we must consider the future implications. This is similar to the challenge of selling used cars without new supply entering the market. Without a steady influx of raw materials, the recycling process becomes constrained and ineffective, making it crucial to address the issue from both angles.

Producers all over the EU are now left questioning whether wood fiber will even be available at an affordable price in the future. The uncertainty surrounding these future costs has also hindered further investments. As a result, producers find themselves grappling with the risks associated with producing low-quality grades and the uncertainty of future expenses. This has led them to wonder whether they should venture into new products or retreat from them altogether.

How Will the Use of Wood Change?

As the cost of raw materials continues to rise, several outcomes are likely. A natural reaction for integrated virgin fiber mills may be to cease the production of low-value, low-demand paper products. They can then explore opportunities to develop new products that offer higher value. However, it's important to acknowledge that switching to a different paper product may not always be a feasible option in certain market conditions.

Mills employing a kraft pulp process have untapped reserves of bio-based products. For example, from the depths of black liquor emerges crude tall oil, while the fiber-cooking process yields crude turpentine oil. These raw materials have the potential to replace fossil-based products in a multitude of applications, making them valuable in the hunt for sustainable alternatives.

However, black liquor also serves as a valuable source of energy for mills. This resource is essential for the kraft pulp chemical recovery process. Currently, approximately half of the woody biomass consumed in kraft pulp mills is used for energy generation, while the other half is used in the production of market pulp and other paper products. Using all the black liquor through burning allows mills to maximize their generation of excess electricity and steam, which can be sold for additional revenue.

In the long term, relying solely on black liquor as a source of energy may not be a viable option. This is primarily due to the likelihood that EU regulations will favor higher-value products and the ongoing debate about whether black liquor should be considered a bio-based waste or a valuable raw material.

Additionally, the growing adoption of wind and solar power is expected to influence electricity prices. The zero-fuel cost of these energy sources compared to wood-based energy may diminish the feasibility of using wood to generate energy. As a result, it is unlikely that wood costs will remain low in the future.

Leveraging Bio-Based Fuels for Sustainable Growth in the Pulp and Paper Industry

One option for generating added value in the pulp and paper industry is the production of liquid biofuels from the byproducts of pulp mills. By extracting and refining biodiesel, methanol, and ethanol from the kraft pulp process, mills can tap into a new revenue stream. Down the road, there may also be opportunities to capture biogenic carbon from pulp mill smokestacks to produce e-fuel.

With the implementation of EU regulations in 2024, companies will be required to report on the progress of their decarbonization plans. One of the most straightforward ways for businesses to achieve this is by adopting bio-based fuels. This approach typically doesn't necessitate any additional investments and offers easily measurable results.

The current supply of feedstocks for liquid biofuels is insufficient to meet the industry's demand. It is important to acknowledge that achieving the industry's ambitious goals cannot be accomplished using a single feedstock or pathway. Currently, 70% of sustainable aviation fuels (SAF) rely on hydrotreated vegetable oil (HVO). However, there is concern that the supply of HVO will not be able to keep up with the growing demand.

To meet the growing demand for liquid biofuels, it’s essential to consider a diverse array of feedstocks and pathways.

- Ethanol: Food crop restrictions are sensible, but they limit supply.

- New Plants: The establishment of new biofuel plants requires a learning curve and ambassadors.

- Woody Biomass: Wood is a renewable feedstock and a readily available resource in many markets.

Wood-based biofuels offer a double-edged opportunity for the pulp and paper industry. Unlike the costly and extensive kraft pulp process, these biofuels can be produced at a lower cost and with less capital expenditure. However, the drawback lies in the fact that these new processes are still relatively untested and rely on emerging technologies.

The Role of Forest Owners in Shaping Sustainable Pulp and Paper Industry Dynamics

As the industry navigates these complexities, forest owners emerge as key stakeholders. Their decisions will play a significant role in determining who benefits in a landscape of rising wood demand.

In the near future, the industry will need to adapt, innovate, and diversify to thrive in an environment where wood remains a precious commodity, and sustainability takes center stage. Forest owners, regulators, and industry players will all have a vital role to play in shaping the future of the pulp and paper industry.

With a foundation of rich data and expertise, ResourceWise's business intelligence transforms complex market uncertainty into comprehensive insights and strategies. We are here to help you capitalize on your strengths and seize opportunities while mitigating risks in your supply chain, operations, and environmental impact.

Learn more about our forest products tools and how they can empower your decision-making in the pulp and paper industry.