3 min read

Avoiding Risk and Planning for the Future in the Pulp and Paper Industry

ResourceWise

:

Feb 26, 2024 12:00:00 AM

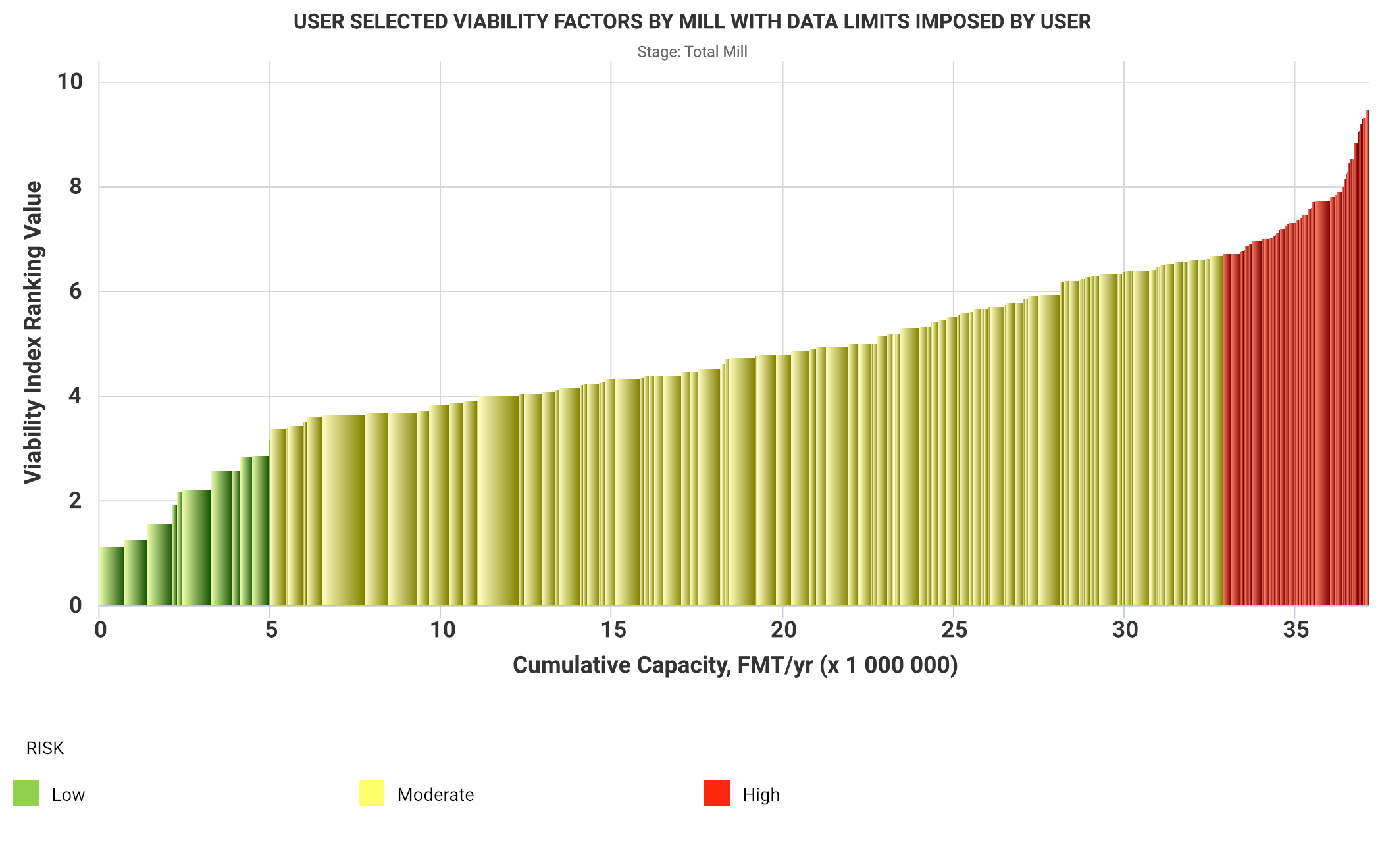

For producers and suppliers navigating the complex landscape of the pulp and paper industry, understanding a mill's viability and that of industry peers and partners is the key to making informed decisions and achieving success. Amidst a sea of data analytics tools and market analyses, FisherSolve's Viability Benchmark Module stands out for its depth, precision, and forward-thinking approach.

Considering the volatile economic landscape pulp and paper professionals are forced to navigate, not having this type of information could be the difference between imminent closure and robust growth. It’s a narrative of critical data and strategic insight that resonates deeply within the industry on both commercial and operational fronts.

What Is the FisherSolve Viability Benchmark?

Embedded within ResourceWise’s FisherSolve platform, the Viability Benchmark Module is a cutting-edge tool designed to forecast the long-term sustainability of pulp lines and paper machines. Drawing from years of historical data on closures and survival rates, this module offers a comprehensive assessment of the staying power of individual machines, mills, and companies. It serves as a valuable resource for uncovering the unique strengths and weaknesses of each asset, providing crucial insights for strategic decision-making within the industry.

FisherSolve Viability Benchmark

-1.png?width=600&height=377&name=Merger%20Containerboard%20Mills%20Worldwide%20-%20Rank%20Curve%20by%20Mill%20(2)-1.png)

Depending on the user, the Viability Benchmark can help you understand a number of industry aspects. The tool considers cost-of-production, size, technical age, grade risk, position in company fleet, capital required, transportation, and other factors. All of these can be assessed under various economic scenarios.

Long-term Planning for Producers

For producers, the Viability Benchmark not only serves as a crucial tool during market downturns but also functions as a strategic compass for long-term planning. By identifying potential closures within your region, you can uncover opportunities to capture market shares that might otherwise go unnoticed. This goes beyond simple cost comparisons, offering a deeper understanding of market dynamics and strategic positioning.

Achieving a competitive edge through a deep understanding of viability can result in higher returns than conventional cost-cutting maneuvers. Market survival means more than just reducing your expenses. You need to strategically understand how your competitors’ viability compares against yours. This benchmark equips producers with the clarity needed to navigate complex decisions, paving the way not only for survival but for sustained growth.

Navigating Risk with Our Viability Benchmark: A Supplier's Guide

Suppliers and buyers of pulp and paper often find themselves navigating the unpredictable waters of customer and supplier portfolio management. Customer value (margins) generally increase with time, so it's ideal to try to find "forever customers."

A short-term risk when dealing with customer portfolio management is default and bankruptcy. For suppliers that have cosigned inventories, which often happens when their customers are low on cash, this is a big risk. In the case of pulp and paper buyers, having too many eggs in one basket can create huge issues during tight markets.

As a result, many suppliers and buyers will try to navigate this issue by using a risk index published by credit checking agencies to decide on terms. The problem with this approach is that bankruptcy risk calculation for nearly all firms is essentially zero right up to the point they declare it.

To combat this risk, FisherSolve's Viability Benchmark utilizes longer-run intrinsic factors that are cross-cycle. This is much more powerful and beneficial as it gives actionable guidance instead of general direction.

What Sets FisherSolve Apart?

The strength and precision of FisherSolve's Viability Benchmark are both derived from the platform's exclusive data repository. With two decades' worth of asset-based variables at its core, this benchmark offers an unparalleled level of analysis within the industry. While many consulting and data analytics services rely on subjective factors, FisherSolve's Viability model is built on regressions formed from this extensive and reliable long-term data.

This benchmark is a product of objectivity, not speculation, made possible by thorough and meticulously vetted datasets. It's not just a claim of expertise; it's the pivot towards solutions grounded in the concrete data of sustained history and predictive insights. While other models tend to answer "what I think should cause viability," we answer "what actually causes viability."

Navigating the Next Chapter of Pulp and Paper

Access to such strategic data and forecasts empowers players in the pulp and paper industry to surpass their competitors. This invaluable intelligence is particularly crucial as we sit in economic uncertainty.

To learn more about how our consulting services and data solutions can enhance your company, reach out to a Fisher expert today or book a demo.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)