3 min read

EU Biodiesel on Alert for Margin Shifts, Chinese Import Exploits

ResourceWise

:

Aug 30, 2024 12:00:00 AM

The EU’s anti-dumping tariffs on Chinese biodiesel have officially been in place since August 16. Since then, the biofuels and feedstocks industry in Europe is eagerly tracking changing market developments.

They are primarily looking for significant changes in profit margins since the new costs make importing most biodiesel and HVO products from China untenable.

Understanding Anti-Dumping Tariffs

The EU's anti-dumping actions target the enduring problems that European producers have experienced within the biodiesel market. EU-based operations have seen their profitability suffer due to what they deem unfair competition from China. This has decreased production capacity, shuttered manufacturing plants, and idled resources.

The tariffs—up to 36.4% in many cases—make profitable trade through this route far less possible. In effect, such duties will stop the influx of these fuels from the Chinese market into the EU.

Despite these changes, some risk remains in how and where Chinese imports could find their way into Europe's market. European trade associations are closely monitoring the market for any anomalies in trading patterns that might indicate potential loopholes in the new trading system.

Duties Resulting from Rapid Increase of Chinese Biodiesel

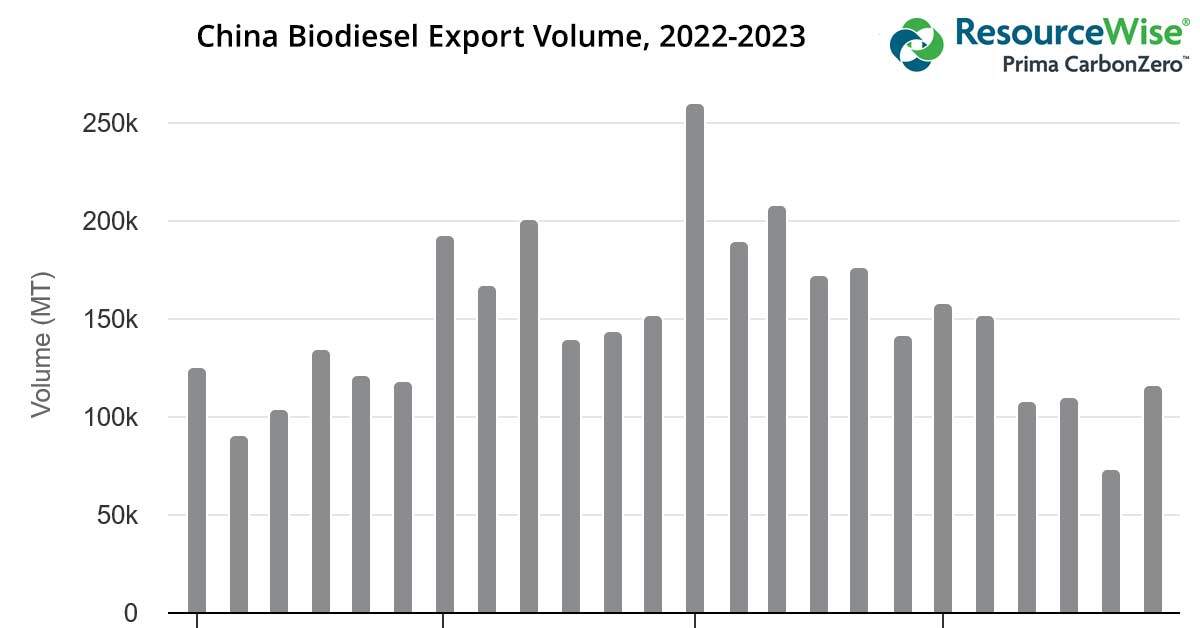

According to data from Prima CarbonZero’s Green Diesel Report, the volume of Chinese biodiesel exports began to increase rapidly toward the end of 2022. By January 2023, these numbers peaked at over 250,000 tons of monthly outflow. This amount was more than double the monthly outflow from one year prior in January 2022 (see chart).

(Source: Prima CarbonZero from ResourceWise)

Total exports of Chinese biodiesel peaked at 1.95 million tons last year. This was slightly higher than 2022 and far ahead of the 1.1 million tons exported in 2021 and the 847,000 tons in 2020.

Even factoring in the increase in waste-based Chinese HVO exports, the data clearly shows that China's exports have continued to climb.

Shifting Prices and Trade Forecasts in Motion After EU Ruling

The scale of China's export flow has directly impacted the price predictions for Annex IX A advanced biofuels in Europe. This comes as no surprise considering the number of Chinese products that meet this description.

The incentives to export advanced biodiesel have grown following Germany's decision in late 2022 to apply double counting for above-cap Annex IX A deliveries. Despite the theoretical limitations on the supply of Annex IX A feedstocks, the price spreads for these biofuels are only marginally higher than those of Annex IX B products.

To complicate matters further, the EU's Annex IX A mandate is set to increase rapidly under RED III. The outlook is now facing ambiguity as the market adjusts to the new trading dynamic and upcoming changes.

Producers Keep Watch for Loopholes to Continued Chinese Exports

Meanwhile, European producers are wary that Chinese biodiesel may somehow find a way into the market through the exploitation of loopholes. Analysts and producers alike are keeping a close eye on trading patterns while tracking import vessels to ensure operations stay above board.

In this climate of thin 2024 margins, producers are also examining the influence of foreign tax reliefs. Such incentives could exempt imported biodiesel from its 6.5% EU import duty.

Though the UK has done away with this practice, it continues to function this way in the EU. This could potentially allow imports to evade the anti-dumping duties—much to the detriment of domestic producers.

Biodiesel Exports from China Still Moving into UK

Traders have noticed an increasing trend of importing Chinese biodiesel into the UK. We could see this trend continuing as Chinese producers offload stock formerly destined for the EU. But the UK’s own anti-dumping investigation into Chinese biodiesel may ultimately dry up this export source as well.

Related: UK Launches Anti-Dumping Probe on Chinese Biodiesel Exports

All of this ambiguity in pending investigations and shifting market focus leaves overall trade dynamics highly uncertain.

The EU is still accepting Chinese SAF exports, which were not included under temporary anti-dumping. However, European trade associations have pointed out that Chinese SAF could potentially provide an entry point for Chinese HVO into the EU road transport fuel market.

Industry Transparency, Traceability Key to Biofuels’ Future

In light of these developments, industry stakeholders are calling for greater transparency and more robust enforcement mechanisms to ensure fair competition within the biofuels market. The potential for sidestepping tariffs through “creative” shipping practices poses an ongoing challenge. Many European producers are demanding a comprehensive review of the existing regulations.

By tightening import controls and enhancing traceability standards, the EU could safeguard the interests of its domestic producers. Such a move would also directly promote a much more level playing field.

Free eBook on EU Biofuels Market and Anti-Dumping Now Available

As the biofuels and feedstocks market responds to the EU’s anti-dumping rule, uncertainty will undoubtedly persist. But that does not mean you have to fly blind in your own strategic decision-making.

ResourceWise’s latest eBook, After China Anti-dumping: A Detailed Analysis of the Changing Dynamics of the Biofuels Market, gets to the heart of the issue. Our eBook covers all the following topic areas:

A comprehensive overview of the anti-dumping duties and what it means for Chinese biofuel and HVO exports.

- Where and how the market will experience disruptions in pricing and margins.

- The role of emerging fuels like SAF in wake of these tariffs and regulations.

- Future outlook in light of evolving legislation and continued market volatility.

The eBook serves as an excellent resource for keeping you informed about what’s important in the changing European biofuel landscape. Use the link below to download.