7 min read

Western PET Sector Profit Loss 2023: How Much and For How Long?

Jane Denny And Javier Rivera : Dec 7, 2023 12:00:00 AM

PET industry participants in Europe and North America are locked in a fight for survival. What can the PET sector do to improve its outlook for 2024? What are the key factors in improving PET operating rates going forward?

Increasing final demand for PET products is one key factor—closely related to wider economic and business landscapes. The outcome of ongoing competition regulation is also a contributing factor. Lastly, the future development of protectionism measures, and their impacts, will be key.

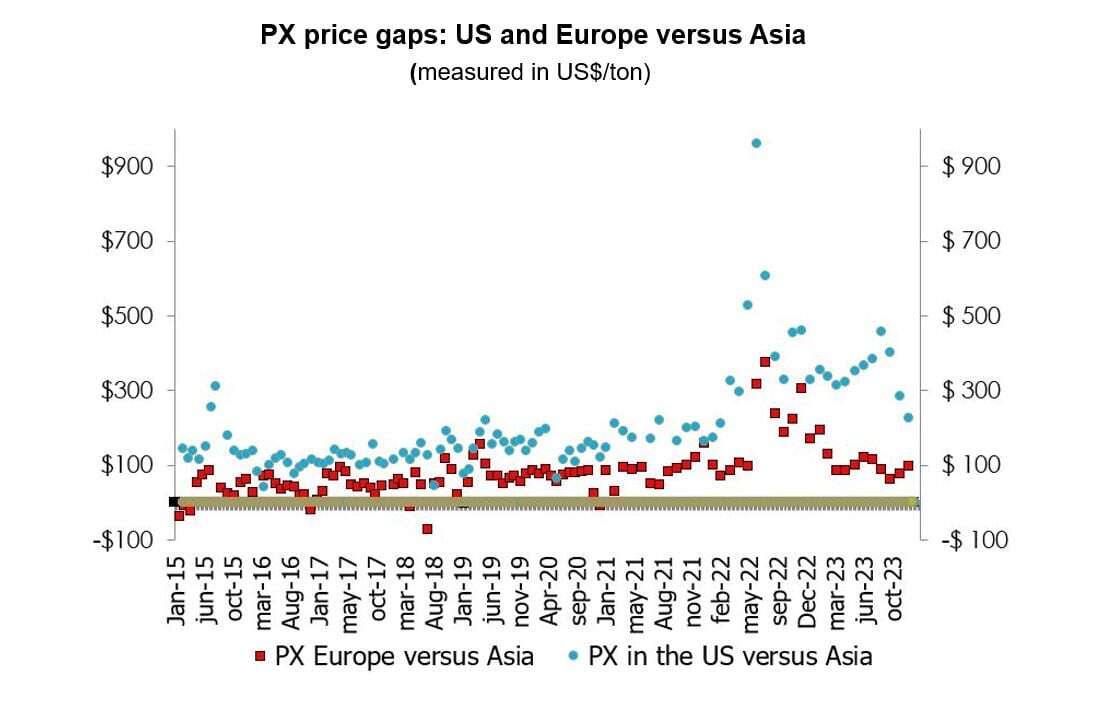

But ensuring reasonably low paraxylene (PX) price gaps with Asian imports to the US and Europe is vital.

PET Feedstock Cost Impact

Producers of raw materials (PTA, MEG, PIA) are experiencing the trickle-down impact of low PET operating rates in these two western regions. And, in the absence of exceptional demand moving forward—and reductions to imports—rationalization of the chain is expected.

Achieving low PX price gaps—compared with a key Asian price point (outlined below)—continues to be the main objective for US and European market participants. That's one side of the coin, or double-edged sword.

Achieving low PX price gaps—compared with a key Asian price point (outlined below)—continues to be the main objective for US and European market participants. That's one side of the coin, or double-edged sword.

The other side of the dilemma is tied up with the threat of polyester chain companies making low value feedstock (PET, PTA) available to downstream converters including PET bottle blowers. Access to the raw materials PTA and PET at low cost improves the competitiveness of downstream industries.

Paraxylene Price Trends: Year End 2023

Europe:

- The November 2023 PX contract price was confirmed on 1 December at €998/ton—a €42/ton drop from October. The settlement maintains a price gap with Asian prices below the $100/ton level and well below the price gaps observed in mid-2022.

- The October 2023 PX contract price confirmed on 2 November was €1040/ton—€50/ton lower than September 2023 and the same value observed in August 2023. This settlement also left the price gap between Europe's PX settlement and the cost per ton of Asian product under $100/ton and significantly lower than the price gap observed in mid-2022.

North America:

- The November 2023 PX contract price was confirmed on 1 December at 55 c/lb ($1100)—a 4 c/lb drop from October. The settlement led to a price gap just over $200/ton, the lowest since February 2022.

- The October 2023 PX contract price confirmed at the end of September was 59 c/lb ($1180/ton)—a 9 c/lb drop on the prior month's contract price. This put the North American versus Asian PX price gap per ton under $300 for the first time in 2023.

With Asian product available to North American buyers at a cheap price, and minimal reductions to North American producers' prices, it's easy to grasp how threatened the latter producers feel right now.

Recent PX settlements in Europe appear to give confidence that the price gaps may be reasonable in 2024.

Tecnon OrbiChem business manager Javier Rivera

Upward pressure on PX prices from gasoline markets is likely to feature during 2024—in the US especially. However, recent PX settlements in Europe appear to give confidence that 2024 price gaps may be reasonable.

This situation leads to a price gap (also referred to by industry participants as a disparity). PX disparity Europe/US versus Asia is defined as “PX contract price in Europe or the US versus monthly average of daily PX fob South Korea in the same month".

When cheaper products and raw materials enter Europe from China for example, buyers can opt for cheaper product for their inventories. However, they must weigh up the benefits of taking advantage of the arbitrage against the risks of giving up reliable supplies from local producers. It's true that Chinese producers are eyeing European and North American markets for customers today, but when the country's domestic markets recover exports may reduce.

Arbitrage opportunity for PX, PTA and PET

When there is high disparity between the price of a locally produced product and the same product entering a country—or region—from elsewhere in the world, an arbitrage window opens.

When it comes to PET markets, high PX disparities versus Asia increase the cost of producing PTA/PET relative to that in Asia and create an arbitrage window for PX, PTA and PET imports.

Paraxylene Prices: US, Europe and Asia

The above graph illustrates PX price differences between Europe and North America versus Asia. Traditionally, Asia's fob South Korea PX values were the key reference for PX settlements in other regions. That changed in Q2 2022.

Asian PX values lost their benchmark relevance to North American and European PX settlements when gasoline market dynamics took over as the main driver.

Specifically, there has been an increased demand for mixed xylenes in North America based on suitability as gasoline blendstock. That demand growth has underpinned a sharp price increase. Particularly during 2023, strong demand for gasoline and transport fuel has applied upward pressure to the gasoline blend and mixed xylenes values. Therefore, PX price settlements, which are linked to mixed xylenes prices, are in turn based on the premiums that mixed xylenes can obtain from gasoline/blend markets. The drivers of those markets are completely different to those of polyester, PET and packaging.

A high level of PTA (and its derivatives) imports—specifically PET—was among the consequences of the low prices of Asian compared to locally produced PX in 2022 and 2023.

The knock-on effect is a reduction in regional producers' market share, concurrent with softening end demand as the world teeters on the edge of recession.

However, high inventories throughout the chain have largely been consumed so far in 2023. As producers and convertors look to restock for 2024, price points for purchases remain key to business profitability. The graph below (click to open in a new window) shows that paraxylene prices are subject to a downward trajectory in the latter part of 2023. Subscribers to our chemicals data and market intelligence platform OrbiChem360 have access to eight PX price points globally.

Low End-demand for PET-related Products

Some critical aspects to assuring the competitiveness of the European PET sector have clearly improved. PX disparities and energy costs have diminished. However, end-demand and PET requirements from European sources continue to suffer the consequences of high disparities and high energy in 2022, along with changes in consumer habits and the end of the peak season.

The structural changes to consumption habits of the previous couple of years—namely the exceptional PET consumption during the pandemic—have disappeared. End-demand is significantly reduced compared to previous years, which we should now consider exceptional.

In 2023, producers have been forced to decide between volumes and reasonable margins, which have been impossible to achieve together at the same time.

Javier Rivera

In 2023, producers have been forced to decide between volumes and reasonable margins, which have been impossible to achieve together at the same time. Low demand in the coming weeks could prioritize margins versus volumes for the remainder of 2023.

Structural changes are taking place and there is no clarity on when final demand will increase, to what extent, and how sustainability. Changes in consumer habits, in the way of life and many other factors will impact PET markets.

An Industry Adjusts to a New Reality

Rationalization and consolidation within the polyester chain is expected. Critical to evaluating positions for 2024 and beyond will be each individual company's competitiveness, integration, financial strength and medium to long term strategies.

- JBF Global announced a temporary shutdown of its 430 ktpa plant in Belgium citing "unsustainable market conditions”. The producer is still active in the market and the outcome of the financial restructuring is key to understanding what the situation could be in 2024.

- At the end of September, Indorama Ventures communicated the cessation of PTA production in Portugal.

- INEOS Aromatics announced on 29 November its intention to mothball the smaller and older of two of its PTA units at its integrated PX and PTA production facility in Belgium.

- The US-based consortium comprising Indorama, Alpek and Far Eastern New Century decided to temporarily pause construction at the integrated PTA-PET plant in Corpus Christi, Texas. That decision—announced on 27 September—was taken to manage the challenging environment related to cost inflation, high interest rates, and labour shortages. They will also evaluate possible ways to efficiently prioritize or phase completion of the plant, maximize use of invested capital, and minimize excess expenditures to provide an efficient and competitive supply solution to customers.

High and structural PX price gaps (and delayed settlements), high imports and low demand for PET products are the main drivers of the current PET market in Europe and the US. These remain PET producers' key concerns for 2024 and additional reasons to justify the Corpus Christi announcement.

It remains to be seen what the effects of the current rationalization of PTA and PET will have on purchasing and commercial strategies of individual producers/buyers in the PET chain.

Protectionism Policy: Now and Expected

- US market participants say PET producers have been collecting data to support the initiation of trade measures against some countries exporting PET to the US.

- Mexico's federal government implemented mechanisms to stabilize national industry and eliminate distortions in trade. It has established temporary import tariffs from 5% to 25%. Merchandise classified includes that related to steel, aluminium, bamboo, rubber, chemical products, oils, soap, paper, cardboard, ceramic products, glass, electrical material, musical instruments and furniture. PET (with 3907.61.01 code) is subject to a 25% import tax until 31 July 2025.

- Other countries could be evaluating measures similar to the one implemented in Mexico.

- On 27 November, the European Commission imposed provisional anti-dumping duties on imports of PET originating in China having a viscosity of 78 ml/g or higher (CN code 3907 61 00). PET from China will now be subject to duties ranging from 6.6% to 24.2%, depending on the exporting producer. These duties will be in place for a maximum period of six months, during which all interested parties can provide feedback, before the Commission, after consulting EU Member States, takes the final decision on the imposition of definitive (permanent) measures. Contrary to what could have been expected, shipments from China to Europe increased again in October and were 22,520 tons.

2024 Contractual PET Deliveries...

While fundamentals for the PET industry remain challenging and the market depressed, there are signs of improvements for 2024. Achieving better outcomes is unlikely to be difficult (relatively speaking) since "2023 has been described as the worst year ever, especially for PET producers in Europe with low margins/low operating rates," says Rivera.

There is evident uncertainty about the PET requirements that buyers could commit to due to uncertainty as regards end-demand.

The number of import options is expected to be reduced in 2024. Imports from countries where domestic producers have other units are significant, especially in the US, with a figure between 65-70% of total imports in 2023.

Navigating a Changing PET Landscape

In Europe, it appears that freely negotiated or market related contracts are the preferred option. That scenario could change. It depends upon how European producers capitalize on the provisional anti-dumping measures, the JBF closure (if any) and existing rationalization via lower operating rates.

The low prices and poor margins of recent months are not sustainable. Producers are now focused on prioritizing reasonable margins over volumes. The need to guarantee minimum volumes in 2024 will surely lead to different commercial approaches, says Rivera. "The consensus is that buyers should rely more on European sources compared to 2023," he says.

In the US, a highly contractual market, a complete change in market dynamics compared to the same period last year is expected to result in significant declines of between 5-8 c/lb in PET adders/deltas over raw materials for contractual deliveries compared to 2023.

In the medium-term, the need to incorporate 25% of recycled material in beverage bottles in Europe is a threat for consumption of virgin PET. Current low prices of recycled material could accelerate the trend in 2024, which along with new capacities and improved availability could penalize the usage of virgin PET.

Javier Rivera and our South Korea-based consultant Hyun-Min Kim (Min) scrutinized Europe's response to an anti-competition allegation against Chinese importers of PET earlier this year. Read the blog post PET Anti-dumping Update: Proposed Provisional Duties which includes a free-to-download eBook.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)