Currently, there is low profitability for producers in the polyester chain in all regions. This blog post is designed to provide an indication of what market participants can expect in the coming weeks and months. We outline the key aspects to understanding paraxylene (PX), purified terephthalic acid (PTA), monoethylene glycol (MEG), purified isophthalic acid (PIA), and PET markets in 2025

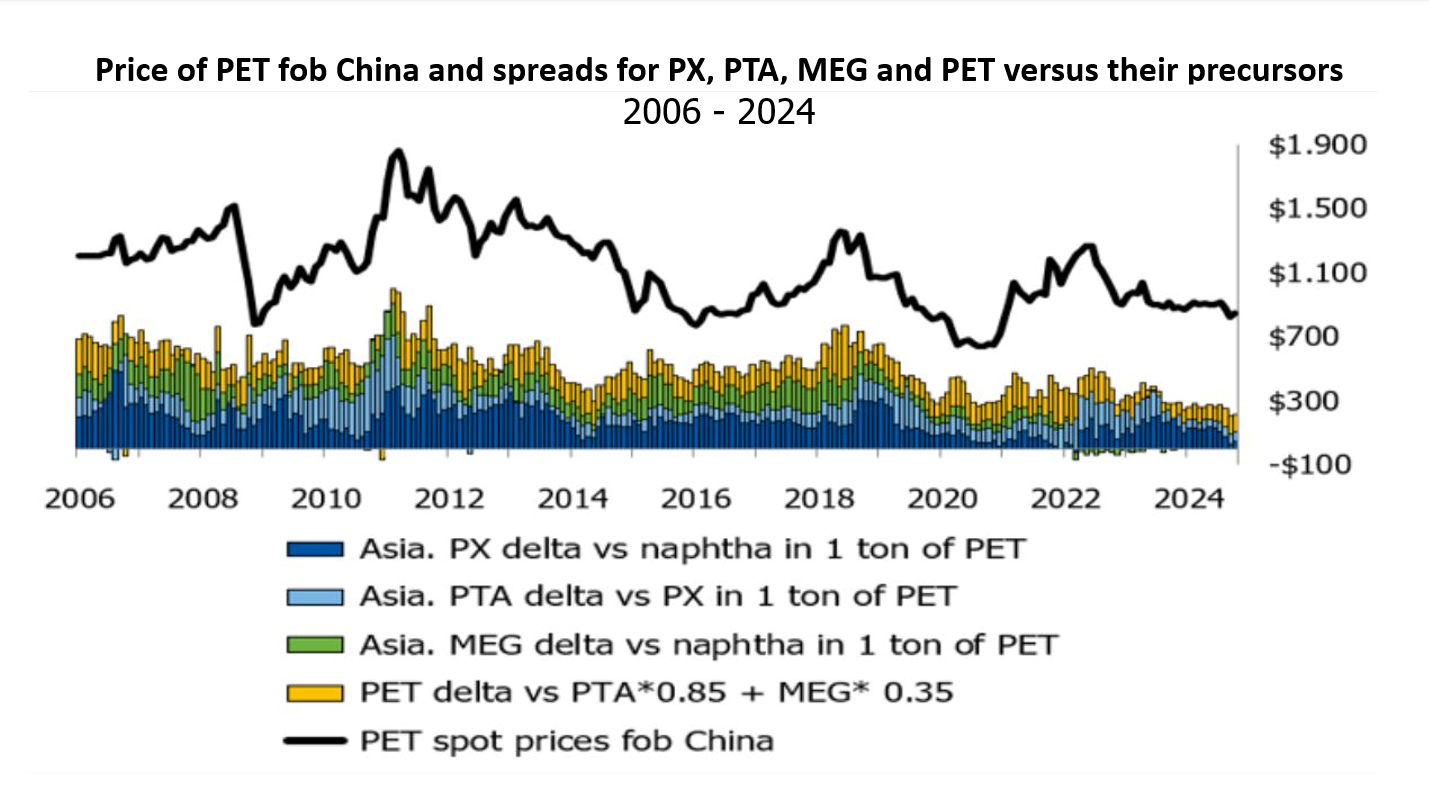

The chart shows the evolution of spreads for all products in the polyester chain in Asia including those for PX, PTA, MEG, PIA and PET over raw materials.

The same analysis in Europe and America provides a similar result, which is a clear downward trend of spreads over time and the current low profitability for products and most producers in the polyester chain in all regions.

- Low spreads in Asia could be justified by huge overcapacity, but also a high level of integration leading to different economics compared to other regions.

- Low profitability has led to PTA and PET rationalization in Europe and North America in 2023-2024.

- Of the 4 US PET producers, three of them published letters in September announcing price increases for Q4 2024 justified by unsustainably low profitability.

Source: ResourceWise

The black line in the graph represents China's fob (free on board) PET prices (in US dollars). The colored bars represent the spreads (no margins) of PX, PTA, MEG, PET over their precursors (naphtha, PX, ethylene, PTA/MEG respectively).

The impact of a $1/bbl change in the cost of PET and the limited spreads for products in the chain spreads suggest that PET prices will closely follow Brent crude oil values, and margins for most products in the chain will remain stable or higher.

Increasing geopolitical instability, volatility in logistics, as well as a clear trend towards protectionism globally, will be key aspects to consider when assessing markets outside of Asia/China.

Paraxylene

- PX disparity/gap versus Asia remains the main problem for Europe and especially North America. High PX gaps versus Asia increases the cost to produce PTA and PET in other regions and encourage imports of PX, PTA, PET, and downstream products.

- The start of the Dangote residue fluid catalytic cracker (RFCC) unit in Nigeria and Dos Bocas in Mexico will provide additional gasoline supplies to the domestic markets, impacting gasoline exports from Europe, the US and Asia, a situation that should change refineries and gasoline markets in 2025.

- PX gap/disparity in the US versus Asia is defined as “PX contract price in the US versus monthly average of daily PX fob South Korea in the same month".

Source: ResourceWise

Purified Isophthalic Acid (PIA)

- In India, Reliance has achieved PIA to specification. Volumes of PIA from India have already been shipped for industrial homologation to some customers.

- Global overcapacity will result in low utilization or rationalization in 2025.

- In Asia, all producers are running, and all companies have reasons to justify business continuity.

- In Europe, the only producer has been running smoothly at high (not full) operating rates.

-

In the US, unstable production of the only producer justifies higher imports in recent months and in 2025.

Not only are some PIA buyers outside of Asia interested in continuing with alternative suppliers outside Europe, but also PIA producers in Asia are keen to increase market share in other regions due to the start of Reliance PIA unit in India.

India imported 62,772 tons in 2023. From 2023 to date, 60 percent of the PIA was imported from South Korea, 23 percent from Taiwan, 12 percent from Japan, 2.5 percent from China and 1.5 percent from Spain.

Purified Terephthalic Acid (PTA)

PTA in North America:

Higher than expected PTA utilization is expected to continue in the US and Mexico as Indorama discontinued PTA production in Canada in September (407,710 tons of PTA were exported from Canada to the US in 2023).

Ineos expects to restart a PTA line that was shut down in 2023 at Cooper River. Negotiations for contractual PTA deliveries in 2025 have begun, with sellers seeking higher deltas/adders in light of changes in supply, and buyers (especially, but not only, non-integrated PET producers) seeking better terms to be competitive in challenging downstream markets.

PTA in Europe:

A more balanced or slightly tight European PTA market and more complex and costly logistics will result in higher deltas/adders of PTA over PX in 2025 compared to 2024, a result which work against the competitiveness needed by European PET producers when trying to compete with PET imports.

The severe rationalization of the European PTA industry has reduced the number of sources and volumes, resulting in a slightly tight market. Alternative options do exist—namely the import of PTA from overseas—but involve more complex supply chains. That creates uncertainty about arrivals and competitiveness amid more complex logistics, longer routes, and the volatility of freight costs.

Reliable PTA production is key in Europe, and two large European PTA producers will have turnaround outages at the end of Q1 2025. On 8 October 2024, Ineos communicated that its PTA plant at Geel in Belgium is threatened with closure, an uncertainty that should be resolved in January 2025.

Meanwhile, SASA's new PTA unit in Turkey is expected to start in early 2025 and will change the usual trade flows for PTA in the region. PTA exports from China and South Korea to Turkey will have to find alternative markets. The chart shows PTA imports into Turkey. ResourceWise's OrbiChem360 chemical intelligence platform allows subscribers to obtain import/export charts (volumes and prices) of chemicals at country level as soon as official trade data figures are available. (Click graph to open in a new window)

Source: ResourceWise

Monoethylene Glycol

In China, the slight decline of crude oil Brent and naphtha values during the second half of 2024 has slightly improved the profitability for oil-based glycol production in the country. This has not been the case for coal, and high cost and poor economics/profitability have been the main reason for several shutdowns of coal-based MEG units in China.

The bars in the below chart show the glycol consumption in China (local production plus imports), which corresponds with the growth of the polyester industry in the country. Despite a clear increase of Chinese capacity (black line), MEG utilization remains at 65 percent of capacity despite good textile and PET production.

Imports from Taiwan, South Korea and Japan remained at the lowest level historically due to severe rationalization in these countries amid low MEG CFR (cost and freight) China prices and poor profitability.

Source: ResourceWise

In North America, multiple unplanned supply limitations in 2024 resulted in more balanced conditions. The MEG market has been well supplied for contractual commitments (domestic and export), but with limited availability and incremental volumes for spot or additional export volumes.

Regional production is improving in Q4 2024 before another round of scheduled outages in Q1 2025 (MEGlobal in Texas, Indorama at Clear Lake, Lotte, and Gulf Coast Growth Ventures) reduces availability one again.

Contract negotiations for 2025 contract deliveries continue and, although some deals have been closed, most talks are still ongoing. Terms are being discussed between ASP - US$70-75/ton and US$80-85/, with still different positions observed. The new US administration's approach to trade tariffs could have a significant impact on products in the polyester chain, as it already happened with MEG six years ago.

In Europe, the market has been well supplied and balanced amid low European production, regular imports at low levels, and good but not strong demand.

Market participants continue to focus on contract negotiations for 2025, with traders reporting delays and ongoing negotiations in both purchases and sales. Uncertainty over volumes and/or conditions with major origins for 2025 (the US and Saudi Arabia) have delayed MEG contracts, but conditions are expected to be stable or with small variations compared to 2024.

The chart below shows MEG prices in Asia (black line), MEG prices in the US (red line) and prices in Europe (Contract and spot), which are above prices in other regions and are justified, among other things, by a different cost position.

Source: ResourceWise

PET Packaging Resin

In China, Q4 2024 PET prices are at the lowest levels observed since January 2021. Margins for PET resin has shown no signs of improvement in recent months, with most Chinese PET resin producers continuing to grapple with subdued profitability and reducing operating rates.

Following the addition of 4 million tons of new capacity by August 2024. Sinopec Yizheng is likely to bring its 500 ktpa expansion onstream early in 2025.

Source: ResourceWise

In North America, low adders in 2024 and rising operating costs provided unsustainable profitability for PET production. This justifies increased adders in 2025. The decline in PET and raw material prices during the second half of 2024 and the associated depreciation will further deteriorate PET results in 2024.

A total of 1,049,000 tons of PET (code 390761 and 390769), or average monthly of 116,000 tons were imported between January and September 2024. PET producers in the US have been collecting data to assess a complaint that could lead to an investigative case on PET imports from several Asian countries. It is understood that a broader scope to include recycled products could have led to a delay in the timing of when the case was expected to be filed, with the first quarter of 2025 as the most likely time.

On 9 August, Mexico imposed provisional countervailing duties on imports of polyester resin originating in China, regardless of the country of origin, between 34 percent and 63 percent applied to the customs value declared.

In South America, the combined effect of low PET fob values together with low freight costs led to the lowest PET cfr prices at the end of 2024, with the most competitive values slightly above US$900/ton cfr confirmed for from China to specific destination. The chart below shows PET imports in South America by origin. Import are representative of overall PET consumption in South America. Except for Argentina and Brazil, the rest of the region is supplied almost exclusively from Asia and especially from China, which has significantly increased its market share in the region. (Click graph to open in a new page)

Source: ResourceWise

In Brazil, end-demand for PET-related products has remained exceptionally strong compared to other countries in the region, with high prices for Recycling having a significant effect. On 18 September, import taxes for 29 chemical products (PET included) had rates ranging from 7.2 to 12.6 percent, which will be increased to 20 percent for a period of 12 months. PET prices in Brazil are increasing accordingly in line with higher import parity.

In Argentina, the only PET producer restarted production in mid-October (after a 4-month outage). Uncertain production in the country in recent months, very high PET domestic prices, the end of certain limitations for imported PET (national tax declined 10 percent to 7.5 percent as of 1 September, better payment conditions for imported goods) will continue with exceptionally high imports in the country.

In Europe, although 2024 has been much better than initially expected for PET producers, the peak season for PET season finalized with disappointing sales and prices (margins) compared to initial expectations. The arrival of imports expected by the end of the year and other factors have prevented the PET market from being tighter.

Import Analysis: Europe

Despite the anti-dumping of PET from China and multiple logistic disruptions, average PET volumes stand at 106 kilotons per month in 2024 to date, similar average monthly volumes to 2023 and above the 96 kilotons per month average in 2022.

Source: ResourceWise

The different pricing mechanisms and settlement periods for raw materials (mainly PX), daily in Asia and monthly in Europe, do not allow the European PTA/PET industry to adapt to the short-term volatility and competitiveness of PET imports, which enjoy an advantage for back-to-back business regardless of the competitiveness of imports on arrival.

It is also certain that imports arriving in most of 2024 were concluded at higher prices than those that European producers were offering at the time of import arrival.

Negotiations for 2025 PET deliveries continue. Uncertainty of demand for PET-related products, import competitiveness, recycling legislation and impact on virgin PET, negotiation of PET feedstocks (especially PTA), among others, are key factors being taken into consideration.

Several bottling and packaging companies have recently reported new sustainability goals. The Coca‑Cola Company announced 2 December new Environmental Goals, including packaging goals to reach by 2035, centered on packaging design and collection after use. These replace previous goals, including 2025 and 2030 targets related to recyclability, recycled content and reusable packaging.

The ResourceWise Chemicals team follows raw materials and PET market trends globally. Our main target is to improve and share our understanding of the main dynamics of the products involved. Our analysis informs the daily decision-making process for our subscribers.

OrbiChem360 provides database services (monthly/weekly prices, monthly supply/demand forecasts, and trade flows), as well as business reports that include contributions by our experts, quarterly Plants & Projects Reviews and bespoke single-client studies.

Stay up to date by subscribing to our newsletter.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)