3 min read

Chlorine and Derivatives Markets at Mid-year 2023

Philippa Davies : Jul 3, 2023 12:00:00 AM

The markets for chlor-alkali have faltered during the first half of 2023, as projected in our early-year analysis of these markets.

As predicted, the increase in interest rates and high inflation, particularly in Europe and the US, have dampened demand, especially for sectors related to construction.

This means that materials like PVC have seen very limited growth this year so far and production rates in the 60% range in Europe and 70% range in the US reflect this downturn. News that US housing starts were up in May 2023 was surprising and led to some hope for recovery, but the fact that other markets did not respond positively to this news contributed to skepticism that there would be a substantial turnaround in the US economy. The crude oil market, in particular, remained weak, despite the uptick in housing starts, leading to doubts about the market’s belief

The European market was if anything more downtrodden than the US for PVC particularly, with capacity utilisation at around 60% and talk of long-term shutdowns rife. Usual spring and summer maintenance turnarounds have taken place or been planned. There are suggestions that the upcoming shutdowns could be extended if markets do not improve. Unplanned outages in April and May did not lead to any shortage of product; in fact, the market did not notice they had happened!

An Unsustainable Situation

Prices over the second quarter moved down steadily, almost everywhere. Because they moved down more than the negative contribution from a falling ethylene market, producers of PVC have started to say the current situation can not be sustained.

"...The jury is out on whether a European PVC producer will shut down if there is no improvement in margins and/or demand..."

Tecnon OrbiChem Consultant Philippa Davies

Will a PVC producer shut down in Europe if there is no improvement in margins and/or demand? The jury is out. The main reason for shutting down is not just the lull in demand, but the lack of cost competitiveness with the US, which means that exports to other regions are unattractive for the most part.

But, there are many reasons this might not happen, including the fact that many players are integrated, large producers take time to pivot, and smaller, more financially exposed producers tend to have only one unit, which means that if they do shut a plant down, it means they are withdrawing from the market altogether, and possibly permanently. Time will tell what will happen on the PVC production front in Europe, but we will be keeping a keen eye open for possible mothballing or shutdowns of European plants.

More Buoyancy in Chlorine

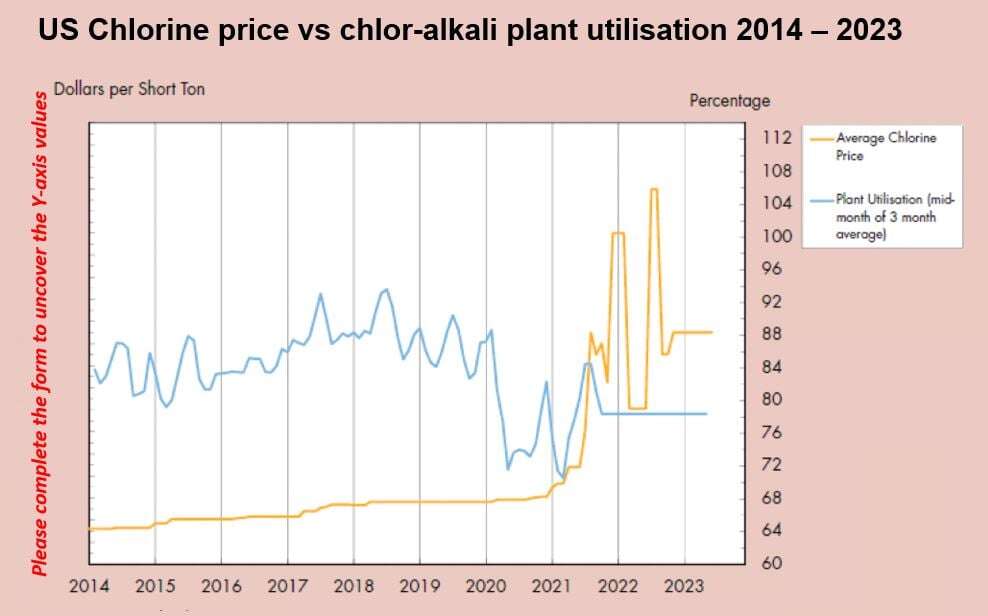

Chlorine itself has a little more buoyancy and production rates may be a little higher since other markets have been a bit stronger than that for construction, but this upside is limited. Chlorine capacity utilization for the US was reported in the high 70% range for May 2023, higher than the estimated PVC rate of around 70%.

In Europe, rates are at 62% for May, reflecting a weaker demand market and a more challenging margin situation. US chlorine offtake was improving with the summer weather as offtake into water treatment and bleaching picked up seasonally. This was less evident in Europe. The weakness of caustic soda pricing has also contributed to the chlor-alkali producers’ dilemma as there is little in the way of balancing to add value to the bottom line.

"...Prices for chlorine in China were even negative - which means chlorine sellers had to give subsidies to sell it..."

Philippa Davies

Source: Tecnon OrbiChem

Source: Tecnon OrbiChem

Negative Pricing Structures

Chlorine prices in China have remained at low levels since the second half of 2022, owing to oversupply. Prices were even negative, which means chlorine sellers had to give subsidies to sell chlorine. Chinese chlor-alkali producers kept operating rates at relatively high levels due to a better caustic soda market and profitable caustic soda margins, but demand from chlorine downstream industries was not so good due to slow economic growth. Most downstream industries were affected by weak demand, making it difficult for prices and profits to perform well, leading to resistance to high prices of chlorine. This put downward pressure on chlorine prices.

Source: Tecnon OrbiChem

PVC Review And Outlook

Asian PVC prices were on a firming trend from November 2022, but in February 2023, driven by weak demand and plentiful supply, markets began to subside again and prices fell. Formosa Plastics Taiwan revised down its market-leading offers from March amid oversupply and weak demand. In the first half of 2023, Asian exporters struggled with low overseas demand and competitively priced US cargoes.

Source: Tecnon OrbiChem

In China, the domestic PVC market prices rose in early 2023, then moved down after the Chinese New Year holidays owing to the inventory pressure amongst sellers.

Export demand from China was active in the first few months of 2023, although export activities slowed down from April owing to lower overseas market prices. According to China Customs, China exported 787.7 kt in the first four months of 2023, 4.64% more than in the same period of 2022.

New PVC capacities added to the mix

New PVC capacity came into operation in the first half of this year, which put more supply into the market. Wanhua Chemical started up its 400 ktpa ethylene-based plant in May, based in Fujian province. As for the second half of this year, Shaanxi Jintai Chlor-alkali plans to test run a 180 ktpa line of its 600 ktpa plant in August. The startup of the new capacity of Ningbo Zhenyang Chemical will be postponed to 2024.

The one-minute video above outlines the benefits of a subscription to our business intelligence platform OrbiChem360. For a demonstration of how Tecnon OrbiChem's insights into global chemicals markets can inform your business, hit the button below.