1 min read

China’s Caprolactam, Adiponitrile Markets Face Opposing Forces

Joyce Chen and Anna Zhou

:

Apr 23, 2021 12:00:00 AM

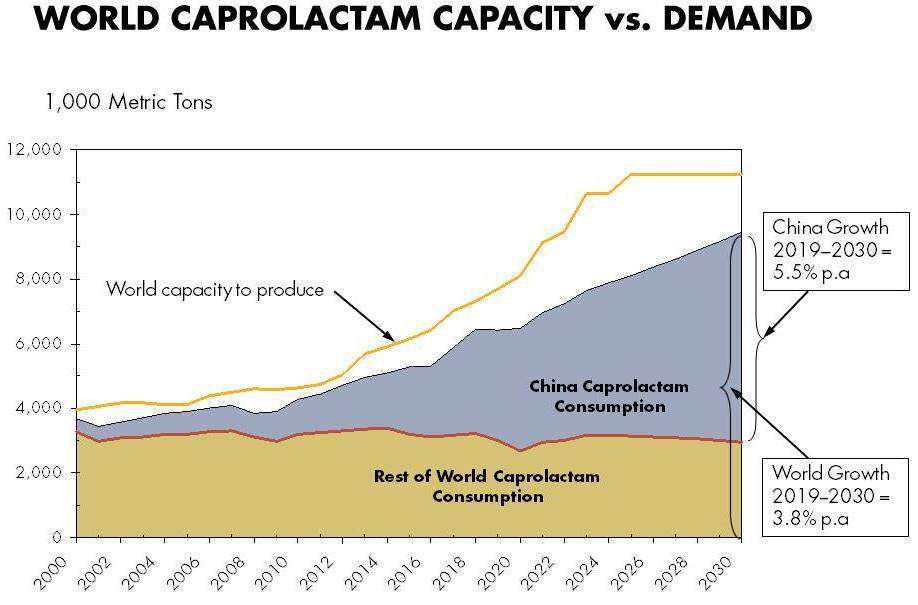

The outlook for polyamide market demand, the stop-and-start nature of economic recovery during the COVID pandemic, and key feedstock materials – both in abundance and in scarcity – were among the many topics discussed during the China International Polyamide & Intermediates Forum held in Shanghai on 29-30 March. An enthusiastic crowd of delegates heard speeches and presentations from leading market experts, and many in attendance were interested in market developments for caprolactam and adiponitrile, the key intermediate chemicals for polyamide 6 and polyamide 66, respectively.

The COVID-19 pandemic crisis in 2020 was a major influence on the development of global caprolactam consumption. As China recovered from the COVID pandemic crisis at a faster pace, the growth rate of caprolactam consumption during 2020 was much higher than other countries at around 10-11% for the full year. Almost all the capacity expansions globally in the next few years are in China as well. By the end of 2020, the total global capacity to produce caprolactam reached around 4.4 million tpa, and is estimated to reach around 5.5 million tpa by the end of 2021. Some major producers are scheduled to start up new units this year including Hualu Hengshang, Yankuang Lunan, and Henan Shenma. If Hengyi’s 1.2 million tpa project and other announced projects start-up as scheduled, total capacity to produce caprolactam globally could reach 7.5 million tpa by the end of 2025.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)