1 min read

Maleic Anhydride – New Capacity Meets “New Normal”

Philippa Davies : Jun 10, 2020 12:00:00 AM

The maleic anhydride market has been hit hard by the COVID-19 pandemic. It is not yet clear how much demand will be negatively affected due to the slow-building recession accelerated and exacerbated by the onset of the COVID-19 pandemic beginning in the early months of 2020. Automotive has been the worst hit sector and the fastest to respond to the downturn. Our next update will include the impact of the pandemic on these markets. Early analysis suggests that the negative growth seen globally in 2020 will be followed by a sharp upturn in late 2020 and 2021 as markets continue to open up in most major economies.

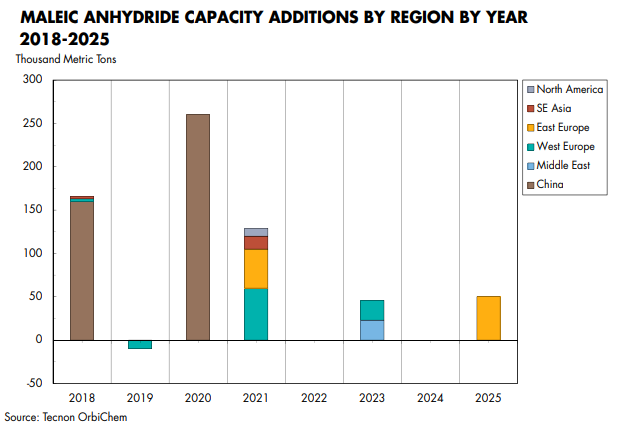

A possible second wave of the pandemic in the third quarter of 2020 would create a second downturn, but this is not anticipated to be as severe as the first. The long-term 2025-2030 forecast remains relatively unchanged from the forecast contained in the current update of the database. The growth trend is unchanged. However, there will be a gap between what we expected and the reality that COVID-19 has dealt us. World GDP remains about 4% lower than in the last forecast through 2030 and the maleic market will track this trend quite closely. New capacities coming up in the coming five to ten years present challenges to this new normal environment.

As Western markets have started to open up from May/ June 2020, global markets are sputtering back up and some increases in crude oil and chemical feedstock prices have also been seen. The market in China has been ramping back up since March 2020, at a time when other major consuming markets, like the US and Europe, were shuttering demand as their citizens hunkered down at home. UPR and maleic plants have been restarting in China but outlets for this product have been largely limited to Asia as China waited for the world to catch up. This has kept a lid on Asian prices during this period.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)