2 min read

A Current Look at the Forest Products Sector in the Lake States

ResourceWise

:

May 23, 2025 9:05:28 AM

As we approach mid-2025, the forest products industry across the Lake States reflects a region navigating both opportunity and constraint. While logging activity remains generally steady, external disruptions, climatic variability, and market uncertainties continue to influence production and pricing dynamics.

Logging Activity: Michigan’s Momentum Leads the Region

Michigan stood out in early 2025 for its high logging activity, particularly for maple and mixed hardwood sawlogs. State forestlands played a significant role, with favorable market conditions supporting strong harvests across all eight logging regions.

Wisconsin and Minnesota maintained consistent output but with more weather-related setbacks. In Wisconsin, where private forestlands dominate the harvest base, steady deliveries of pulpwood and sawlogs continued despite localized delays. In Minnesota, volumes remain below long-term norms while investments in mill infrastructure and a growing focus on engineered products like CLT are positioning the state for future recovery.

Climate Impacts: Storm Damage and Operational Delays

Late winter brought a series of weather challenges to the region. A destructive ice storm hit Michigan’s northern counties and the Upper Peninsula in March, downing trees and damaging infrastructure. Salvage operations are ongoing, but reports suggest some logging contractors may be delayed in returning to the region due to more lucrative opportunities in the southeastern US.

Meanwhile, heavy spring rains in Wisconsin and Minnesota limited site access, delaying operations and raising concerns about soil compaction and erosion. These challenges underscore the increasing unpredictability of seasonal patterns that forestry professionals must now navigate.

Market Dynamics: Product Demand and Mill Pressures

Despite disruptions on the ground, product demand remains healthy—particularly for higher-quality hardwoods destined for both domestic and export markets. However, mill infrastructure remains a pressure point—especially in Minnesota. Several closures over the past five years have increased logistical burdens for lower-grade material in the state.

At the same time, innovation is reshaping regional opportunities. Growing interest in CLT (cross-laminated timber), biochar, and other value-added wood products is helping create new markets for small-diameter and lower-value timber, especially in regions where traditional pulp markets have contracted.

Fiber Price Trends: Lake States Remain Stable Compared to Other Regions

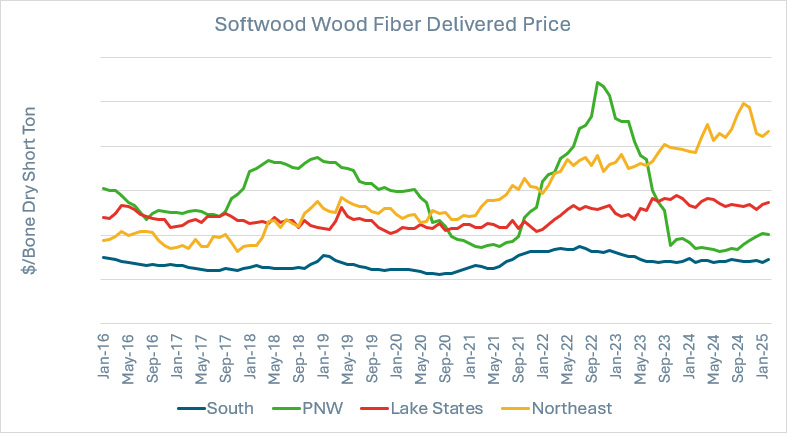

When looking at delivered fiber prices from SilvaStat360, we can see that this region has shown remarkable stability over the past year, especially when compared to other regions like the Pacific Northwest and the Northeast, which have seen more dramatic swings.

Source: SilvaStat360

However, it’s important to note that these prices don’t reflect Michigan’s March ice storm. April and May figures will be critical in evaluating potential shifts.

A Sector in Evolution

The Lake States forestry sector continues to adapt to a shifting landscape—both literally and economically. Mature timber inventories, labor constraints, infrastructure pressures, and environmental volatility are forcing new strategies and partnerships across the region.

Still, strong forest stewardship programs and increasing collaboration around sustainable forestry, carbon markets, and cross-border timber trade offer reasons for optimism. Regional coordination will be essential to help navigate the transition and build long-term resilience.

Timely insights are essential in today’s forest products industry. At ResourceWise, we help forest managers, suppliers, and manufacturers stay informed with real-time market intelligence and trend tracking. Subscribe to our newsletter to receive updates and analysis directly in your inbox—so you’re always ready for what’s next.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)