5 min read

Future Funding: Billion-dollar Policy Offers US Bioeconomy a Lifeline

Jane Denny

:

Jun 7, 2023 12:00:00 AM

Jane Denny

:

Jun 7, 2023 12:00:00 AM

Chemical companies are struggling to find markets as weak demand – driven by inflation fears – permeates the economy worldwide.

Manufacturing investment slowdowns are projected due to the excess of high-priced chemical inventories in supply chains. Expanded inventories have been a significant factor in trade flow disruption since mid-2022. If there’s a silver lining, it’s that this is a climate in which the cost of fossil-based hydrocarbons will largely – though slowly – fall, as we are seeing now.

Historically, downward spirals in fossil fuel-based feedstocks send buyers towards petrochemicals sellers en masse. Any burgeoning hopes for bioeconomic turnarounds are dashed. In the US, this time round at least, bioeconomic aspirations are being thrown a bit of a lifeline...

Billion-dollar policy

US President Biden’s recently-implemented Inflation Reduction Act (IRA) is enabling various US government agencies to invest in the renewables sector. From fuels to chemicals and materials, the support is designed to boost bioeconomic growth. It aims to encourage renewable R&D, biotechnology use and the implementation of various bio manufacturing technologies.

Without the IRA funding safety net, more carrot and less stick, declining fossil-based energy prices might divert attention from biobased innovation and effort. ..At least when the global economy begins to pick up again, that is. Indeed, the biosuccinic acid subsector found itself in a precipitous place during the last decade. That's what can happen when fossil-based feedstocks suddenly become exceptionally cost-effective supply solutions. Our blog post Biosuccinic acid: Is the sustainable route becoming viable once more? fully explains the issues at play.

With the new act, Biden’s administration is injecting funding into sustainability blueprints. The money will be targeted at plans with five to 20-year targets for replacing virgin fossil-based plastics and chemicals with lower-carbon alternatives. Promotion of biomanufacturing and biobased feedstock is the aim.

Source: Tecnon OrbiChem

Ammonia & methanol

The commodity chemicals most exposed to gas feedstock and electricity volatility are those in which energy accounts for more than 40% of input costs. They include methanol and ammonia.

Russian methanol imports into the EU decreased dramatically during the first quarter of 2023, falling almost 70% to 113,943 tons from 378,564 tons during the same period in 2022.

Against this backdrop, there is excitement about the promise of renewable methanol and ammonia projects in those markets. Both are major raw materials in the production of nylon intermediates so there is potential for benefit in that downstream sector too. In fact, a recent Tecnon OrbiChem blog post Green ammonia chemical feedstocks: A promising future explores these issues.

Also looming is a full ban on methanol imports into the European Union from Russia. Scheduled to take effect on 18 June – following delay from January 2023 – a further delay implementing the ban is anticipated however.

The price rise of natural gas in Europe was far steeper compared to the US. Fossil feedstock prices worldwide have hit historically high levels – especially in March 2022 when the Russia-Ukraine war tightened the supplies of natural gas and crude oil in Europe. That translated to natural gas prices in Europe being many times the cost in the US.

Many chemical plants either shut down or operated at low rates. Europe also started importing significantly more liquid natural gas from the US and elsewhere in 2022. This trend is continuing in 2023.

Source: Tecnon OrbiChem

Agricultural feedstock: The low-down on low carbon

Raw materials including starch, sugar and/or oils made from palm, soybeans and sunflowers – along with crop residues – are increasingly featuring in new and emerging markets.

This is driven in part by Environmental, Social and Governance (ESG) issues placing sustainability centre stage in companies, but also due to the looming threat of legislation and growing consumer awareness.

In petrochemicals sectors, agricultural feedstock markets are coming under increasing attention as biofuels – such as renewable diesel and SAF – diverting fats and oils feedstock from their traditional usage. These vegetable and plant oils and animal fats were typically used to make oleochemicals.

From the turn of the millennium, their use in methyl ester of fatty acids fuel production began to grow exponentially. Rapid growth of the more efficient renewable diesel markets – known as hydrotreated vegetable oil (HVO) in Europe – triggered high pricing in agricultural feedstock markets.

More recently, there has been a growing demand for sustainable aviation fuel (SAF). As airlines fight for fuel blends that satisfy regulators, prices are maintaining high levels as a knock-on effect.

SAF-fuelled price surges

In fact, the price of feedstock fats and oils has surged since 2020.

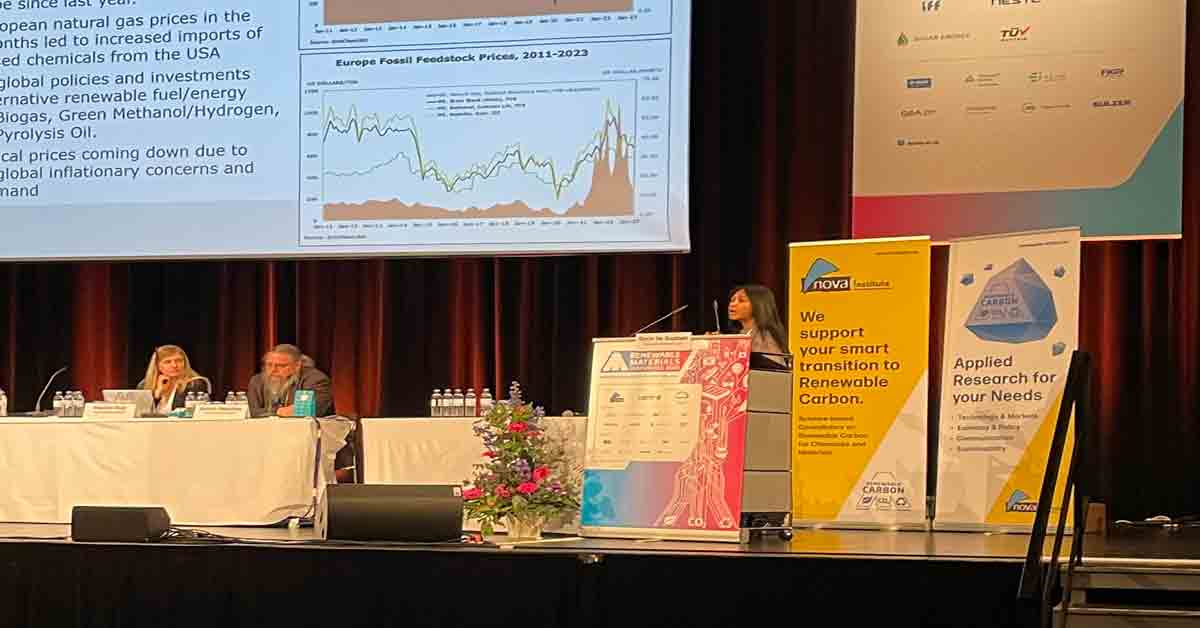

Tecnon OrbiChem’s biomaterials expert Doris de Guzman has been monitoring the changing dynamics within these biomass markets for most of this century.

Source: Prima Markets

Source: Prima Markets

According to Guzman – and as outlined in her presentation at the Renewable Materials Conference in Siegburg, Cologne, Germany at the end of May 2023 – low carbon-intensity feedstocks are priced higher than crude palm oil.

Animal fats – and even used cooking oil (UCO) – come under this low carbon-intensity umbrella term. Tallow [predominantly rendered fat of cattle and sheep] is now priced competitively with soybean oil.

One problem with animal fats and UCO is that they are by-products. Supplies are therefore finite compared with crop-based vegetable oils

Tecnon OrbiChem biomaterials expert Doris de Guzman

Fats & oils: A race to replace

‘One problem with animal fats and UCO is that they are by-products. Supplies are therefore finite compared with crop-based vegetable oils,' explains de Guzman. A more important problem is that they are used in foods, so are a threat to the pricing and availability of food.

The problem with palm oil, however, goes a little deeper than fluctuating supply based on outside events (such as Covid which restricted the UCO supply from the restaurant trade). Palm oil remains a contentious product due to deforestation, with Europe increasingly limiting its imports.

Since the EU placed restrictions on palm oil use in biofuels, alternative vegetable oil as well as waste fats and UCO use has stepped up. But the potential impact on foodstuffs remains.

Russia-Ukraine

The Russia-Ukraine war brought with it another challenge to fats and oils markets. Sunflower oil supply – a major export product for both nations – was cut off due to the conflict. Some 15 months on from the start of the war, fats and oils prices are dropping. Production and supply are stabilising but also, demand has weakened as inflation rages through global economies.

Sugar feedstocks prices too are at historic highs, having risen steadily since 2020, though not as steeply as fats and oils. And the Russia-Ukraine war pushed wheat prices sky high, although downward movements were seen in the second half of 2022.

Source: ResourceWise/World Bank

Both sugar and carbohydrates prices are still not at normal levels and there are spikes again for sugar prices in May 2023. Top-producing countries - India, Thailand, China and even the EU region – have lowered projections for sugar production going forward.

Though not as tight as seen in global fats and oils markets, the issue of food versus fuel vexes even sugar and starch sector participants. Chemical and fuel companies are, however, increasingly seeking non-food alternatives.

Wood-based wonders

US wood chip prices remained steady for some years, but this market could change as several technology companies are starting to use woody biomass to produce ethanol and SAF. Companies including US-based carbon negative materials firm Origin and Finnish forestry company UPM are poised to commercialise chemicals using this feedstock.

Austria’s Lenzing – a specialist in cellulose fibres – and Estonia’s biotech firm Fibenol are also accelerating chemicals and materials production using woody biomass. That’s a subject more fully explored by ResourceWise VP of global sales Matt Elhardt. Elhardt presented at the 2023 International Petrochemical Conference hosted by the American Fuel & Petrochemical Manufacturers. Below is a short clip of Elhardt's presentation.

The full video of Elhardt’s talk and downloadable eBook of the presentation slides can be accessed in the blog post What wood-based molecules bring to next generation fuels & chemicals.

Bright future for a bioeconomy

It is clear that the US approach to encouraging the acceleration of renewables chemicals output, and is helped by the fact that much of the country’s land mass lends itself to a wood-based economical future. It may also make many outside the region wonder why the legislative prodding is favoured over the Inflation Reduction Act’s carrot and stick approach.

In essence, are there enough billion-Euro (or pound) incentives for businesses in West Europe, or indeed anywhere outside of the US?

Tecnon OrbiChem's chemical data platform OrbiChem360 includes de Guzman’s Biomaterials’ Chemical Profile Service. Its comprehensive coverage of biobased chemicals markets, prices, developments and commercialisations worldwide is vital to companies incorporating sustainability into their strategy.

Its monitoring of renewable carbon-derived chemicals, polymers and materials against their petrochemicals equivalents and competitors is a vital tool in the transition to net zero.