WILL THE RUSSIA-UKRAINE WAR TRIGGER MORE RENEWABLE HYDROCARBON INVESTMENTS?

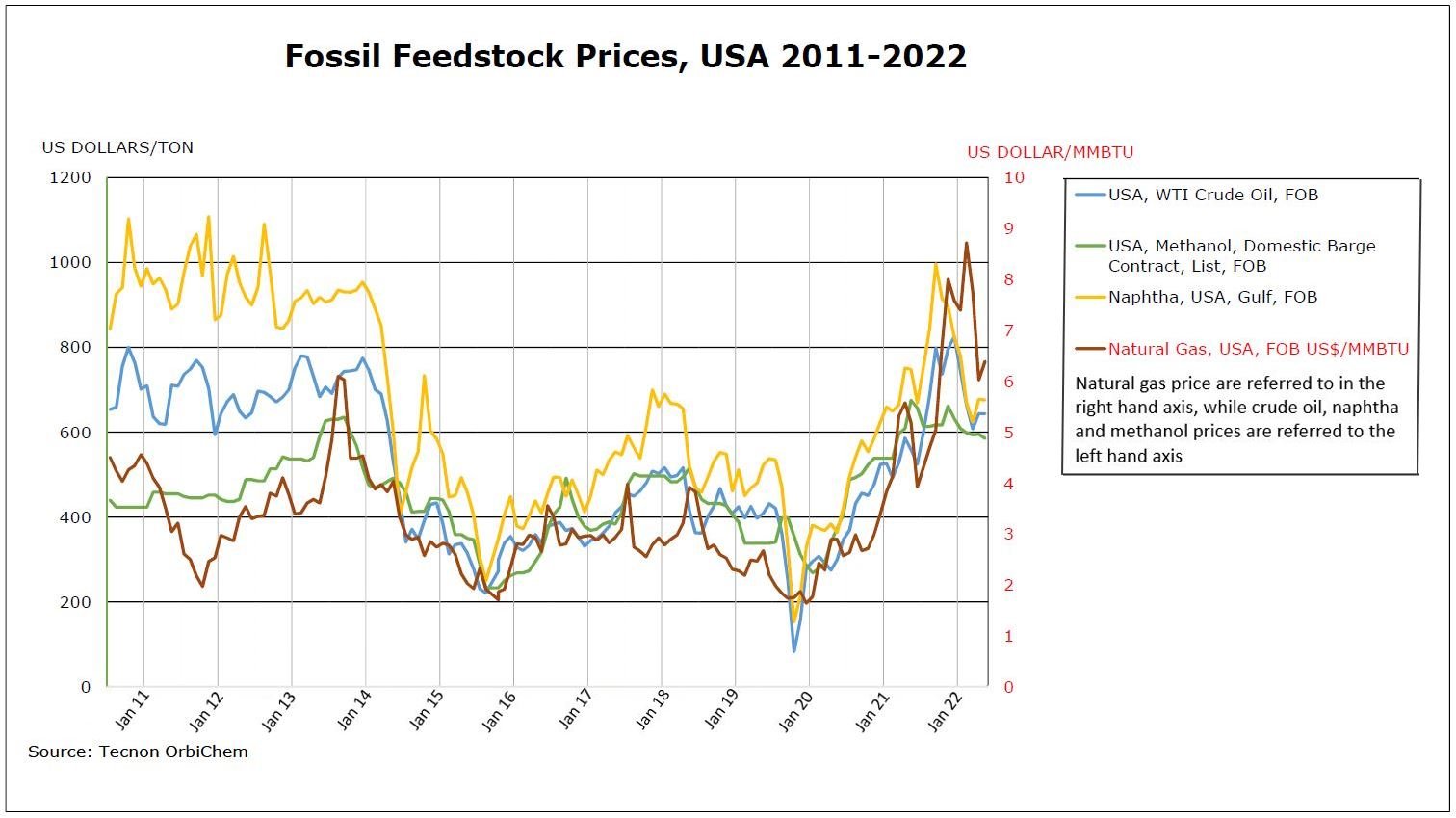

Over the course of 2022, Russia’s ongoing invasion of Ukraine has accelerated the surge in fossil feedstock prices. WTI crude oil futures traded at over $130 early in March 2022 – the highest front-month contract finish seen since the 2008 recession – while Brent crude reached a peak of $139/bbl, marking the highest settlement in a decade. In the few weeks after the invasion, the US retail price of gasoline topped $4/gal, and natural gas futures prices hit $5/mmBTU.

Although Q4 2022 saw significant oil price declines, OPEC+’s decision to reduce output in a bid to stem rising inflation is triggering yet another upward trend in prices. The majority of price surges in 2022, however, were and are still, underpinned by the US ban on Russian oil and gas imports. The EU too aims to cut Russian gas imports by two-thirds in the near future, with the UK government pledging to phase out Russian oil imports by the end of 2022 and reducing Russian gas imports too.