Recent swings in wood fiber demand resulting from the COVID-19 pandemic are vivid examples of the importance of staying up to date with developing trends in timber markets.

For instance, the huge demand shift for tissue products coupled with the slowdown in construction over the last several months presented an ideal time to market and sell timber from young pine stands. Likewise, there will also be good sales opportunities for older pine sawtimber as new home construction gets back on track over the next few months.

Based on these tremendous shifts in the market, I wanted to draft an update of our most popular blog post ever (How Much Money is an Acre of Timber Worth?) to provide some revised trends, context, and related information about the value of pine timber per acre. Since we’re talking dollars and cents, it’s always instructive to stay abreast of market movements during periods of significant turbulence.

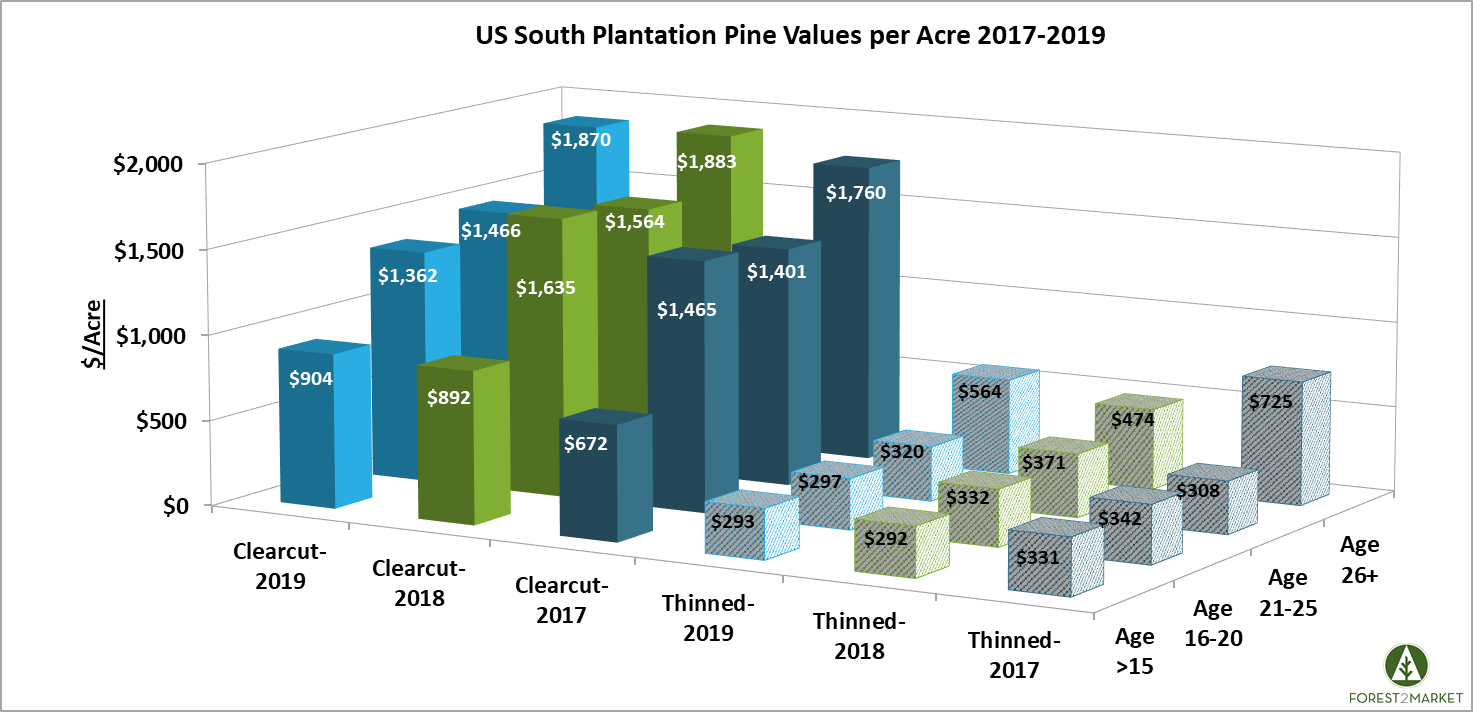

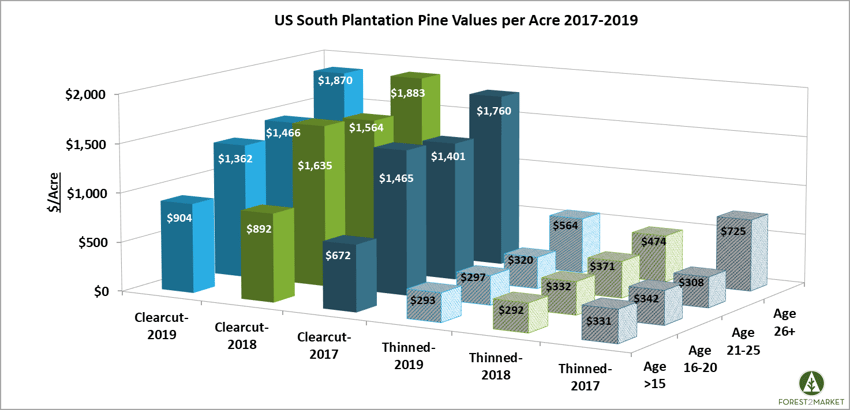

The original blog post analyzed values based on a rolling 12-month time frame. This new update will provide more detail by looking at values over a full 3-year period (2017-2019). In keeping with the format of the original post, the information below includes pine stumpage[i] values from timber sales across the US South for both natural and plantation stands that were harvested either in thinning (selective tree removal) or clearcut (complete harvest) operations.

What Drives Timber Prices?

Before we can determine how much an acre of timber is worth, we first need to understand the law of supply and demand ultimately drives the price of timber. Demand is heavily influenced by location, surrounding mill types, proximity to those mills, and the volume and type of timber products consumed in a given area. The volume and types of products available on a tract of timber will therefore determine the value per acre.

For example, larger pine logs used to manufacture top-quality grades of lumber are more valuable in a region with multiple sawmills than are smaller logs that are converted to woodchips to make pulp and paper products.

Timberland owners in the US South who manage their land for timber production predominately manage for the growth of large pine logs. These pine timber stands most often go through even-aged management regimes where the majority of the trees present are the same age (+/- a couple of years). Even-aged plantation pine stands typically experience 1-2 commercial thinnings and one final commercial harvest, or clearcut. When following this model, thinnings typically remove smaller trees at younger ages and clearcuts remove the remainder of the larger trees at older ages.

As a result, the size of the trees removed during thinnings and clearcuts are quite different and therefore vary in value. In general, pine logs fall into one of the following categories:

- Logs 5”-7” diameter at breast height (DBH) are considered “pulpwood”

- Logs 8”-11” DBH are considered “chip-n-saw” (CNS)

- Logs 12”+ DBH in diameter are considered “sawtimber”

For this new analysis, I analyzed US South prices for plantation pine stands on a per-acre basis by harvest type (thinning vs. clearcut) and age class (less than 15 years old, 16-20 years old, 21-25 years old and 26+ years old). I also analyzed US South prices for natural pine stands by harvest type (concise age class data is unavailable for these harvests).

With that said, let’s explore the question…

How Much Money is an Acre of Timber Worth?

Plantation Pine Stands

Not surprisingly, first thinnings of young timber brought lower prices from 2017-2019 due to the smaller trees that were removed; only pulpwood and smaller logs that fall into the chip-n-saw category are harvested at this time. However, second thinnings in the 21-25 age class typically remove more than just pulpwood, including larger chip-n-saw logs and smaller-diameter sawtimber.

Clearcuts, on the other hand, typically carry a higher price per acre due to the average size of the trees and the volumes of material removed. Most landowners prefer to clearcut their timberland when it is in the 26+ age class, since a majority of the trees have reached the higher-value sawtimber category.

However, it is important to note a clearcut will remove all standing timber on a tract of land, which, even in the case of a managed forest in the 26+ age class, will include both pulpwood and chip-n-saw logs. This mixture of harvested timber products will ultimately affect the price per acre.

Some obvious and expected trends can be detected from the data above, namely, clearcut harvests of older timber are more valuable per acre. However, there are a couple of notable trends as well:

- Thinnings of CNS and small sawtimber in the 16-25 ages classes command a higher price per ton than pulpwood, but the price differential between the age classes is minimal. This is typically governed by the fact that thinnings in higher age class stands are less common and usually yield less volume per acre, which results in a lower price per acre.

- Thinning values per acre for CNS and small sawtimber in the 16-25 age classes were up in 2018 but dropped markedly in 2019—a sign that supply of these products outpaced demand in that year.

- Like thinnings, clearcut values per acre for timber in the higher-value age classes all decreased in 2019, also a sign that supply outstripped demand.

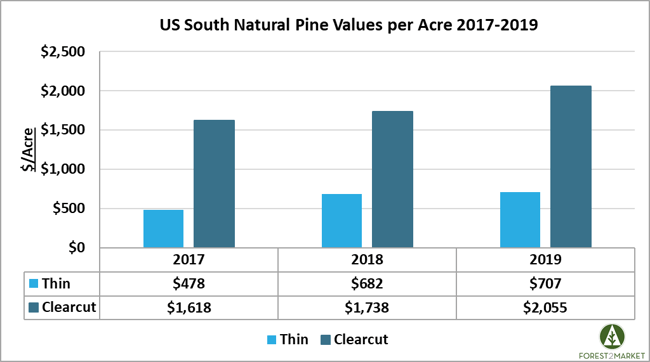

Natural Pine Stands

Individual age class data is unavailable for natural stands of timber, however, the harvest information of natural pine stands illustrates similar price-per-acre ranges as the plantation pine harvest data. There are a couple of considerations to keep in mind when analyzing the natural pine data:

- Naturally regenerated stands of pine timber often have a higher density of trees than do plantations. During thinnings on natural stands, more material is therefore typically removed, resulting in an increase in volume and price per acre.

- The clearcut price per acre on natural pine stands is slightly higher due to the presence of some hardwood sawtimber that is harvested along with the pine during a clearcut, which carries a higher price than pine in the current market. Older timber stands also typically allow for larger trees, which can affect the total stand volume or the price per tree. The increased timber volumes combined with a mix of hardwood sawtimber will result in a higher price per acre.

In the chart above, the expected higher stumpage value for clearcut timber sales is evident. Unlike the plantation data, there is a clear trend of increasing stumpage prices over the three-year period for both clearcut and thinning timber sales on natural stands.

For a quick comparison of the two, the table below illustrates clearcut values of sawtimber-sized logs from both plantation and natural timber stands over the last three years.

|

Pine Timber Values/Acre |

||

|

Year |

Plantation* |

Natural |

|

2017 |

$1,542 |

$1,618 |

|

2018 |

$1,694 |

$1,738 |

|

2019 |

$1,566 |

$2,055 |

|

*Average of all age classes excluding <15 (clearcut) |

||

Importance of Current, Reliable Pricing Data

This kind of information can be very useful in determining emerging market trends, which can be used to guide operational and strategic planning for both sellers and purchasers of pine timber.

For sellers, a trained forester is essential to provide insight into local market dynamics and help determine an accurate amount of merchantable wood that exists on an acre of timberland. Prices for timber products can vary considerably even from county to county in a specific region based on demand.

As detailed in the data above, there can be significant yearly swings in timber prices based on product type, age class and harvest type. Forest2Market’s direct market price data and specific harvest volume information provide the most complete and accurate timber pricing service in the southern US. Our timber price database is continually updated and contains comprehensive sales data from more than $6 billion in actual timber transactions across the entire region.

[i] “Stumpage” is the term used for the purchase price of standing timber and the rights to harvest that timber. In the South, stumpage is most often quoted in dollars per ton of wood, so we used that measurement to arrive at our values.