4 min read

New Chemical Industry Imperatives: Expanding Inventory & Making Supply Chains Robust

Charles Fryer

:

Jul 12, 2022 10:17:08 AM

Charles Fryer

:

Jul 12, 2022 10:17:08 AM

Factories need to keep inventory, to guard against delayed delivery of vital feedstocks or components. This is especially the case for chemical plants, which operate 24/7/365 and for which a shutdown and restart can be very costly. Except for raw material delivered by pipeline or over the fence, inventory must be held in tanks and drums for liquids, or silos and warehouses for solids, or cylinders and cryogenic containers for gases.

Finance managers dislike inventory. It ties up capital that could be more profitably employed. It needs management, to ensure proper circulation (new in, old out), and to avoid risks for some chemicals. It may need to be quality tested at intervals, especially if of limited shelf life. The less of it that is sitting around, the better.

Just-in-time ideal diminishes

Improvements in world transportation of goods over the past three decades (up to early 2020) – especially as regards chemical parcel tankers and containers – was seized upon by purchasing agents and financial managers to reduce the need for inventory. Just-in-time delivery replaced just-in-case hoarding. The chemical industry emphasised purchasing from the cheapest production sites, even if halfway around the world, rather than from the most reliable but higher priced sources.

World chemical logistics had reached a peak of efficiency by early 2020, at which point the whole edifice came crashing down with the onset of the Covid-19 pandemic. An immediate drop in manpower availability developed from forced lockdowns, resulting in an acute shortage of truck drivers, train operatives, port stevedores and ships’ crew.

'...the megatrend of globalisation has not brought the global

harmony predicated...'

Charles Fryer, Tecnon OrbiChem founder & senior advisor

Containers piled up on quays, with no one to move them to destination. With full containers left unloaded, and empty containers at the wrong ports, a world shortage of containers developed. Container freight rates across oceans escalated to unheard of levels, even higher than $15,000 for a 40ft container. Hundreds of ships queued for weeks to get into key ports, like Los Angeles and Long Beach on the US west coast, or Shanghai and Guangzhou in China. Just-in-time (JIT) delivery became a faded dream.

Purchasing managers faced a new challenge. Important supplies needed by Western producers from Asian sources became delayed, taking months rather than weeks, or were pushed aside by more urgent trade - such as personal protection equipment – or dried up completely. Managers had to beg for supplies from local companies, or from anywhere, at any price.

This continued as demand from the public for home delivery of some goods rose during lockdowns, and then of other goods flourished as people surged back to shopping malls after lockdowns ended. Chemicals shortages rose as the supply chains became entangled, leading to a further escalation in feedstock prices. To cap it all, managers felt it essential to build up inventory levels, in spite of these difficulties, to protect smooth plant operation, giving a further upward twist to prices.

A cusp of two curves

Economists are well versed in the stock-building cycle. Inventory build-up as economies recover gives an extra spurt to GDP growth, but stock reduction on the downturn hastens the fall in GDP. The world at present is at the cusp of these two curves. In mid May, Walmart informed shareholders that it held large inventories of unsold goods, public demand for which had evaporated, which led to a steep fall in its share price. There is a warning here that ill-judged over-stocking could exacerbate a coming recession.

Some chemical companies are already finding that demand for their products is declining, leaving them with more high-priced inventory than they are comfortable with. There is more danger of this happening in China, where an economy at a low ebb following lockdowns is now having to cope with reduced demand for imports by the West. Mounting inventories of caprolactam and plant shutdowns as demand for exports of nylon sports clothing subsides is one example.

Reliability at a premium

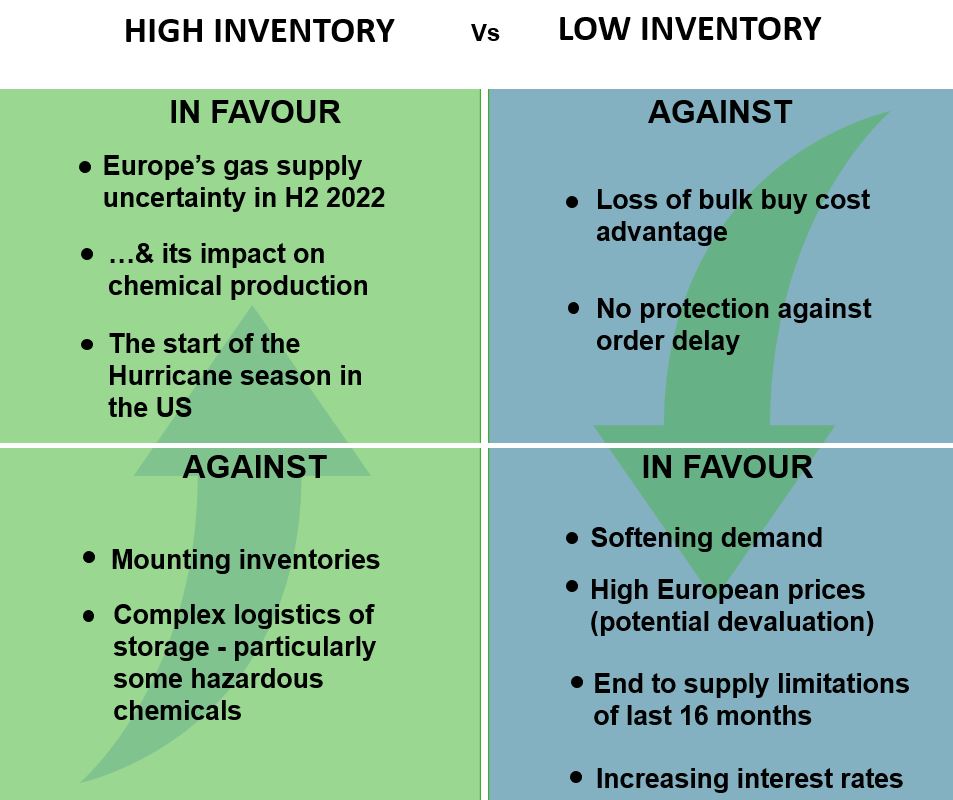

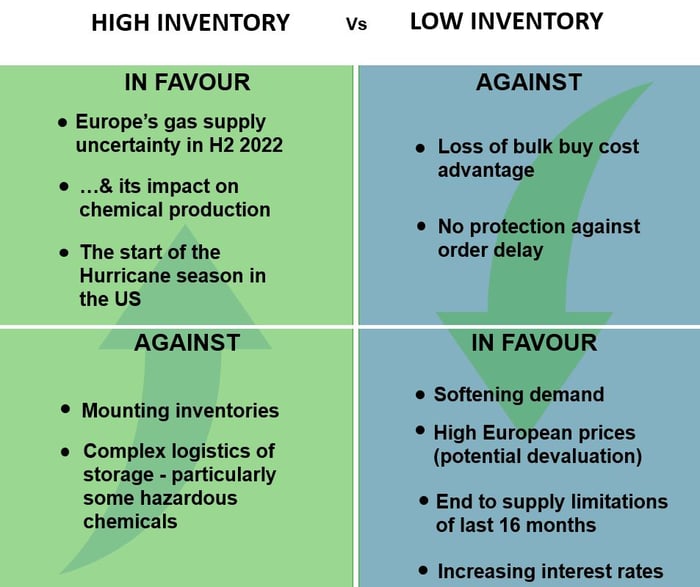

Companies are weighing up how they should react. Certainly, they should keep higher inventory of raw materials than previously, and indeed also inventory of products or finished goods ready for sale. This means more capital tied up, but it may also require expenditure on extra storage tanks, silos or warehouses. Purchasing activity philosophy will move to put a premium on reliability and downgrade cheapness as criteria, and to favour local suppliers over those across the oceans. In some cases, local supply chains will be strengthened by major investment to achieve vertical integration, by joint ventures with suppliers, or acquisition, or building new plants.

Source: Tecnon OrbiChem

Source: Tecnon OrbiChem

There will be some voices that say: Be patient, logistics and the whole supply chain will return to normal soon. But others will judge that the world is moving towards greater instability, in view of climate change, geopolitical tensions, and political volatility. Supply chain leaders are putting in place a variety of measures, in the following order of importance – according to McKinsey & Company:

- Dual or multiple sourcing of raw materials

- Increasing inventory along the supply chain

- Regionalising the supply chain

- Expanding back-up production sites

- Near-shoring of production facilities

All this implies a retreat from globalisation, a megatrend which, in truth, has not brought about the greater global harmony that had been predicated. In turn, that implies a reduction in efficiency, and increased costs that in the end consumers and the public will have to bear.

Just when and where is the chemical industry reshaping its supply chains? It may take some time, since petrochemical facilities involve huge investment. But the following signs are telling.

China's Q2 2022 epoxy resin (ER) exports ramped up a notch following a few years' lull. China's maleic anhydride (MA) meanwhile, may benefit from a levelling out of cargo costs.

White paper download

The white paper New chemical industry imperatives: Expanding inventory and making supply chains robust explores PET & polyester inventory strategy using a SWOT analysis (of sorts). And the precariousness of acrylic acid & acrylates is considered in light of the threat of production cutbacks at BASF's Ludwigshafen site.

To find out more about the signs in ER, MA, PET & polyester, Nylon and the acrylic acid & acrylates subsectors, follow this link to chemical data and analytics company Tecnon OrbiChem - A ResourceWise company - where you can fill a form for access to the full white paper.